Fund Overview

Fund Size

₹16,935 Cr

Expense Ratio

1.70%

ISIN

INF740K01797

Minimum SIP

₹100

Exit Load

1.00%

Inception Date

14 Jun 2007

About this fund

As of 23-Jan-26, it has a Net Asset Value (NAV) of ₹182.22, Assets Under Management (AUM) of 16934.59 Crores, and an expense ratio of 1.7%.

- DSP Small Cap Fund Regular Growth has given a CAGR return of 16.88% since inception.

- The fund's asset allocation comprises around 94.08% in equities, 0.00% in debts, and 5.92% in cash & cash equivalents.

- You can start investing in DSP Small Cap Fund Regular Growth with a SIP of ₹100 or a Lumpsum investment of ₹100.

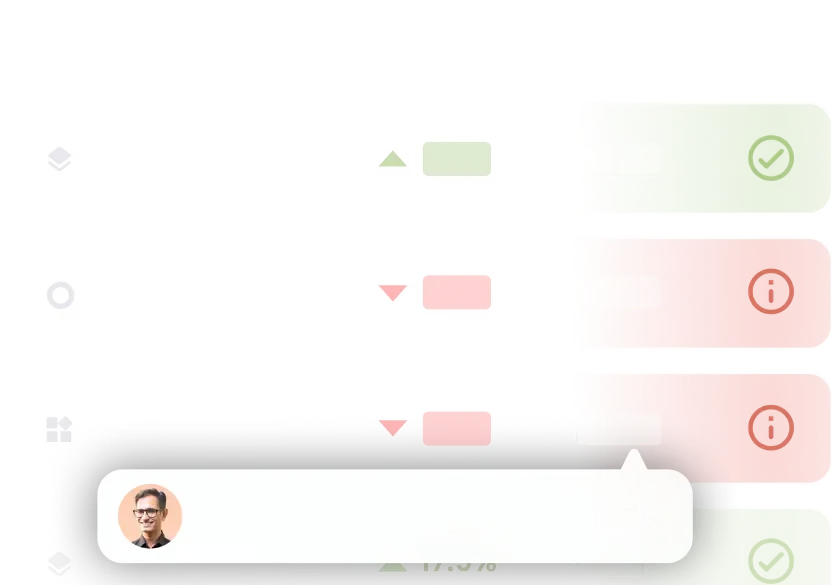

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

-2.14%

— (Cat Avg.)

3 Years

+17.53%

+17.19% (Cat Avg.)

5 Years

+20.32%

+20.96% (Cat Avg.)

10 Years

+16.48%

+16.95% (Cat Avg.)

Since Inception

+16.88%

— (Cat Avg.)

Portfolio Summaryas of 31st December 2025

| Equity | ₹15,931.43 Cr | 94.08% |

| Others | ₹1,003.16 Cr | 5.92% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Treps / Reverse Repo Investments | Cash - Repurchase Agreement | ₹1,089.41 Cr | 6.43% |

