Regular

NAV (18-Jun-25)

Returns (Since Inception)

Fund Overview

Fund Size

₹4,529 Cr

Expense Ratio

1.90%

ISIN

INF789F1AUO6

Minimum SIP

₹1,000

Exit Load

1.00%

Inception Date

22 Dec 2020

About this fund

As of 18-Jun-25, it has a Net Asset Value (NAV) of ₹25.92, Assets Under Management (AUM) of 4529.01 Crores, and an expense ratio of 1.9%.

- UTI Small Cap Fund Regular Growth has given a CAGR return of 23.64% since inception.

- The fund's asset allocation comprises around 96.31% in equities, 0.00% in debts, and 3.69% in cash & cash equivalents.

- You can start investing in UTI Small Cap Fund Regular Growth with a SIP of ₹1000 or a Lumpsum investment of ₹5000.

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+7.94%

+3.72% (Cat Avg.)

3 Years

+25.11%

+27.47% (Cat Avg.)

Since Inception

+23.64%

— (Cat Avg.)

Portfolio Summaryas of 31st May 2025

| Equity | ₹4,362.02 Cr | 96.31% |

| Others | ₹167 Cr | 3.69% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Net Current Assets | Cash | ₹166.04 Cr | 3.67% |

| Multi Commodity Exchange of India Ltd | Equity | ₹133.7 Cr | 2.95% |

| City Union Bank Ltd | Equity | ₹102.67 Cr | 2.27% |

| Techno Electric & Engineering Co Ltd | Equity | ₹96.49 Cr | 2.13% |

| Paradeep Phosphates Ltd | Equity | ₹95.41 Cr | 2.11% |

| Karur Vysya Bank Ltd | Equity | ₹91.96 Cr | 2.03% |

| Aster DM Healthcare Ltd Ordinary Shares | Equity | ₹90.67 Cr | 2.00% |

| Navin Fluorine International Ltd | Equity | ₹85.66 Cr | 1.89% |

| Eris Lifesciences Ltd Registered Shs | Equity | ₹85.02 Cr | 1.88% |

| KEI Industries Ltd | Equity | ₹82.09 Cr | 1.81% |

| Affle 3i Ltd | Equity | ₹81.6 Cr | 1.80% |

| Zensar Technologies Ltd | Equity | ₹78.8 Cr | 1.74% |

| Jubilant Ingrevia Ltd Ordinary Shares | Equity | ₹76.68 Cr | 1.69% |

| India Shelter Finance Corporation Ltd | Equity | ₹76.56 Cr | 1.69% |

| TD Power Systems Ltd | Equity | ₹75.69 Cr | 1.67% |

| Caplin Point Laboratories Ltd | Equity | ₹75.45 Cr | 1.67% |

| INOX India Ltd | Equity | ₹73.43 Cr | 1.62% |

| JK Cement Ltd | Equity | ₹72.24 Cr | 1.60% |

| KPIT Technologies Ltd | Equity | ₹71.57 Cr | 1.58% |

| Gravita India Ltd | Equity | ₹71.09 Cr | 1.57% |

| Tips Music Ltd | Equity | ₹68.24 Cr | 1.51% |

| Acutaas Chemicals Ltd | Equity | ₹66.97 Cr | 1.48% |

| Subros Ltd | Equity | ₹66.6 Cr | 1.47% |

| Brigade Enterprises Ltd | Equity | ₹65.39 Cr | 1.44% |

| Coforge Ltd | Equity | ₹64.98 Cr | 1.43% |

| eClerx Services Ltd | Equity | ₹62.07 Cr | 1.37% |

