Regular

NAV (11-Jan-24)

Returns (Since Inception)

Fund Overview

Fund Size

₹36 Cr

Expense Ratio

1.06%

ISIN

INF247L01AT5

Minimum SIP

₹500

Exit Load

1.00%

Inception Date

01 Dec 2021

About this fund

As of 11-Jan-24, it has a Net Asset Value (NAV) of ₹11.68, Assets Under Management (AUM) of 35.75 Crores, and an expense ratio of 1.06%.

- Motilal Oswal MSCI EAFE Top 100 Select Index Fund Regular Growth has given a CAGR return of 7.62% since inception.

- The fund's asset allocation comprises around 98.91% in equities, 0.00% in debts, and 1.08% in cash & cash equivalents.

- You can start investing in Motilal Oswal MSCI EAFE Top 100 Select Index Fund Regular Growth with a SIP of ₹500 or a Lumpsum investment of ₹500.

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+11.82%

— (Cat Avg.)

Since Inception

+7.62%

— (Cat Avg.)

Portfolio Summaryas of 30th November 2023

| Equity | ₹35.36 Cr | 98.91% |

| Others | ₹0.39 Cr | 1.08% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Novo Nordisk A/S Class B | Equity | ₹1.47 Cr | 4.11% |

| Nestle SA | Equity | ₹1.34 Cr | 3.74% |

| ASML Holding NV | Equity | ₹1.21 Cr | 3.39% |

| Shell PLC | Equity | ₹0.96 Cr | 2.68% |

| Lvmh Moet Hennessy Louis Vuitton SE | Equity | ₹0.93 Cr | 2.61% |

| Toyota Motor Corp | Equity | ₹0.89 Cr | 2.48% |

| Novartis AG Registered Shares | Equity | ₹0.88 Cr | 2.46% |

| AstraZeneca PLC | Equity | ₹0.88 Cr | 2.45% |

| Roche Holding AG | Equity | ₹0.84 Cr | 2.34% |

| SAP SE | Equity | ₹0.73 Cr | 2.05% |

| BHP Group Ltd | Equity | ₹0.68 Cr | 1.91% |

| TotalEnergies SE | Equity | ₹0.67 Cr | 1.89% |

| HSBC Holdings PLC | Equity | ₹0.66 Cr | 1.86% |

| Siemens AG | Equity | ₹0.56 Cr | 1.58% |

| Unilever PLC | Equity | ₹0.53 Cr | 1.48% |

| Commonwealth Bank of Australia | Equity | ₹0.51 Cr | 1.43% |

| L'Oreal SA | Equity | ₹0.5 Cr | 1.40% |

| Sony Group Corp | Equity | ₹0.48 Cr | 1.35% |

| Sanofi SA | Equity | ₹0.47 Cr | 1.31% |

| BP PLC | Equity | ₹0.46 Cr | 1.30% |

| Allianz SE | Equity | ₹0.45 Cr | 1.26% |

| Schneider Electric SE | Equity | ₹0.44 Cr | 1.24% |

| Air Liquide SA | Equity | ₹0.44 Cr | 1.23% |

| Mitsubishi UFJ Financial Group Inc | Equity | ₹0.43 Cr | 1.20% |

| UBS Group AG | Equity | ₹0.41 Cr | 1.14% |

| Airbus SE | Equity | ₹0.39 Cr | 1.09% |

| Net Receivables / (Payables) | Cash - Collateral | ₹0.39 Cr | 1.08% |

| CSL Ltd | Equity | ₹0.37 Cr | 1.03% |

| Keyence Corp | Equity | ₹0.37 Cr | 1.03% |

| iShares MSCI EAFE ETF | Mutual Fund - ETF | ₹0.36 Cr | 1.01% |

| Diageo PLC | Equity | ₹0.35 Cr | 0.97% |

| Deutsche Telekom AG | Equity | ₹0.34 Cr | 0.96% |

| Rio Tinto PLC Registered Shares | Equity | ₹0.34 Cr | 0.95% |

| Tokyo Electron Ltd | Equity | ₹0.34 Cr | 0.95% |

| Zurich Insurance Group AG | Equity | ₹0.33 Cr | 0.93% |

| Iberdrola SA | Equity | ₹0.33 Cr | 0.93% |

| GSK PLC | Equity | ₹0.32 Cr | 0.91% |

| RELX PLC | Equity | ₹0.32 Cr | 0.90% |

| British American Tobacco PLC | Equity | ₹0.3 Cr | 0.83% |

| Banco Santander SA | Equity | ₹0.3 Cr | 0.83% |

| Hermes International SA | Equity | ₹0.29 Cr | 0.82% |

| BNP Paribas Act. Cat.A | Equity | ₹0.29 Cr | 0.82% |

