ICICI Prudential Regular Savings Fund Regular Growth

HybridConservative AllocationHigh Risk

Regular

NAV (05-Mar-26)

Returns (Since Inception)

Fund Overview

Fund Size

₹3,334 Cr

Expense Ratio

1.72%

ISIN

INF109K01902

Minimum SIP

₹500

Exit Load

1.00%

Inception Date

30 Mar 2004

About this fund

As of 05-Mar-26, it has a Net Asset Value (NAV) of ₹77.25, Assets Under Management (AUM) of 3333.86 Crores, and an expense ratio of 1.72%.

- ICICI Prudential Regular Savings Fund Regular Growth has given a CAGR return of 9.77% since inception.

- The fund's asset allocation comprises around 23.54% in equities, 67.55% in debts, and 8.61% in cash & cash equivalents.

- You can start investing in ICICI Prudential Regular Savings Fund Regular Growth with a SIP of ₹500 or a Lumpsum investment of ₹5000.

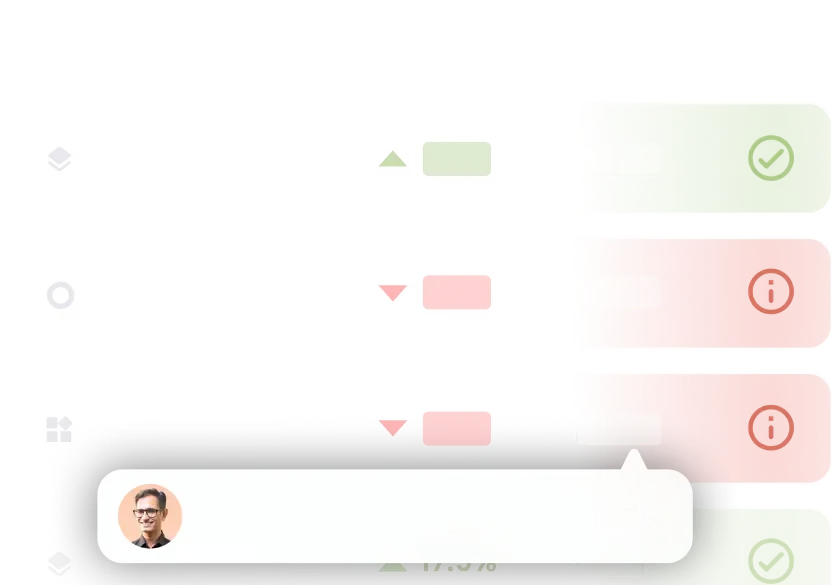

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+8.10%

+7.07% (Cat Avg.)

3 Years

+9.98%

+8.95% (Cat Avg.)

5 Years

+8.58%

+7.94% (Cat Avg.)

10 Years

+9.66%

+7.49% (Cat Avg.)

Since Inception

+9.77%

— (Cat Avg.)

Portfolio Summaryas of 15th February 2026

| Equity | ₹784.87 Cr | 23.54% |

| Debt | ₹2,252.17 Cr | 67.55% |

| Others | ₹296.82 Cr | 8.90% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| 6.68% Gs 2040 | Bond - Gov't/Treasury | ₹158.64 Cr | 4.73% |

| 6.90% Gs 2065 | Bond - Gov't/Treasury | ₹138.96 Cr | 4.14% |

| National Bank For Agriculture And Rural Development | Bond - Corporate Bond | ₹100.62 Cr | 3.00% |

| Manappuram Finance Limited | Bond - Corporate Bond | ₹99.9 Cr | 2.98% |

| Adani Enterprises Limited | Bond - Corporate Bond | ₹99.62 Cr | 2.97% |

| L&T Metro Rail (Hyderabad) Limited | Bond - Corporate Bond | ₹79.84 Cr | 2.38% |