| Krishna Institute of Medical Sciences Ltd | Equity | ₹60.39 Cr | 1.33% |

| Tube Investments of India Ltd Ordinary Shares | Equity | ₹60.25 Cr | 1.33% |

| V-Mart Retail Ltd | Equity | ₹58.19 Cr | 1.28% |

| IndiaMART InterMESH Ltd | Equity | ₹54.73 Cr | 1.21% |

| Praj Industries Ltd | Equity | ₹53.08 Cr | 1.17% |

| Kajaria Ceramics Ltd | Equity | ₹52.89 Cr | 1.17% |

| Godrej Agrovet Ltd Ordinary Shares | Equity | ₹52.71 Cr | 1.16% |

| Great Eastern Shipping Co Ltd | Equity | ₹52.33 Cr | 1.16% |

| Timken India Ltd | Equity | ₹52.08 Cr | 1.15% |

| Sonata Software Ltd | Equity | ₹51.28 Cr | 1.13% |

| Awfis Space Solutions Ltd | Equity | ₹50.27 Cr | 1.11% |

| Grindwell Norton Ltd | Equity | ₹47.85 Cr | 1.06% |

| Nesco Ltd | Equity | ₹47.35 Cr | 1.05% |

| TeamLease Services Ltd | Equity | ₹46.64 Cr | 1.03% |

| Whirlpool of India Ltd | Equity | ₹46.07 Cr | 1.02% |

| Marksans Pharma Ltd | Equity | ₹45.8 Cr | 1.01% |

| Blue Jet Healthcare Ltd | Equity | ₹45.79 Cr | 1.01% |

| Heritage Foods Ltd | Equity | ₹44.53 Cr | 0.98% |

| Carborundum Universal Ltd | Equity | ₹44.37 Cr | 0.98% |

| AAVAS Financiers Ltd | Equity | ₹44.19 Cr | 0.98% |

| CIE Automotive India Ltd | Equity | ₹44.03 Cr | 0.97% |

| Fine Organic Industries Ltd Ordinary Shares | Equity | ₹43.9 Cr | 0.97% |

| Blue Star Ltd | Equity | ₹43.64 Cr | 0.96% |

| PSP Projects Ltd | Equity | ₹43.49 Cr | 0.96% |

| Vijaya Diagnostic Centre Ltd | Equity | ₹43 Cr | 0.95% |

| Aditya Birla Capital Ltd | Equity | ₹42.88 Cr | 0.95% |

| Metropolis Healthcare Ltd | Equity | ₹42.04 Cr | 0.93% |

| KFin Technologies Ltd | Equity | ₹41.68 Cr | 0.92% |

| CreditAccess Grameen Ltd Ordinary Shares | Equity | ₹41.12 Cr | 0.91% |

| Clean Science and Technology Ltd | Equity | ₹41.05 Cr | 0.91% |

| Metro Brands Ltd | Equity | ₹40.91 Cr | 0.90% |

| Dixon Technologies (India) Ltd | Equity | ₹40.56 Cr | 0.90% |

| Rossari Biotech Ltd Ordinary Shares | Equity | ₹39.65 Cr | 0.88% |

| Computer Age Management Services Ltd Ordinary Shares | Equity | ₹39.54 Cr | 0.87% |

| Ratnamani Metals & Tubes Ltd | Equity | ₹37.66 Cr | 0.83% |

| Aarti Industries Ltd | Equity | ₹36.83 Cr | 0.81% |

| Pitti Engineering Ltd | Equity | ₹36.14 Cr | 0.80% |

| Cera Sanitaryware Ltd | Equity | ₹35.64 Cr | 0.79% |

| NIIT Learning Systems Ltd | Equity | ₹35.58 Cr | 0.79% |

| Concord Biotech Ltd | Equity | ₹35.31 Cr | 0.78% |

| Ujjivan Small Finance Bank Ltd Ordinary Shares | Equity | ₹35.29 Cr | 0.78% |

| Johnson Controls - Hitachi Air Conditioning India Ltd | Equity | ₹33.99 Cr | 0.75% |