| Lumax Auto Technologies Ltd | Equity | ₹957.07 Cr | 5.65% |

| Thangamayil Jewellery Ltd | Equity | ₹540.64 Cr | 3.19% |

| eClerx Services Ltd | Equity | ₹519.26 Cr | 3.07% |

| Jubilant Ingrevia Ltd Ordinary Shares | Equity | ₹492.42 Cr | 2.91% |

| Kirloskar Oil Engines Ltd | Equity | ₹487.52 Cr | 2.88% |

| Dodla Dairy Ltd | Equity | ₹469.05 Cr | 2.77% |

| Welspun Corp Ltd | Equity | ₹447.92 Cr | 2.65% |

| LT Foods Ltd | Equity | ₹389.45 Cr | 2.30% |

| Triveni Engineering & Industries Ltd | Equity | ₹359.08 Cr | 2.12% |

| Shriram Pistons & Rings Ltd | Equity | ₹350.08 Cr | 2.07% |

| Cyient Ltd | Equity | ₹335.34 Cr | 1.98% |

| Ipca Laboratories Ltd | Equity | ₹329.18 Cr | 1.94% |

| Sansera Engineering Ltd | Equity | ₹296.83 Cr | 1.75% |

| Dhanuka Agritech Ltd | Equity | ₹290.65 Cr | 1.72% |

| Safari Industries (India) Ltd | Equity | ₹282.67 Cr | 1.67% |

| Suprajit Engineering Ltd | Equity | ₹278.1 Cr | 1.64% |

| IFB Industries Ltd | Equity | ₹273 Cr | 1.61% |

| Techno Electric & Engineering Co Ltd | Equity | ₹270.52 Cr | 1.60% |

| Aarti Drugs Ltd | Equity | ₹262.95 Cr | 1.55% |

| Harsha Engineers International Ltd | Equity | ₹262.61 Cr | 1.55% |

| Swaraj Engines Ltd | Equity | ₹261.78 Cr | 1.55% |

| Archean Chemical Industries Ltd | Equity | ₹250.72 Cr | 1.48% |

| Atul Ltd | Equity | ₹247.94 Cr | 1.46% |

| Greenlam Industries Ltd | Equity | ₹247.27 Cr | 1.46% |

| Prudent Corporate Advisory Services Ltd | Equity | ₹232.26 Cr | 1.37% |

| Vardhman Textiles Ltd | Equity | ₹218.78 Cr | 1.29% |

| Gland Pharma Ltd | Equity | ₹218.37 Cr | 1.29% |

| Navin Fluorine International Ltd | Equity | ₹213.34 Cr | 1.26% |

| Voltamp Transformers Ltd | Equity | ₹204.15 Cr | 1.21% |

| Rainbow Childrens Medicare Ltd | Equity | ₹202.87 Cr | 1.20% |

| TCPL Packaging Ltd | Equity | ₹193.33 Cr | 1.14% |

| R R Kabel Ltd | Equity | ₹188.35 Cr | 1.11% |

| Campus Activewear Ltd | Equity | ₹185.98 Cr | 1.10% |

| Eris Lifesciences Ltd Registered Shs | Equity | ₹185.19 Cr | 1.09% |

| Concord Biotech Ltd | Equity | ₹179.2 Cr | 1.06% |

| Nilkamal Ltd | Equity | ₹162.52 Cr | 0.96% |

| Mold-tek Packaging Ltd | Equity | ₹157.77 Cr | 0.93% |

| Westlife Foodworld Ltd | Equity | ₹152.84 Cr | 0.90% |

| Sharda Cropchem Ltd | Equity | ₹152.79 Cr | 0.90% |

| PNB Housing Finance Ltd | Equity | ₹148.6 Cr | 0.88% |

| Amber Enterprises India Ltd Ordinary Shares | Equity | ₹146.9 Cr | 0.87% |

| Ratnamani Metals & Tubes Ltd | Equity | ₹142.83 Cr | 0.84% |

| Max Financial Services Ltd | Equity | ₹140.04 Cr | 0.83% |

| Narayana Hrudayalaya Ltd | Equity | ₹136.45 Cr | 0.81% |

| S.P. Apparels Ltd | Equity | ₹135.7 Cr | 0.80% |

| La Opala RG Ltd | Equity | ₹132.83 Cr | 0.78% |

| Sandhar Technologies Ltd Ordinary Shares | Equity | ₹132.52 Cr | 0.78% |

| Niva Bupa Health Insurance Co Ltd | Equity | ₹132.14 Cr | 0.78% |

| Kalyani Steels Ltd | Equity | ₹131.07 Cr | 0.77% |

| GHCL Ltd | Equity | ₹128.37 Cr | 0.76% |

| Alembic Pharmaceuticals Ltd | Equity | ₹126.92 Cr | 0.75% |

| Anand Rathi Wealth Ltd | Equity | ₹126.12 Cr | 0.74% |

| Prince Pipes And Fittings Ltd Ordinary Shares | Equity | ₹120.61 Cr | 0.71% |

| Borosil Ltd Ordinary Shares | Equity | ₹115.48 Cr | 0.68% |

| Apar Industries Ltd | Equity | ₹115.07 Cr | 0.68% |