| 360 One Prime Limited | Bond - Corporate Bond | ₹75.09 Cr | 2.24% |

| Yes Bank Limited | Bond - Corporate Bond | ₹64.59 Cr | 1.93% |

| Goi Frb 2034 | Bond - Gov't/Treasury | ₹63.22 Cr | 1.88% |

| Treps | Cash - Repurchase Agreement | ₹60.94 Cr | 1.82% |

| Net Current Assets | Cash | ₹57.17 Cr | 1.70% |

| ICICI Bank Ltd | Equity | ₹52.67 Cr | 1.57% |

| 6.48% Gs 2035 | Bond - Gov't/Treasury | ₹51.84 Cr | 1.55% |

| Godrej Properties Limited | Bond - Corporate Bond | ₹50.8 Cr | 1.51% |

| Godrej Industries Limited | Bond - Corporate Bond | ₹50.63 Cr | 1.51% |

| National Bank For Agriculture And Rural Development | Bond - Corporate Bond | ₹50.57 Cr | 1.51% |

| SIDDHIVINAYAK SECURITISATION TRUST | Bond - Asset Backed | ₹50.54 Cr | 1.51% |

| Indostar Capital Finance Limited | Bond - Corporate Bond | ₹50.5 Cr | 1.51% |

| Eris Lifesciences Limited | Bond - Corporate Bond | ₹50.45 Cr | 1.50% |

| Vedanta Limited | Bond - Corporate Bond | ₹50.42 Cr | 1.50% |

| Eris Lifesciences Limited | Bond - Corporate Bond | ₹50.33 Cr | 1.50% |

| Narayana Hrudayalaya Limited | Bond - Corporate Bond | ₹50.13 Cr | 1.49% |

| Keystone Realtors Limited | Bond - Corporate Bond | ₹49.88 Cr | 1.49% |

| Motilal Oswal Financial Services Limited | Bond - Corporate Bond | ₹49.86 Cr | 1.49% |

| Adani Power Limited | Bond - Corporate Bond | ₹49.85 Cr | 1.49% |

| Bank Of Baroda | Cash - CD/Time Deposit | ₹46.99 Cr | 1.40% |

| Bharti Telecom Limited | Bond - Corporate Bond | ₹40.43 Cr | 1.20% |

| AShiana Housing Limited | Bond - Corporate Bond | ₹40.15 Cr | 1.20% |

| NTPC Ltd | Equity | ₹37.13 Cr | 1.11% |

| SBI Life Insurance Co Ltd | Equity | ₹35.73 Cr | 1.06% |

| Axis Bank Ltd | Equity | ₹35.43 Cr | 1.06% |

| JM Financial Products Limited | Bond - Corporate Bond | ₹35.04 Cr | 1.04% |

| Bharti Airtel Ltd | Equity | ₹33.69 Cr | 1.00% |

| HDFC Bank Ltd | Equity | ₹33.12 Cr | 0.99% |

| Britannia Industries Ltd | Equity | ₹33.09 Cr | 0.99% |

| Vedanta Limited | Bond - Corporate Bond | ₹30.18 Cr | 0.90% |

| Prism Johnson Limited | Bond - Corporate Bond | ₹30.08 Cr | 0.90% |

| Prism Johnson Limited | Bond - Corporate Bond | ₹29.96 Cr | 0.89% |

| HDFC Life Insurance Co Ltd | Equity | ₹28.83 Cr | 0.86% |

| Mindspace Business Parks REIT Unit | Equity - REIT | ₹28.57 Cr | 0.85% |

| Hindustan Unilever Ltd | Equity | ₹27.92 Cr | 0.83% |

| Infosys Ltd | Equity | ₹27.52 Cr | 0.82% |

| Reliance Industries Ltd | Equity | ₹26.96 Cr | 0.80% |

| ICICI Lombard General Insurance Co Ltd | Equity | ₹26.68 Cr | 0.80% |

| SHIVSHAKTI SECURITISATION TRUST | Bond - Asset Backed | ₹25.24 Cr | 0.75% |

| JM Financial Credit Solutions Limited | Bond - Corporate Bond | ₹25.18 Cr | 0.75% |