| 360 One Wam Ltd Ordinary Shares | Equity | ₹33.49 Cr | 0.74% |

| Firstsource Solutions Ltd | Equity | ₹32.33 Cr | 0.71% |

| Kewal Kiran Clothing Ltd | Equity | ₹31.77 Cr | 0.70% |

| Sheela Foam Ltd | Equity | ₹30.87 Cr | 0.68% |

| Radico Khaitan Ltd | Equity | ₹29.95 Cr | 0.66% |

| RHI Magnesita India Ltd | Equity | ₹29.75 Cr | 0.66% |

| Equitas Small Finance Bank Ltd Ordinary Shares | Equity | ₹28.36 Cr | 0.63% |

| Avanti Feeds Ltd | Equity | ₹27.67 Cr | 0.61% |

| Indo Count Industries Ltd | Equity | ₹27.03 Cr | 0.60% |

| Indian Energy Exchange Ltd | Equity | ₹25.14 Cr | 0.56% |

| La Opala RG Ltd | Equity | ₹21.62 Cr | 0.48% |

| PNB Housing Finance Ltd | Equity | ₹21.28 Cr | 0.47% |

| National Aluminium Co Ltd | Equity | ₹21.03 Cr | 0.46% |

| Route Mobile Ltd Ordinary Shares | Equity | ₹19.2 Cr | 0.42% |

| Orchid Pharma Ltd | Equity | ₹17.82 Cr | 0.39% |

| Greenpanel Industries Ltd Ordinary Shares | Equity | ₹16.7 Cr | 0.37% |

| Sai Silks (Kalamandir) Ltd | Equity | ₹14.34 Cr | 0.32% |

| PNC Infratech Ltd | Equity | ₹11.24 Cr | 0.25% |

| Arman Financial Services Ltd | Equity | ₹10.38 Cr | 0.23% |

| Safari Industries (India) Ltd | Equity | ₹9.64 Cr | 0.21% |

| Raymond Lifestyle Ltd | Equity | ₹6.69 Cr | 0.15% |

| Clearing Corporation Of India Ltd. Std - Margin | Cash - Repurchase Agreement | ₹0.96 Cr | 0.02% |

Allocation By Market Cap (Equity)

Large Cap Stocks

--

Mid Cap Stocks

12.67%

Small Cap Stocks

83.65%

Allocation By Credit Quality (Debt)

AAA

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Industrials | ₹1,105.8 Cr | 24.42% |

| Financial Services | ₹687.02 Cr | 15.17% |

| Basic Materials | ₹633.77 Cr | 13.99% |

| Healthcare | ₹541.28 Cr | 11.95% |

| Technology | ₹482.81 Cr | 10.66% |

| Consumer Cyclical | ₹431.74 Cr | 9.53% |

| Communication Services | ₹223.77 Cr | 4.94% |

| Consumer Defensive | ₹190.43 Cr | 4.20% |

| Real Estate | ₹65.39 Cr | 1.44% |

Risk & Performance Ratios

Standard Deviation

This fund

17.13%

Cat. avg.

17.23%

Lower the better

Sharpe Ratio

This fund

0.81

Cat. avg.

0.95

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.58

Higher the better

Fund Managers

Ankit Agarwal

Since December 2020

Nitin Jain

Since October 2024

Additional Scheme Detailsas of 31st May 2025

ISIN | INF789F1AUO6 | Expense Ratio | 1.90% | Exit Load | 1.00% | Fund Size | ₹4,529 Cr | Age | 4 years 5 months | Lumpsum Minimum | ₹5,000 | Fund Status | Open Ended Investment Company | Benchmark | Nifty Smallcap 250 TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

- If units are sold after 1 year from the date of investment: Gains up to INR 1.25 lakh in a financial year are exempt from tax. Any gains exceeding INR 1.25 lakh are taxed at a rate of 12.5%.

- If units are sold within 1 year from the date of investment: The entire amount of gain is taxed at a rate of 20%.

- Holding the units: No tax is applicable as long as you continue to hold the units.

