Regular

NAV (18-Jun-25)

Returns (Since Inception)

Fund Overview

Fund Size

₹34,028 Cr

Expense Ratio

1.56%

ISIN

INF200K01T28

Minimum SIP

₹1,000

Exit Load

1.00%

Inception Date

09 Sep 2009

About this fund

As of 18-Jun-25, it has a Net Asset Value (NAV) of ₹170.30, Assets Under Management (AUM) of 34028.06 Crores, and an expense ratio of 1.56%.

- SBI Small Cap Fund Regular Growth has given a CAGR return of 19.69% since inception.

- The fund's asset allocation comprises around 81.75% in equities, 0.00% in debts, and 18.25% in cash & cash equivalents.

- You can start investing in SBI Small Cap Fund Regular Growth with a SIP of ₹1000 or a Lumpsum investment of ₹5000.

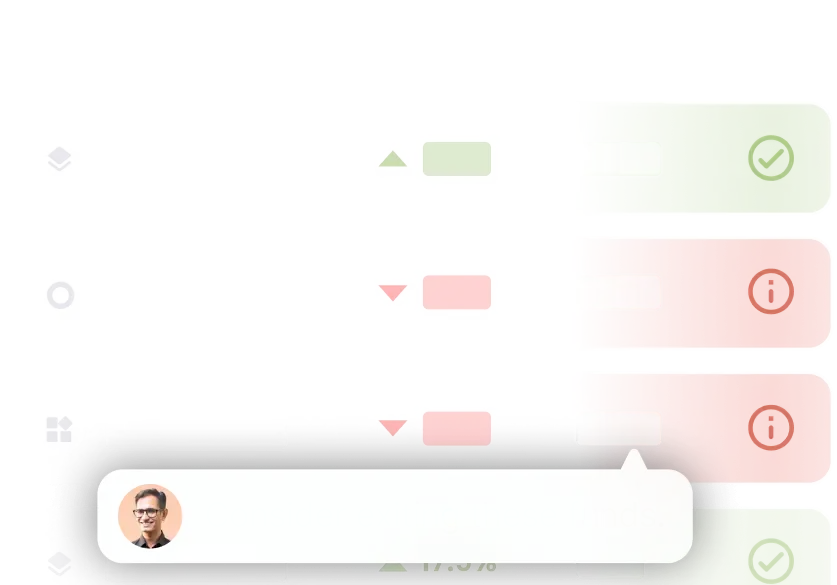

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

-2.64%

+3.72% (Cat Avg.)

3 Years

+21.72%

+27.47% (Cat Avg.)

5 Years

+29.14%

+34.59% (Cat Avg.)

10 Years

+19.05%

+17.98% (Cat Avg.)

Since Inception

+19.69%

— (Cat Avg.)

Portfolio Summaryas of 31st May 2025

| Equity | ₹27,817.82 Cr | 81.75% |

| Others | ₹6,210.24 Cr | 18.25% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Treps | Cash - Repurchase Agreement | ₹5,285.24 Cr | 15.53% |