| Oberoi Realty Limited | Bond - Corporate Bond | ₹25.16 Cr | 0.75% |

| LIC Housing Finance Ltd | Bond - Corporate Bond | ₹25.15 Cr | 0.75% |

| Aavas Financiers Limited | Bond - Corporate Bond | ₹25.14 Cr | 0.75% |

| Shriram Finance Limited | Bond - Corporate Bond | ₹25.13 Cr | 0.75% |

| TATA Projects Limited | Bond - Corporate Bond | ₹25.1 Cr | 0.75% |

| Aadhar Housing Finance Limited | Bond - Corporate Bond | ₹25.04 Cr | 0.75% |

| One Prime Limited | Bond - Corporate Bond | ₹25.03 Cr | 0.75% |

| Mahindra Rural Housing Finance Limited | Bond - Corporate Bond | ₹24.97 Cr | 0.74% |

| 7.24% Maharashtra Sgs 2034 | Bond - Gov't/Treasury | ₹24.83 Cr | 0.74% |

| 7.24% Uttarpradesh Sgs 2036 | Bond - Gov't/Treasury | ₹24.51 Cr | 0.73% |

| 7.24% Gs 2055 | Bond - Gov't/Treasury | ₹24.41 Cr | 0.73% |

| Bank of Baroda | Bond - Corporate Bond | ₹23.46 Cr | 0.70% |

| Telangana (Government of) | Bond - Sub-sovereign Government Debt | ₹22.17 Cr | 0.66% |

| Maruti Suzuki India Ltd | Equity | ₹21.78 Cr | 0.65% |

| Sun Pharmaceuticals Industries Ltd | Equity | ₹20.97 Cr | 0.62% |

| 7.34% Telangana Sgs 2038 | Bond - Gov't/Treasury | ₹20.24 Cr | 0.60% |

| APtus Value Housing Finance India Limited | Bond - Corporate Bond | ₹20 Cr | 0.60% |

| Aavas Financiers Limited | Bond - Corporate Bond | ₹19.97 Cr | 0.60% |

| 7.24% Rajasthan Sgs 2036 | Bond - Gov't/Treasury | ₹19.21 Cr | 0.57% |

| Emmvee Photovoltaic Power Ltd | Equity | ₹19.2 Cr | 0.57% |

| Mankind Pharma Limited | Bond - Corporate Bond | ₹19.02 Cr | 0.57% |

| Aurobindo Pharma Ltd | Equity | ₹18.1 Cr | 0.54% |

| Gland Pharma Ltd | Equity | ₹17.45 Cr | 0.52% |

| 7.29% Rajasthan Sgs 2037 | Bond - Gov't/Treasury | ₹16.86 Cr | 0.50% |

| INDIA UNIVERSAL TRUST AL2 | Bond - Asset Backed | ₹15.3 Cr | 0.46% |

| Bamboo Hotel And Global Centre (Delhi) Private Limited | Bond - Corporate Bond | ₹15.13 Cr | 0.45% |

| Avanse Financial Services Limited | Bond - Corporate Bond | ₹15 Cr | 0.45% |

| Chemplast Sanmar Ltd | Equity | ₹14.97 Cr | 0.45% |

| Embassy Office Parks REIT | Equity - REIT | ₹12.92 Cr | 0.39% |

| PVR INOX Ltd | Equity | ₹12.89 Cr | 0.38% |

| Affle 3i Ltd | Equity | ₹12.4 Cr | 0.37% |

| 7.25% Maharashtra Sgs 2037 | Bond - Gov't/Treasury | ₹12.07 Cr | 0.36% |

| SRF Ltd | Equity | ₹11.9 Cr | 0.35% |

| INDIA UNIVERSAL TRUST AL2 | Bond - Asset Backed | ₹11.65 Cr | 0.35% |

| Aditya Birla Lifestyle Brands Ltd | Equity | ₹10.32 Cr | 0.31% |

| Kogta Financial (India) Limited | Bond - Corporate Bond | ₹10 Cr | 0.30% |

| Cash Margin - Derivatives | Cash - Collateral | ₹10 Cr | 0.30% |

| Corporate Debt Market Development Fund (Class A2) | Mutual Fund - Unspecified | ₹9.76 Cr | 0.29% |