| Hitachi Ltd | Equity | ₹0.29 Cr | 0.81% |

| Vinci SA | Equity | ₹0.29 Cr | 0.81% |

| Compagnie Financiere Richemont SA Class A | Equity | ₹0.29 Cr | 0.81% |

| Shin-Etsu Chemical Co Ltd | Equity | ₹0.28 Cr | 0.79% |

| ABB Ltd | Equity | ₹0.28 Cr | 0.78% |

| Sumitomo Mitsui Financial Group Inc | Equity | ₹0.28 Cr | 0.77% |

| Safran SA | Equity | ₹0.27 Cr | 0.74% |

| Glencore PLC | Equity | ₹0.26 Cr | 0.73% |

| National Australia Bank Ltd | Equity | ₹0.26 Cr | 0.73% |

| Munchener Ruckversicherungs-Gesellschaft AG | Equity | ₹0.26 Cr | 0.72% |

| AXA SA | Equity | ₹0.25 Cr | 0.71% |

| Essilorluxottica | Equity | ₹0.25 Cr | 0.69% |

| Banco Bilbao Vizcaya Argentaria SA | Equity | ₹0.24 Cr | 0.68% |

| Recruit Holdings Co Ltd | Equity | ₹0.24 Cr | 0.66% |

| Mitsubishi Corp | Equity | ₹0.24 Cr | 0.66% |

| Mercedes-Benz Group AG | Equity | ₹0.23 Cr | 0.65% |

| ING Groep NV | Equity | ₹0.22 Cr | 0.63% |

| Prosus NV Ordinary Shares - Class N | Equity | ₹0.22 Cr | 0.63% |

| Infineon Technologies AG | Equity | ₹0.22 Cr | 0.63% |

| Daiichi Sankyo Co Ltd | Equity | ₹0.22 Cr | 0.62% |

| Westpac Banking Corp | Equity | ₹0.22 Cr | 0.61% |

| Reckitt Benckiser Group PLC | Equity | ₹0.22 Cr | 0.60% |

| Nintendo Co Ltd | Equity | ₹0.21 Cr | 0.60% |

| ANZ Group Holdings Ltd | Equity | ₹0.21 Cr | 0.60% |

| Mitsui & Co Ltd | Equity | ₹0.21 Cr | 0.59% |

| National Grid PLC | Equity | ₹0.21 Cr | 0.59% |

| Honda Motor Co Ltd | Equity | ₹0.21 Cr | 0.58% |

| KDDI Corp | Equity | ₹0.21 Cr | 0.58% |

| DHL Group | Equity | ₹0.21 Cr | 0.58% |

| ITOCHU Corp | Equity | ₹0.2 Cr | 0.57% |

| Industria De Diseno Textil SA Share From Split | Equity | ₹0.2 Cr | 0.56% |

| London Stock Exchange Group PLC | Equity | ₹0.2 Cr | 0.56% |

| Takeda Pharmaceutical Co Ltd | Equity | ₹0.2 Cr | 0.55% |

| Fast Retailing Co Ltd | Equity | ₹0.2 Cr | 0.55% |

| Tokio Marine Holdings Inc | Equity | ₹0.2 Cr | 0.55% |

| Compass Group PLC | Equity | ₹0.19 Cr | 0.54% |

| SoftBank Group Corp | Equity | ₹0.19 Cr | 0.52% |

| Basf SE | Equity | ₹0.18 Cr | 0.51% |

| Atlas Copco AB Class A | Equity | ₹0.18 Cr | 0.51% |

| Danone SA | Equity | ₹0.18 Cr | 0.51% |

| Mizuho Financial Group Inc | Equity | ₹0.18 Cr | 0.51% |

| Macquarie Group Ltd | Equity | ₹0.18 Cr | 0.51% |

| BAE Systems PLC | Equity | ₹0.18 Cr | 0.50% |

| Hoya Corp | Equity | ₹0.18 Cr | 0.49% |

| Sika AG | Equity | ₹0.18 Cr | 0.49% |

| Daikin Industries Ltd | Equity | ₹0.18 Cr | 0.49% |

| Wesfarmers Ltd | Equity | ₹0.17 Cr | 0.49% |

| Woodside Energy Group Ltd | Equity | ₹0.17 Cr | 0.48% |

| Alcon Inc | Equity | ₹0.17 Cr | 0.46% |

| Oriental Land Co Ltd | Equity | ₹0.16 Cr | 0.46% |

| Lloyds Banking Group PLC | Equity | ₹0.16 Cr | 0.44% |

| Pernod Ricard SA | Equity | ₹0.16 Cr | 0.44% |

| Nippon Telegraph & Telephone Corp | Equity | ₹0.15 Cr | 0.43% |

| Anglo American PLC | Equity | ₹0.15 Cr | 0.43% |

| Bayer AG | Equity | ₹0.15 Cr | 0.42% |

| Murata Manufacturing Co Ltd | Equity | ₹0.15 Cr | 0.42% |

| Kering SA | Equity | ₹0.14 Cr | 0.39% |

| Prudential PLC | Equity | ₹0.13 Cr | 0.37% |

| Lonza Group Ltd | Equity | ₹0.13 Cr | 0.35% |

Allocation By Market Cap (Equity)