| Just Dial Ltd | Equity | ₹111.97 Cr | 0.66% |

| Rolex Rings Ltd | Equity | ₹109.68 Cr | 0.65% |

| HLE Glascoat Ltd | Equity | ₹105.44 Cr | 0.62% |

| Manappuram Finance Ltd | Equity | ₹102.8 Cr | 0.61% |

| Kalpataru Projects International Ltd | Equity | ₹100.98 Cr | 0.60% |

| Amrutanjan Health Care Ltd | Equity | ₹98.03 Cr | 0.58% |

| Stylam Industries Ltd | Equity | ₹97.25 Cr | 0.57% |

| Net Receivables/Payables | Cash | ₹-96.25 Cr | 0.57% |

| Canara HSBC Life Insurance Co Ltd | Equity | ₹95.52 Cr | 0.56% |

| West Coast Paper Mills Ltd | Equity | ₹94.84 Cr | 0.56% |

| Carysil Ltd | Equity | ₹89.87 Cr | 0.53% |

| Sheela Foam Ltd | Equity | ₹84.76 Cr | 0.50% |

| R Systems International Ltd | Equity | ₹83.13 Cr | 0.49% |

| Bayer CropScience Ltd | Equity | ₹82.35 Cr | 0.49% |

| Happy Forgings Ltd | Equity | ₹81.78 Cr | 0.48% |

| Ujjivan Small Finance Bank Ltd Ordinary Shares | Equity | ₹78.05 Cr | 0.46% |

| Sona BLW Precision Forgings Ltd | Equity | ₹76.04 Cr | 0.45% |

| Angel One Ltd Ordinary Shares | Equity | ₹73.7 Cr | 0.44% |

| Graphite India Ltd | Equity | ₹71.93 Cr | 0.42% |

| CSB Bank Ltd Ordinary Shares | Equity | ₹69.16 Cr | 0.41% |

| Sudarshan Chemical Industries Ltd | Equity | ₹60.65 Cr | 0.36% |

| Engineers India Ltd | Equity | ₹60.37 Cr | 0.36% |

| Equitas Small Finance Bank Ltd Ordinary Shares | Equity | ₹57.62 Cr | 0.34% |

| JNK India Ltd | Equity | ₹37.24 Cr | 0.22% |

| Jamna Auto Industries Ltd | Equity | ₹36.82 Cr | 0.22% |

| Shoppers Stop Ltd | Equity | ₹34.64 Cr | 0.20% |

| GHCL Textiles Ltd | Equity | ₹31.73 Cr | 0.19% |

| IRM Energy Ltd | Equity | ₹23.02 Cr | 0.14% |

| Power Mech Projects Ltd | Equity | ₹20.62 Cr | 0.12% |

| Cash Margin | Cash | ₹10 Cr | 0.06% |

Allocation By Market Cap (Equity)

Large Cap Stocks

--

Mid Cap Stocks

4.26%

Small Cap Stocks

89.82%

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Consumer Cyclical | ₹5,673.21 Cr | 33.50% |

| Basic Materials | ₹2,735.88 Cr | 16.16% |

| Industrials | ₹2,572.23 Cr | 15.19% |

| Healthcare | ₹1,739.16 Cr | 10.27% |

| Financial Services | ₹1,256 Cr | 7.42% |

| Consumer Defensive | ₹1,217.58 Cr | 7.19% |

| Technology | ₹602.39 Cr | 3.56% |

| Communication Services | ₹111.97 Cr | 0.66% |

| Utilities | ₹23.02 Cr | 0.14% |

Risk & Performance Ratios

Standard Deviation

This fund

18.73%

Cat. avg.

16.80%

Lower the better

Sharpe Ratio

This fund

0.72

Cat. avg.

0.78

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.25

Higher the better

Fund Managers

Vinit Sambre

Since June 2010

Additional Scheme Detailsas of 31st December 2025

ISIN INF740K01797 | Expense Ratio 1.70% | Exit Load 1.00% | Fund Size ₹16,935 Cr | Age 18 years 7 months | Lumpsum Minimum ₹100 | Fund Status Open Ended Investment Company | Benchmark S&P BSE 250 SmallCap TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Small-Cap Funds

About the AMC

DSP Mutual Fund

Total AUM

₹2,26,547 Cr

Address

West Wing, 11th Floor, Mumbai, 400021

Other Funds by DSP Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of DSP Small Cap Fund Regular Growth?

What are the returns of DSP Small Cap Fund Regular Growth?

What is the portfolio composition of DSP Small Cap Fund Regular Growth?

Who manages the DSP Small Cap Fund Regular Growth?

- Vinit Sambre