| 7.12% Maharashtra Sgs 2038 | Bond - Gov't/Treasury | ₹9.67 Cr | 0.29% |

| 7.14% Maharashtra Sgs 2039 | Bond - Gov't/Treasury | ₹9.64 Cr | 0.29% |

| Sona BLW Precision Forgings Ltd | Equity | ₹9.62 Cr | 0.29% |

| Tenneco Clean Air India Ltd | Equity | ₹9.33 Cr | 0.28% |

| V-Guard Industries Ltd | Equity | ₹8.3 Cr | 0.25% |

| Medi Assist Healthcare Services Ltd | Equity | ₹8.26 Cr | 0.25% |

| Apollo Tyres Ltd | Equity | ₹8.17 Cr | 0.24% |

| 7.43% ODisha Sgs 2040 | Bond - Gov't/Treasury | ₹7.81 Cr | 0.23% |

| Can Fin Homes Ltd | Equity | ₹7.5 Cr | 0.22% |

| DLF Ltd | Equity | ₹7.35 Cr | 0.22% |

| Carborundum Universal Ltd | Equity | ₹7.23 Cr | 0.22% |

| Tata Motors Passenger Vehicles Ltd | Equity | ₹7.15 Cr | 0.21% |

| Mahindra & Mahindra Ltd | Equity | ₹6.96 Cr | 0.21% |

| KNR Constructions Ltd | Equity | ₹6.82 Cr | 0.20% |

| Mold-tek Packaging Ltd | Equity | ₹6.77 Cr | 0.20% |

| 7.13% Karnataka Sgs 2034 | Bond - Gov't/Treasury | ₹6.56 Cr | 0.20% |

| Mphasis Ltd | Equity | ₹6.44 Cr | 0.19% |

| UTI Asset Management Co Ltd | Equity | ₹6.33 Cr | 0.19% |

| Haryana (State Of) | Bond - Sub-sovereign Government Debt | ₹6.16 Cr | 0.18% |

| Wipro Ltd | Equity | ₹5.82 Cr | 0.17% |

| CIE Automotive India Ltd | Equity | ₹5.82 Cr | 0.17% |

| Indian Railway Catering And Tourism Corp Ltd | Equity | ₹5.77 Cr | 0.17% |

| Zydus Lifesciences Ltd | Equity | ₹5.63 Cr | 0.17% |

| Petronet LNG Ltd | Equity | ₹5.62 Cr | 0.17% |

| INDIA UNIVERSAL TRUST AL2 | Bond - Asset Backed | ₹5.54 Cr | 0.17% |

| Coforge Ltd | Equity | ₹5.46 Cr | 0.16% |

| National Bank For Agriculture And Rural Development | Bond - Corporate Bond | ₹5.04 Cr | 0.15% |

