HDFC Dividend Yield Fund Regular Growth

EquityDividend YieldVery High Risk

Regular

NAV (21-Jan-26)

Returns (Since Inception)

Fund Overview

Fund Size

₹6,105 Cr

Expense Ratio

1.83%

ISIN

INF179KC1AR9

Minimum SIP

₹100

Exit Load

1.00%

Inception Date

18 Dec 2020

About this fund

As of 21-Jan-26, it has a Net Asset Value (NAV) of ₹24.27, Assets Under Management (AUM) of 6104.64 Crores, and an expense ratio of 1.83%.

- HDFC Dividend Yield Fund Regular Growth has given a CAGR return of 19.00% since inception.

- The fund's asset allocation comprises around 99.77% in equities, 0.00% in debts, and 0.23% in cash & cash equivalents.

- You can start investing in HDFC Dividend Yield Fund Regular Growth with a SIP of ₹100 or a Lumpsum investment of ₹100.

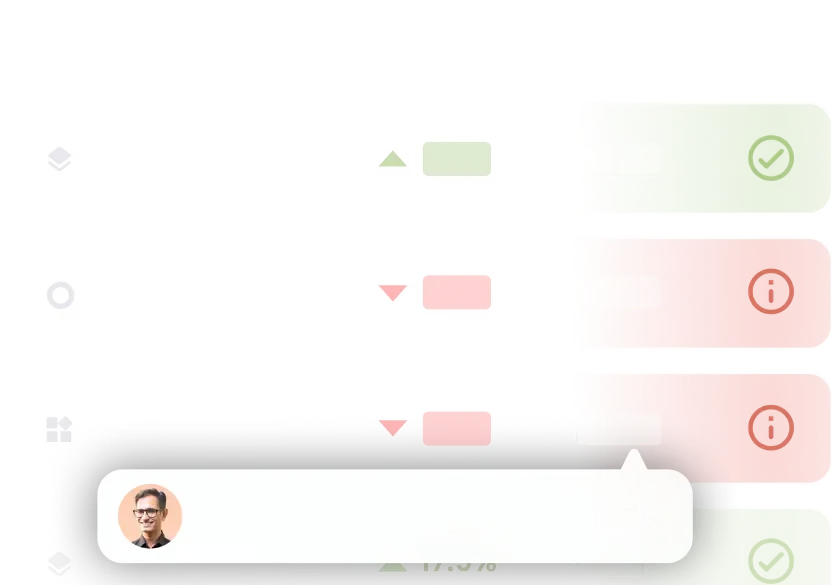

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+3.22%

+4.48% (Cat Avg.)

3 Years

+16.36%

+18.41% (Cat Avg.)

5 Years

+18.38%

+17.94% (Cat Avg.)

Since Inception

+19.00%

— (Cat Avg.)

Portfolio Summaryas of 31st December 2025

| Equity | ₹6,090.62 Cr | 99.77% |

| Others | ₹14.02 Cr | 0.23% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| HDFC Bank Ltd | Equity | ₹386.57 Cr | 6.33% |