| SBFC Finance Ltd | Equity | ₹1,008.58 Cr | 2.96% |

| Kalpataru Projects International Ltd | Equity | ₹899.61 Cr | 2.64% |

| Margin Amount For Derivative Positions | Cash - Collateral | ₹895 Cr | 2.63% |

| Chalet Hotels Ltd | Equity | ₹891.73 Cr | 2.62% |

| E I D Parry India Ltd | Equity | ₹885.92 Cr | 2.60% |

| K.P.R. Mill Ltd | Equity | ₹867.41 Cr | 2.55% |

| Krishna Institute of Medical Sciences Ltd | Equity | ₹843.27 Cr | 2.48% |

| City Union Bank Ltd | Equity | ₹815.38 Cr | 2.40% |

| DOMS Industries Ltd | Equity | ₹807.77 Cr | 2.37% |

| Deepak Fertilisers & Petrochemicals Corp Ltd | Equity | ₹780.6 Cr | 2.29% |

| Finolex Industries Ltd | Equity | ₹754.74 Cr | 2.22% |

| CMS Info Systems Ltd | Equity | ₹738.08 Cr | 2.17% |

| Cholamandalam Financial Holdings Ltd | Equity | ₹733.09 Cr | 2.15% |

| Sundaram Fasteners Ltd | Equity | ₹691.61 Cr | 2.03% |

| Aptus Value Housing Finance India Ltd | Equity | ₹665.38 Cr | 1.96% |

| Balrampur Chini Mills Ltd | Equity | ₹649.33 Cr | 1.91% |

| V-Guard Industries Ltd | Equity | ₹644.9 Cr | 1.90% |

| Navin Fluorine International Ltd | Equity | ₹639.18 Cr | 1.88% |

| Ather Energy Ltd | Equity | ₹629.03 Cr | 1.85% |

| Ratnamani Metals & Tubes Ltd | Equity | ₹605.47 Cr | 1.78% |

| Triveni Turbine Ltd | Equity | ₹572.85 Cr | 1.68% |

| Elgi Equipments Ltd | Equity | ₹535.2 Cr | 1.57% |

| Blue Star Ltd | Equity | ₹505.66 Cr | 1.49% |

| Carborundum Universal Ltd | Equity | ₹489.93 Cr | 1.44% |

| Lemon Tree Hotels Ltd | Equity | ₹486.2 Cr | 1.43% |

| Brigade Enterprises Ltd | Equity | ₹485.36 Cr | 1.43% |

| Westlife Foodworld Ltd | Equity | ₹468.48 Cr | 1.38% |

| Chemplast Sanmar Ltd | Equity | ₹466.9 Cr | 1.37% |

| Esab India Ltd | Equity | ₹452.5 Cr | 1.33% |

| Dodla Dairy Ltd | Equity | ₹451.67 Cr | 1.33% |

| Ahluwalia Contracts (India) Ltd | Equity | ₹437.85 Cr | 1.29% |

| Indian Energy Exchange Ltd | Equity | ₹431.37 Cr | 1.27% |

| Happiest Minds Technologies Ltd Ordinary Shares | Equity | ₹416.15 Cr | 1.22% |

