Direct

NAV (25-Jul-24)

Returns (Since Inception)

Fund Overview

Fund Size

₹363 Cr

Expense Ratio

0.48%

ISIN

INF00XX01390

Minimum SIP

₹500

Exit Load

No Charges

Inception Date

18 Oct 2019

About this fund

As of 25-Jul-24, it has a Net Asset Value (NAV) of ₹26.75, Assets Under Management (AUM) of 363.38 Crores, and an expense ratio of 0.48%.

- ITI Long Term Equity Fund Direct Growth has given a CAGR return of 22.91% since inception.

- The fund's asset allocation comprises around 98.27% in equities, 0.00% in debts, and 1.73% in cash & cash equivalents.

- You can start investing in ITI Long Term Equity Fund Direct Growth with a SIP of ₹500 or a Lumpsum investment of ₹500.

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+55.51%

+37.41% (Cat Avg.)

3 Years

+21.28%

+19.51% (Cat Avg.)

Since Inception

+22.91%

— (Cat Avg.)

Portfolio Summaryas of 30th June 2024

| Equity | ₹357.11 Cr | 98.27% |

| Others | ₹6.27 Cr | 1.73% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Bharti Airtel Ltd (Partly Paid Rs.1.25) | Equity | ₹18.11 Cr | 4.98% |