| ICICI Bank Ltd | Equity | ₹301.48 Cr | 4.94% |

| Axis Bank Ltd | Equity | ₹206.91 Cr | 3.39% |

| Maruti Suzuki India Ltd | Equity | ₹161.96 Cr | 2.65% |

| Bharti Airtel Ltd | Equity | ₹157.92 Cr | 2.59% |

| Reliance Industries Ltd | Equity | ₹157.04 Cr | 2.57% |

| Larsen & Toubro Ltd | Equity | ₹155.17 Cr | 2.54% |

| Tech Mahindra Ltd | Equity | ₹143.18 Cr | 2.35% |

| Kotak Mahindra Bank Ltd | Equity | ₹139.77 Cr | 2.29% |

| Infosys Ltd | Equity | ₹134.08 Cr | 2.20% |

| SBI Life Insurance Co Ltd | Equity | ₹122.09 Cr | 2.00% |

| State Bank of India | Equity | ₹117.86 Cr | 1.93% |

| HCL Technologies Ltd | Equity | ₹116.88 Cr | 1.91% |

| NTPC Ltd | Equity | ₹112.05 Cr | 1.84% |

| Sun Pharmaceuticals Industries Ltd | Equity | ₹108.34 Cr | 1.77% |

| Tata Consultancy Services Ltd | Equity | ₹105.99 Cr | 1.74% |

| Bajaj Auto Ltd | Equity | ₹98.1 Cr | 1.61% |

| ITC Ltd | Equity | ₹92.69 Cr | 1.52% |

| Eicher Motors Ltd | Equity | ₹84.83 Cr | 1.39% |

| IndusInd Bank Ltd | Equity | ₹83.83 Cr | 1.37% |

| Coal India Ltd | Equity | ₹79.8 Cr | 1.31% |

| Ambuja Cements Ltd | Equity | ₹77.89 Cr | 1.28% |

| Info Edge (India) Ltd | Equity | ₹76.6 Cr | 1.25% |

| Hindustan Petroleum Corp Ltd | Equity | ₹72.36 Cr | 1.19% |

| Oil & Natural Gas Corp Ltd | Equity | ₹72.11 Cr | 1.18% |

| Tata Steel Ltd | Equity | ₹72.03 Cr | 1.18% |

| Hindustan Unilever Ltd | Equity | ₹66 Cr | 1.08% |

| Cipla Ltd | Equity | ₹65.97 Cr | 1.08% |

| UPL Ltd | Equity | ₹60.06 Cr | 0.98% |

| Aster DM Healthcare Ltd Ordinary Shares | Equity | ₹58.76 Cr | 0.96% |

| PVR INOX Ltd | Equity | ₹54.1 Cr | 0.89% |

| CESC Ltd | Equity | ₹52.15 Cr | 0.85% |

| Cholamandalam Financial Holdings Ltd | Equity | ₹51.75 Cr | 0.85% |

| Wipro Ltd | Equity | ₹47.7 Cr | 0.78% |

| Apollo Hospitals Enterprise Ltd | Equity | ₹47.18 Cr | 0.77% |

| Sterlite Technologies Ltd | Equity | ₹46.37 Cr | 0.76% |

| Balrampur Chini Mills Ltd | Equity | ₹44.44 Cr | 0.73% |

| RHI Magnesita India Ltd | Equity | ₹43.99 Cr | 0.72% |

| Embassy Office Parks REIT | Equity - REIT | ₹43.95 Cr | 0.72% |

| Hindustan Aeronautics Ltd Ordinary Shares | Equity | ₹43.89 Cr | 0.72% |

| Power Finance Corp Ltd | Equity | ₹42.65 Cr | 0.70% |

| Cummins India Ltd | Equity | ₹42.09 Cr | 0.69% |

| Nestle India Ltd | Equity | ₹41.22 Cr | 0.68% |

| HDFC Life Insurance Co Ltd | Equity | ₹41.21 Cr | 0.68% |

| Apollo Tyres Ltd | Equity | ₹40 Cr | 0.66% |

| Bharat Electronics Ltd | Equity | ₹39.19 Cr | 0.64% |

| BEML Land Assets Ltd | Equity | ₹37.5 Cr | 0.61% |

| Godrej Consumer Products Ltd | Equity | ₹36.67 Cr | 0.60% |

| Tata Communications Ltd | Equity | ₹36.51 Cr | 0.60% |

| AIA Engineering Ltd | Equity | ₹36.16 Cr | 0.59% |

| Kaynes Technology India Ltd | Equity | ₹36.12 Cr | 0.59% |

| VRL Logistics Ltd | Equity | ₹36.09 Cr | 0.59% |

| Blue Dart Express Ltd | Equity | ₹35.89 Cr | 0.59% |

| Bharti Hexacom Ltd | Equity | ₹35.81 Cr | 0.59% |

| REC Ltd | Equity | ₹35.68 Cr | 0.58% |

| GAIL (India) Ltd | Equity | ₹34.43 Cr | 0.56% |

| Sagility Ltd | Equity | ₹33.81 Cr | 0.55% |

| Mahindra & Mahindra Ltd | Equity | ₹33.38 Cr | 0.55% |

| Glenmark Pharmaceuticals Ltd | Equity | ₹31.76 Cr | 0.52% |

| NHPC Ltd | Equity | ₹31.69 Cr | 0.52% |

| RBL Bank Ltd | Equity | ₹31.58 Cr | 0.52% |

| Indraprastha Gas Ltd | Equity | ₹31.41 Cr | 0.51% |

| UTI Asset Management Co Ltd | Equity | ₹31.35 Cr | 0.51% |

| Fusion Finance Ltd | Equity | ₹31.19 Cr | 0.51% |

| Canara Bank | Equity | ₹30.98 Cr | 0.51% |

| PNB Housing Finance Ltd | Equity | ₹30.69 Cr | 0.50% |

| Siemens Ltd | Equity | ₹30.63 Cr | 0.50% |