| CSB Bank Ltd Ordinary Shares | Equity | ₹401.34 Cr | 1.18% |

| TTK Prestige Ltd | Equity | ₹363.07 Cr | 1.07% |

| HEG Ltd | Equity | ₹362.85 Cr | 1.07% |

| Happy Forgings Ltd | Equity | ₹359.92 Cr | 1.06% |

| ZF Commercial Vehicle Control Systems India Ltd | Equity | ₹346.5 Cr | 1.02% |

| G R Infraprojects Ltd | Equity | ₹345.55 Cr | 1.02% |

| IndiaMART InterMESH Ltd | Equity | ₹334.74 Cr | 0.98% |

| Fine Organic Industries Ltd Ordinary Shares | Equity | ₹311.83 Cr | 0.92% |

| Go Fashion (India) Ltd | Equity | ₹297.89 Cr | 0.88% |

| Hawkins Cookers Ltd | Equity | ₹292.9 Cr | 0.86% |

| Hatsun Agro Product Ltd | Equity | ₹283.68 Cr | 0.83% |

| Anand Rathi Wealth Ltd | Equity | ₹280.93 Cr | 0.83% |

| Vedant Fashions Ltd | Equity | ₹279.06 Cr | 0.82% |

| Archean Chemical Industries Ltd | Equity | ₹275.44 Cr | 0.81% |

| Thangamayil Jewellery Ltd | Equity | ₹249.08 Cr | 0.73% |

| Electronics Mart India Ltd | Equity | ₹241.72 Cr | 0.71% |

| Sansera Engineering Ltd | Equity | ₹240.79 Cr | 0.71% |

| KNR Constructions Ltd | Equity | ₹238.2 Cr | 0.70% |

| Sheela Foam Ltd | Equity | ₹197.21 Cr | 0.58% |

| Kajaria Ceramics Ltd | Equity | ₹188.54 Cr | 0.55% |

| Star Cement Ltd | Equity | ₹160.43 Cr | 0.47% |

| Rajratan Global Wire Ltd | Equity | ₹154.3 Cr | 0.45% |

| Afcons Infrastructure Ltd | Equity | ₹151.08 Cr | 0.44% |

| VST Industries Ltd | Equity | ₹141.02 Cr | 0.41% |

| PVR INOX Ltd | Equity | ₹139.63 Cr | 0.41% |

| Rossari Biotech Ltd Ordinary Shares | Equity | ₹133.83 Cr | 0.39% |

| ACME Solar Holdings Ltd | Equity | ₹78.78 Cr | 0.23% |

| Relaxo Footwears Ltd | Equity | ₹78.67 Cr | 0.23% |

| Ajax Engineering Ltd | Equity | ₹78.58 Cr | 0.23% |

| V-Mart Retail Ltd | Equity | ₹55.76 Cr | 0.16% |

| 182 DTB 05062025 | Bond - Gov't/Treasury | ₹54.96 Cr | 0.16% |

| Net Receivable / Payable | Cash - Collateral | ₹-24.97 Cr | 0.07% |

| CCL Products (India) Ltd | Equity | ₹3.32 Cr | 0.01% |

Allocation By Market Cap (Equity)

Large Cap Stocks

--

Mid Cap Stocks

1.49%

Small Cap Stocks

78.18%

Allocation By Credit Quality (Debt)

AAA

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Industrials | ₹8,563.8 Cr | 25.17% |

| Consumer Cyclical | ₹6,677.09 Cr | 19.62% |

| Basic Materials | ₹4,413.91 Cr | 12.97% |

| Financial Services | ₹4,336.07 Cr | 12.74% |

| Consumer Defensive | ₹1,529.02 Cr | 4.49% |

| Healthcare | ₹843.27 Cr | 2.48% |

| Real Estate | ₹485.36 Cr | 1.43% |

| Communication Services | ₹474.37 Cr | 1.39% |

| Technology | ₹416.15 Cr | 1.22% |

| Utilities | ₹78.78 Cr | 0.23% |

Risk & Performance Ratios

Standard Deviation

This fund

15.01%

Cat. avg.

17.23%

Lower the better

Sharpe Ratio

This fund

0.80

Cat. avg.

0.95

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.58

Higher the better

Fund Managers

R. Srinivasan

Since November 2013

Mohan Lal

Since May 2024

Additional Scheme Detailsas of 31st May 2025

ISIN | INF200K01T28 | Expense Ratio | 1.56% | Exit Load | 1.00% | Fund Size | ₹34,028 Cr | Age | 15 years 9 months | Lumpsum Minimum | ₹5,000 | Fund Status | Open Ended Investment Company | Benchmark | BSE 250 SmallCap TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

- If units are sold after 1 year from the date of investment: Gains up to INR 1.25 lakh in a financial year are exempt from tax. Any gains exceeding INR 1.25 lakh are taxed at a rate of 12.5%.

- If units are sold within 1 year from the date of investment: The entire amount of gain is taxed at a rate of 20%.

- Holding the units: No tax is applicable as long as you continue to hold the units.

Dividend Taxation:

Dividend Taxation:

Dividends are added to the investor’s income and taxed according to their respective tax slabs. Additionally, if an investors dividend income exceeds INR 5,000 in a financial year, the fund house deducts a 10% Tax Deducted at Source (TDS) before distributing the dividend.