| Zomato Ltd | Equity | ₹14.56 Cr | 4.01% |

| Larsen & Toubro Ltd | Equity | ₹14.2 Cr | 3.91% |

| Trent Ltd | Equity | ₹14.16 Cr | 3.90% |

| InterGlobe Aviation Ltd | Equity | ₹12.83 Cr | 3.53% |

| Bharti Airtel Ltd | Equity | ₹12.24 Cr | 3.37% |

| Jindal Stainless Ltd | Equity | ₹11.55 Cr | 3.18% |

| KEI Industries Ltd | Equity | ₹11.55 Cr | 3.18% |

| Cholamandalam Investment and Finance Co Ltd | Equity | ₹11.35 Cr | 3.12% |

| TVS Motor Co Ltd | Equity | ₹10.23 Cr | 2.82% |

| Arvind Ltd | Equity | ₹10.12 Cr | 2.78% |

| ICICI Bank Ltd | Equity | ₹9.32 Cr | 2.56% |

| Sobha Ltd | Equity | ₹8.86 Cr | 2.44% |

| State Bank of India | Equity | ₹8.71 Cr | 2.40% |

| Century Textiles & Industries Ltd | Equity | ₹8.35 Cr | 2.30% |

| Axis Bank Ltd | Equity | ₹7.92 Cr | 2.18% |

| Jana Small Finance Bank Ltd | Equity | ₹7.76 Cr | 2.14% |

| NTPC Ltd | Equity | ₹7.61 Cr | 2.09% |

| Tata Consultancy Services Ltd | Equity | ₹7.41 Cr | 2.04% |

| Finolex Industries Ltd | Equity | ₹7.16 Cr | 1.97% |

| JTL Industries Ltd | Equity | ₹6.68 Cr | 1.84% |

| Vodafone Idea Ltd | Equity | ₹6.54 Cr | 1.80% |

| Phoenix Mills Ltd | Equity | ₹6.51 Cr | 1.79% |

| Nava Ltd | Equity | ₹6.28 Cr | 1.73% |

| Net Receivables / (Payables) | Cash | ₹6.27 Cr | 1.73% |

| Ceat Ltd | Equity | ₹6.14 Cr | 1.69% |

| Finolex Cables Ltd | Equity | ₹6.08 Cr | 1.67% |

| Mahindra & Mahindra Ltd | Equity | ₹5.99 Cr | 1.65% |

| CMS Info Systems Ltd | Equity | ₹5.92 Cr | 1.63% |

| Sterling and Wilson Renewable Energy Ltd | Equity | ₹5.71 Cr | 1.57% |

| Tata Motors Ltd | Equity | ₹5.23 Cr | 1.44% |

| HDFC Bank Ltd | Equity | ₹5.07 Cr | 1.40% |

| KPIT Technologies Ltd | Equity | ₹4.93 Cr | 1.36% |

| Jindal Saw Ltd | Equity | ₹4.8 Cr | 1.32% |

| Reliance Industries Ltd | Equity | ₹4.79 Cr | 1.32% |

| ITC Ltd | Equity | ₹4.39 Cr | 1.21% |

| Tega Industries Ltd | Equity | ₹4.11 Cr | 1.13% |

| Pidilite Industries Ltd | Equity | ₹4.08 Cr | 1.12% |

| Bharti Hexacom Ltd | Equity | ₹3.91 Cr | 1.08% |

| Hindustan Aeronautics Ltd Ordinary Shares | Equity | ₹3.87 Cr | 1.06% |

| Zensar Technologies Ltd | Equity | ₹3.74 Cr | 1.03% |

| CG Power & Industrial Solutions Ltd | Equity | ₹3.68 Cr | 1.01% |

| NLC India Ltd | Equity | ₹3.6 Cr | 0.99% |

| IndusInd Bank Ltd | Equity | ₹3.5 Cr | 0.96% |

| NCC Ltd | Equity | ₹3.16 Cr | 0.87% |

| Bharat Petroleum Corp Ltd | Equity | ₹2.77 Cr | 0.76% |

| CreditAccess Grameen Ltd Ordinary Shares | Equity | ₹2.68 Cr | 0.74% |

| DLF Ltd | Equity | ₹2.57 Cr | 0.71% |

| GlaxoSmithKline Pharmaceuticals Ltd | Equity | ₹2.39 Cr | 0.66% |

| Siemens Ltd | Equity | ₹2.32 Cr | 0.64% |

| Bharat Electronics Ltd | Equity | ₹2.3 Cr | 0.63% |

| Dredging Corp of India Ltd | Equity | ₹2.21 Cr | 0.61% |

| TVS Srichakra Ltd | Equity | ₹2.19 Cr | 0.60% |

| Indus Towers Ltd Ordinary Shares | Equity | ₹1.88 Cr | 0.52% |

| Nitin Spinners Ltd | Equity | ₹1.21 Cr | 0.33% |

| Tech Mahindra Ltd | Equity | ₹0.96 Cr | 0.26% |

| eClerx Services Ltd | Equity | ₹0.75 Cr | 0.21% |

| Sobha Limited | Equity | ₹0.17 Cr | 0.05% |

Allocation By Market Cap (Equity)

Large Cap Stocks

55.15%

Mid Cap Stocks

16.37%

Small Cap Stocks

26.71%

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Industrials | ₹85.67 Cr | 23.58% |

| Consumer Cyclical | ₹69.83 Cr | 19.22% |

| Financial Services | ₹56.32 Cr | 15.50% |

| Communication Services | ₹42.67 Cr | 11.74% |

| Basic Materials | ₹35.46 Cr | 9.76% |

| Technology | ₹23.5 Cr | 6.47% |

| Real Estate | ₹17.95 Cr | 4.94% |

| Utilities | ₹11.21 Cr | 3.09% |

| Energy | ₹7.56 Cr | 2.08% |

| Consumer Defensive | ₹4.39 Cr | 1.21% |

| Healthcare | ₹2.39 Cr | 0.66% |

Risk & Performance Ratios

Standard Deviation

This fund

12.79%

Cat. avg.

12.52%

Lower the better

Sharpe Ratio

This fund

1.18

Cat. avg.

0.97

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.80

Higher the better

Fund Managers

Dhimant Shah

Since December 2022

Vishal Jajoo

Since May 2023

Additional Scheme Detailsas of 30th June 2024

ISIN | INF00XX01390 | Expense Ratio | 0.48% | Exit Load | No Charges | Fund Size | ₹363 Cr | Age | 18 Oct 2019 | Lumpsum Minimum | ₹500 | Fund Status | Open Ended Investment Company | Benchmark | Nifty 500 TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Withdrawal within 1 year

Withdrawal within 1 year

Flat 15% tax on realised gains (STCG - short term capital gains)

Withdrawal after 1 year

Withdrawal after 1 year

10% tax on realised gains above Rs. 1 lakh per financial year (LTCG - long term capital gains)

Note: Mutual funds are subject to capital gains taxation with surcharge and cess, based on prevailing income tax rules and investor income. Taxation applies to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