Large Cap Stocks

98.80%

Mid Cap Stocks

0.11%

Small Cap Stocks

--

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Healthcare | ₹6.51 Cr | 18.20% |

| Financial Services | ₹6.38 Cr | 17.84% |

| Industrials | ₹4.47 Cr | 12.51% |

| Consumer Cyclical | ₹3.91 Cr | 10.93% |

| Consumer Defensive | ₹3.57 Cr | 9.98% |

| Technology | ₹3.51 Cr | 9.81% |

| Basic Materials | ₹2.52 Cr | 7.04% |

| Energy | ₹2.27 Cr | 6.35% |

| Communication Services | ₹1.33 Cr | 3.72% |

| Utilities | ₹0.54 Cr | 1.52% |

Risk & Performance Ratios

Standard Deviation

This fund

--

Cat. avg.

--

Lower the better

Sharpe Ratio

This fund

--

Cat. avg.

--

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

--

Higher the better

Fund Managers

Ankush Sood

Since December 2021

Rakesh Shetty

Since November 2022

Additional Scheme Detailsas of 30th November 2023

ISIN | INF247L01AT5 | Expense Ratio | 1.06% | Exit Load | 1.00% | Fund Size | ₹36 Cr | Age | 3 years 6 months | Lumpsum Minimum | ₹500 | Fund Status | Open Ended Investment Company | Benchmark | MSCI EAFE Top 100 Select NR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

- If units are sold after 1 year from the date of investment: Gains up to INR 1.25 lakh in a financial year are exempt from tax. Any gains exceeding INR 1.25 lakh are taxed at a rate of 12.5%.

- If units are sold within 1 year from the date of investment: The entire amount of gain is taxed at a rate of 20%.

- Holding the units: No tax is applicable as long as you continue to hold the units.

Dividend Taxation:

Dividend Taxation:

Dividends are added to the investor’s income and taxed according to their respective tax slabs. Additionally, if an investors dividend income exceeds INR 5,000 in a financial year, the fund house deducts a 10% Tax Deducted at Source (TDS) before distributing the dividend.

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

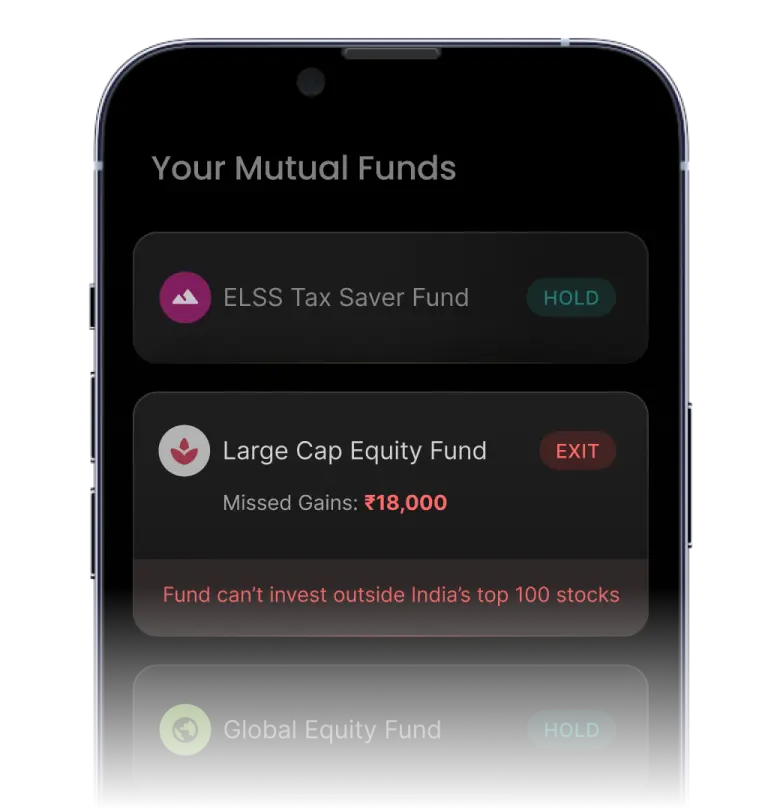

Similar Global - Other Funds

About the AMC

Total AUM

₹90,959 Cr

Address

Motilal Oswal Tower, Mumbai, 400 025

Other Funds by Motilal Oswal Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of Motilal Oswal MSCI EAFE Top 100 Select Index Fund Regular Growth?

What is the portfolio composition of Motilal Oswal MSCI EAFE Top 100 Select Index Fund Regular Growth?

Who manages the Motilal Oswal MSCI EAFE Top 100 Select Index Fund Regular Growth?

- Ankush Sood

- Rakesh Shetty