Dividend Taxation:

Dividend Taxation:

Dividends are added to the investor’s income and taxed according to their respective tax slabs. Additionally, if an investors dividend income exceeds INR 5,000 in a financial year, the fund house deducts a 10% Tax Deducted at Source (TDS) before distributing the dividend.

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

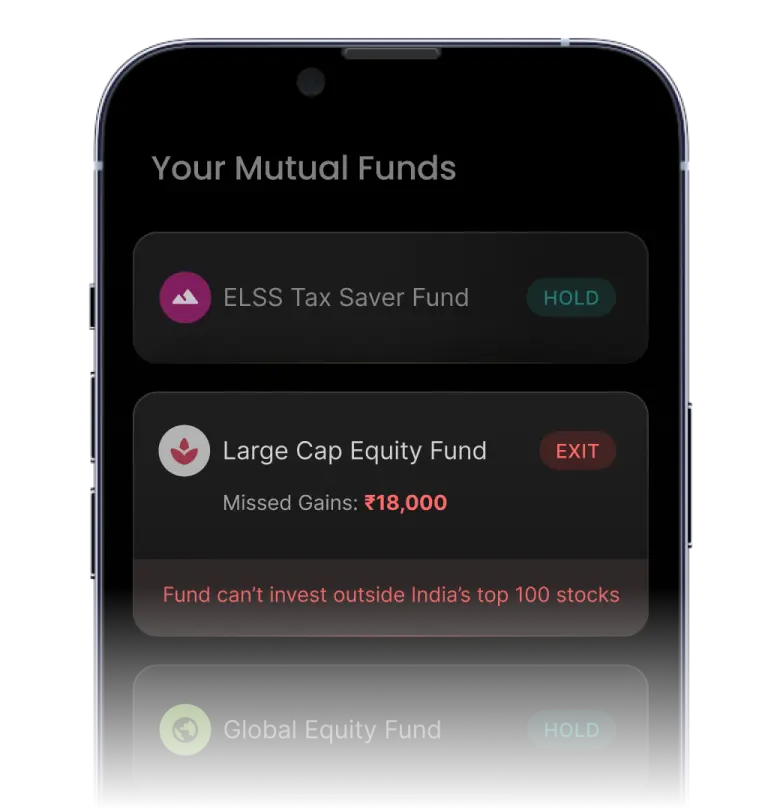

Similar Small-Cap Funds

| Fund name | Expense Ratio | Exit Load | Fund size | 1Y |

|---|---|---|---|---|

| Mirae Asset Small Cap Fund Regular Growth Very High Risk | 2.0% | 1.0% | ₹1580.47 Cr | - |

| Mirae Asset Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹1580.47 Cr | - |

| TrustMF Small Cap Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹970.00 Cr | - |

| TrustMF Small Cap Fund Regular Growth Very High Risk | 2.2% | 1.0% | ₹970.00 Cr | - |

| JM Small Cap Fund Regular Growth Very High Risk | 2.3% | 1.0% | ₹720.48 Cr | 0.0% |

| JM Small Cap Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹720.48 Cr | 1.8% |

| Motilal Oswal Nifty Smallcap 250 ETF Very High Risk | 0.3% | - | ₹100.05 Cr | 0.7% |

| Motilal Oswal Small Cap Fund Regular Growth Very High Risk | 1.8% | 1.0% | ₹4927.18 Cr | 15.5% |

| Motilal Oswal Small Cap Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹4927.18 Cr | 17.1% |

| Quantum Small Cap Fund Direct Growth Very High Risk | 0.7% | 1.0% | ₹132.10 Cr | 8.7% |

About the AMC

Total AUM

₹3,29,939 Cr

Address

UTI Towers, Gn Block, Mumbai, 400 051

Other Funds by UTI Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of UTI Small Cap Fund Regular Growth?

What are the returns of UTI Small Cap Fund Regular Growth?

What is the portfolio composition of UTI Small Cap Fund Regular Growth?

Who manages the UTI Small Cap Fund Regular Growth?

- Ankit Agarwal

- Nitin Jain