| Sheela Foam Limited | Bond - Corporate Bond | ₹5.01 Cr | 0.15% |

| Sheela Foam Limited | Bond - Corporate Bond | ₹5 Cr | 0.15% |

| Kogta Financial (India) Limited | Bond - Corporate Bond | ₹4.99 Cr | 0.15% |

| Info Edge (India) Ltd | Equity | ₹4.56 Cr | 0.14% |

| KPIT Technologies Ltd | Equity | ₹4.45 Cr | 0.13% |

| Inox Wind Ltd | Equity | ₹4.37 Cr | 0.13% |

| Mankind Pharma Limited | Bond - Corporate Bond | ₹4.02 Cr | 0.12% |

| TeamLease Services Ltd | Equity | ₹3.77 Cr | 0.11% |

| Vedant Fashions Ltd | Equity | ₹3.64 Cr | 0.11% |

| Gujarat Alkalies & Chemicals Ltd | Equity | ₹3.32 Cr | 0.10% |

| GAIL (India) Ltd | Equity | ₹3.14 Cr | 0.09% |

| Gujarat State Fertilizers & Chemicals Ltd | Equity | ₹2.89 Cr | 0.09% |

| GNA Axles Ltd | Equity | ₹2.88 Cr | 0.09% |

| 7.29% Westbengal Sgs 2038 | Bond - Gov't/Treasury | ₹2.82 Cr | 0.08% |

| Arvind Fashions Ltd | Equity | ₹2.59 Cr | 0.08% |

| IndiaMART InterMESH Ltd | Equity | ₹2.07 Cr | 0.06% |

| Westlife Foodworld Ltd | Equity | ₹2.03 Cr | 0.06% |

| Sagar Cements Ltd | Equity | ₹1.93 Cr | 0.06% |

| PNC Infratech Ltd | Equity | ₹1.83 Cr | 0.05% |

| Orient Electric Ltd Ordinary Shares | Equity | ₹1.53 Cr | 0.05% |

| Galaxy Surfactants Ltd | Equity | ₹1.38 Cr | 0.04% |

| 7.36% Uttarpradesh Sgs 2036 | Bond - Gov't/Treasury | ₹1.06 Cr | 0.03% |

| Route Mobile Ltd Ordinary Shares | Equity | ₹0.63 Cr | 0.02% |

| Campus Activewear Ltd | Equity | ₹0.56 Cr | 0.02% |

| Kwality Walls India Ltd | Equity | ₹0.49 Cr | 0.01% |

| Travel Food Services Ltd | Equity | ₹0.42 Cr | 0.01% |

| Bajaj Electricals Ltd | Equity | ₹0.34 Cr | 0.01% |

| Birla Corp Ltd | Equity | ₹0.16 Cr | 0.00% |

| Dhanuka Agritech Ltd | Equity | ₹0.13 Cr | 0.00% |

| Atul Ltd | Equity | ₹0.11 Cr | 0.00% |

| Supreme Petrochem Ltd | Equity | ₹0.05 Cr | 0.00% |

| 7.10% Gs 2034 | Bond - Gov't/Treasury | ₹0.02 Cr | 0.00% |

Allocation By Market Cap (Equity)

Large Cap Stocks

13.27%

Mid Cap Stocks

2.69%

Small Cap Stocks

6.33%

Allocation By Credit Quality (Debt)

AAA

AA

A

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Financial Services | ₹226.3 Cr | 6.74% |

| Consumer Cyclical | ₹105.68 Cr | 3.15% |

| Healthcare | ₹70.41 Cr | 2.10% |

| Technology | ₹68.88 Cr | 2.05% |

| Communication Services | ₹66.24 Cr | 1.97% |

| Consumer Defensive | ₹61.5 Cr | 1.83% |

| Industrials | ₹44.22 Cr | 1.32% |

| Utilities | ₹40.28 Cr | 1.20% |

| Energy | ₹32.58 Cr | 0.97% |

| Basic Materials | ₹24.94 Cr | 0.74% |

| Real Estate | ₹7.35 Cr | 0.22% |

Risk & Performance Ratios

Standard Deviation

This fund

2.86%

Cat. avg.

3.65%

Lower the better

Sharpe Ratio

This fund

1.22

Cat. avg.

0.77

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.40

Higher the better

Fund Managers

Manish Banthia

Since September 2013

Akhil Kakkar

Since January 2024

Roshan Chutkey

Since May 2022

Sharmila D’mello

Since July 2022

Additional Scheme Detailsas of 15th February 2026

ISIN INF109K01902 | Expense Ratio 1.72% | Exit Load 1.00% | Fund Size ₹3,334 Cr | Age 21 years 11 months | Lumpsum Minimum ₹5,000 | Fund Status Open Ended Investment Company | Benchmark NIFTY 50 Hybrid Composite 15:85 PR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Conservative Allocation Funds

About the AMC

ICICI Prudential Mutual Fund

Total AUM

₹11,74,403 Cr

Address

3rd Floor, Hallmark Business Plaza, Mumbai, 400 051

Other Funds by ICICI Prudential Mutual Fund

Risk Level

Your principal amount will be at High Risk

Still got questions?

We're here to help.

What is the current NAV of ICICI Prudential Regular Savings Fund Regular Growth?

What are the returns of ICICI Prudential Regular Savings Fund Regular Growth?

What is the portfolio composition of ICICI Prudential Regular Savings Fund Regular Growth?

Who manages the ICICI Prudential Regular Savings Fund Regular Growth?

- Manish Banthia

- Akhil Kakkar

- Roshan Chutkey

- Sharmila D’mello