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

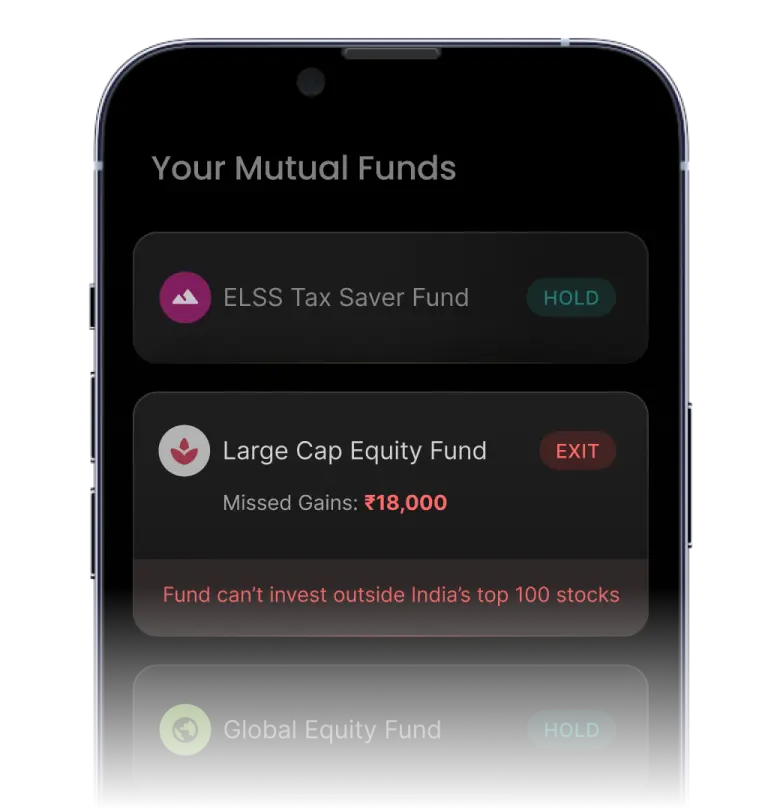

Similar Small-Cap Funds

| Fund name | Expense Ratio | Exit Load | Fund size | 1Y |

|---|---|---|---|---|

| Mirae Asset Small Cap Fund Regular Growth Very High Risk | 2.0% | 1.0% | ₹1580.47 Cr | - |

| Mirae Asset Small Cap Fund Direct Growth Very High Risk | 0.4% | 1.0% | ₹1580.47 Cr | - |

| TrustMF Small Cap Fund Direct Growth Very High Risk | 0.5% | 1.0% | ₹970.00 Cr | - |

| TrustMF Small Cap Fund Regular Growth Very High Risk | 2.2% | 1.0% | ₹970.00 Cr | - |

| JM Small Cap Fund Regular Growth Very High Risk | 2.3% | 1.0% | ₹720.48 Cr | 0.0% |

| JM Small Cap Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹720.48 Cr | 1.8% |

| Motilal Oswal Nifty Smallcap 250 ETF Very High Risk | 0.3% | - | ₹100.05 Cr | 0.7% |

| Motilal Oswal Small Cap Fund Regular Growth Very High Risk | 1.8% | 1.0% | ₹4927.18 Cr | 15.5% |

| Motilal Oswal Small Cap Fund Direct Growth Very High Risk | 0.6% | 1.0% | ₹4927.18 Cr | 17.1% |

| Quantum Small Cap Fund Direct Growth Very High Risk | 0.7% | 1.0% | ₹132.10 Cr | 8.7% |

About the AMC

Total AUM

₹11,01,967 Cr

Address

C-38 & 39, G Block, Bandra Kurla Complex, Mumbai, 400 051

Other Funds by SBI Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of SBI Small Cap Fund Regular Growth?

What are the returns of SBI Small Cap Fund Regular Growth?

What is the portfolio composition of SBI Small Cap Fund Regular Growth?

Who manages the SBI Small Cap Fund Regular Growth?

- R. Srinivasan

- Mohan Lal