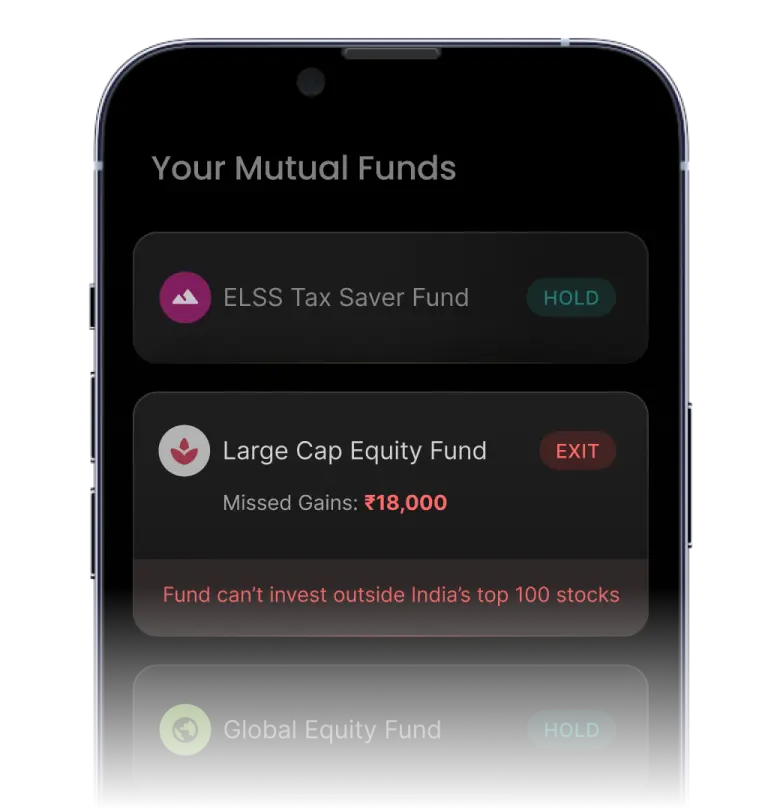

Similar ELSS (Tax Savings) Funds

| Fund name | Expense Ratio | Exit Load | Fund size | 1Y |

|---|---|---|---|---|

| Tata India Tax Savings Fund Direct Growth Very High Risk | 0.7% | 0.0% | ₹4551.18 Cr | 34.0% |

| Tata India Tax Savings Fund Regular Growth Very High Risk | 1.8% | 0.0% | ₹4551.18 Cr | 32.5% |

| Axis Long Term Equity Fund Regular Growth Very High Risk | 1.5% | 0.0% | ₹37106.30 Cr | 29.4% |

| Parag Parikh Tax Saver Fund Direct Growth Very High Risk | 0.6% | 0.0% | ₹3731.20 Cr | 36.0% |

| Parag Parikh Tax Saver Fund Regular Growth Very High Risk | 1.7% | 0.0% | ₹3731.20 Cr | 34.5% |

| Shriram Long Term Equity Fund Direct Growth Very High Risk | 0.8% | 0.0% | ₹54.22 Cr | 41.8% |

| Shriram Long Term Equity Fund Regular Growth Very High Risk | 2.3% | 0.0% | ₹54.22 Cr | 39.5% |

| ITI Long Term Equity Fund Direct Growth Very High Risk | 0.5% | 0.0% | ₹363.38 Cr | 55.5% |

| ITI Long Term Equity Fund Regular Growth Very High Risk | 2.3% | 0.0% | ₹363.38 Cr | 52.7% |

| Sundaram Diversified Equity Regular Growth Very High Risk | 2.2% | 0.0% | ₹1649.12 Cr | 25.5% |

About the AMC

Other Funds by ITI Mutual Fund

| Fund name | Expense Ratio | Exit Load | Fund size | 1Y |

|---|---|---|---|---|

| ITI Focused Equity Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹445.78 Cr | 46.7% |

| ITI Liquid Fund Direct Growth Low to Moderate Risk | 0.1% | 0.0% | ₹75.50 Cr | 7.1% |

| ITI Ultra Short Duration Fund Direct Growth Low to Moderate Risk | 0.1% | 0.0% | ₹229.94 Cr | 7.4% |

| ITI Multi Cap Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹1333.12 Cr | 52.0% |

| ITI Value Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹277.58 Cr | 51.9% |

| ITI Conservative Hybrid Fund Direct Growth Moderate Risk | 0.2% | 0.0% | ₹14.80 Cr | 8.9% |

| ITI Dynamic Bond Fund Direct Growth Moderate Risk | 0.1% | 0.0% | ₹56.60 Cr | 8.7% |

| ITI Balanced Advantage Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹378.71 Cr | 25.5% |

| ITI Small Cap Fund Direct Growth Very High Risk | 0.2% | 1.0% | ₹2299.93 Cr | 66.6% |

| ITI Large Cap Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹345.64 Cr | 38.8% |

| ITI Banking & PSU Debt Fund Direct Growth Moderate Risk | 0.1% | 0.0% | ₹30.46 Cr | 7.7% |

| ITI Banking and Financial Services Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹271.87 Cr | 13.6% |

| ITI Arbitrage Fund Direct Growth Low Risk | 0.2% | 0.0% | ₹33.58 Cr | 8.3% |

| ITI Overnight Fund Direct Growth Low Risk | 0.1% | 0.0% | ₹33.41 Cr | 6.6% |

| ITI Mid Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹1056.68 Cr | 70.2% |

| ITI Long Term Equity Fund Direct Growth Very High Risk | 0.5% | 0.0% | ₹363.38 Cr | 55.5% |

| ITI Pharma and Healthcare Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹173.47 Cr | 45.0% |

| ITI Flexi Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹1116.40 Cr | 50.2% |

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of ITI Long Term Equity Fund Direct Growth?

What are the returns of ITI Long Term Equity Fund Direct Growth?

What is the portfolio composition of ITI Long Term Equity Fund Direct Growth?

Who manages the ITI Long Term Equity Fund Direct Growth?

- Dhimant Shah

- Vishal Jajoo