| Bajaj Finserv Ltd | Equity | ₹30.6 Cr | 0.50% |

| Tata Motors Ltd | Equity | ₹29.09 Cr | 0.48% |

| Biocon Ltd | Equity | ₹28.93 Cr | 0.47% |

| Bosch Ltd | Equity | ₹28.72 Cr | 0.47% |

| TD Power Systems Ltd | Equity | ₹28.08 Cr | 0.46% |

| Mahindra Holidays & Resorts India Ltd | Equity | ₹28.05 Cr | 0.46% |

| Cyient Ltd | Equity | ₹27.95 Cr | 0.46% |

| Vardhman Textiles Ltd | Equity | ₹27.75 Cr | 0.45% |

| Hindalco Industries Ltd | Equity | ₹26.6 Cr | 0.44% |

| Emami Ltd | Equity | ₹26.43 Cr | 0.43% |

| Asian Paints Ltd | Equity | ₹26.03 Cr | 0.43% |

| Tata Motors Passenger Vehicles Ltd | Equity | ₹25.71 Cr | 0.42% |

| Siemens Energy India Ltd | Equity | ₹25.6 Cr | 0.42% |

| Divi's Laboratories Ltd | Equity | ₹25.57 Cr | 0.42% |

| SKF India (Industrial) Ltd | Equity | ₹24.21 Cr | 0.40% |

| InterGlobe Aviation Ltd | Equity | ₹24.09 Cr | 0.39% |

| Whirlpool of India Ltd | Equity | ₹23.9 Cr | 0.39% |

| Dilip Buildcon Ltd | Equity | ₹23.84 Cr | 0.39% |

| Premier Energies Ltd | Equity | ₹23.24 Cr | 0.38% |

| Medi Assist Healthcare Services Ltd | Equity | ₹23.21 Cr | 0.38% |

| Finolex Cables Ltd | Equity | ₹22.49 Cr | 0.37% |

| Lupin Ltd | Equity | ₹21.1 Cr | 0.35% |

| GHCL Ltd | Equity | ₹20.89 Cr | 0.34% |

| PNC Infratech Ltd | Equity | ₹20.03 Cr | 0.33% |

| SKF India Ltd | Equity | ₹17.23 Cr | 0.28% |

| Gland Pharma Ltd | Equity | ₹17.22 Cr | 0.28% |

| Treps - Tri-Party Repo | Cash - Repurchase Agreement | ₹16.98 Cr | 0.28% |

| Emcure Pharmaceuticals Ltd | Equity | ₹13.54 Cr | 0.22% |

| Star Health and Allied Insurance Co Ltd | Equity | ₹13.14 Cr | 0.22% |

| Indus Infra Trust Unit | Equity | ₹12.26 Cr | 0.20% |

| Go Fashion (India) Ltd | Equity | ₹11.96 Cr | 0.20% |

| Diffusion Engineers Ltd | Equity | ₹11.84 Cr | 0.19% |

| Anthem Biosciences Ltd | Equity | ₹11.81 Cr | 0.19% |

| Endurance Technologies Ltd | Equity | ₹11.65 Cr | 0.19% |

| Castrol India Ltd | Equity | ₹11.55 Cr | 0.19% |

| STL Networks Ltd | Equity | ₹11.17 Cr | 0.18% |

| Gujarat Pipavav Port Ltd | Equity | ₹10.92 Cr | 0.18% |

| Birlasoft Ltd | Equity | ₹10.77 Cr | 0.18% |

| Dam Capital Advisors Ltd | Equity | ₹9.98 Cr | 0.16% |

| Afcons Infrastructure Ltd | Equity | ₹9.96 Cr | 0.16% |

| EPACK Durable Ltd | Equity | ₹9.82 Cr | 0.16% |

| Sun TV Network Ltd | Equity | ₹9.08 Cr | 0.15% |

| Popular Vehicles and Services Ltd | Equity | ₹9.07 Cr | 0.15% |

| Jio Financial Services Ltd | Equity | ₹8.85 Cr | 0.14% |

| Electronics Mart India Ltd | Equity | ₹8.77 Cr | 0.14% |

| Chambal Fertilisers & Chemicals Ltd | Equity | ₹8.7 Cr | 0.14% |

| DCX System Ltd | Equity | ₹8.27 Cr | 0.14% |

| INOX India Ltd | Equity | ₹8.25 Cr | 0.14% |

| West Coast Paper Mills Ltd | Equity | ₹8.25 Cr | 0.14% |

| Quess Corp Ltd | Equity | ₹8.23 Cr | 0.13% |

| KEC International Ltd | Equity | ₹8 Cr | 0.13% |

| Stanley Lifestyles Ltd | Equity | ₹7.85 Cr | 0.13% |

| Techno Electric & Engineering Co Ltd | Equity | ₹7.84 Cr | 0.13% |

| Voltamp Transformers Ltd | Equity | ₹7.66 Cr | 0.13% |

| BEML Ltd | Equity | ₹7.24 Cr | 0.12% |

| Sai Silks (Kalamandir) Ltd | Equity | ₹7.07 Cr | 0.12% |

| Bharti Airtel Ltd (Partly Paid Rs.1.25) | Equity | ₹6.04 Cr | 0.10% |

| Rishabh Instruments Ltd | Equity | ₹5.66 Cr | 0.09% |

| Digitide Solutions Ltd | Equity | ₹5.29 Cr | 0.09% |

| Timken India Ltd | Equity | ₹5.18 Cr | 0.08% |

| ITC Hotels Ltd | Equity | ₹4.54 Cr | 0.07% |

| Net Current Assets | Cash | ₹-2.95 Cr | 0.05% |

| GHCL Textiles Ltd | Equity | ₹2.95 Cr | 0.05% |

| Sonata Software Ltd | Equity | ₹2.85 Cr | 0.05% |

| Bluspring Enterprises Ltd | Equity | ₹2.66 Cr | 0.04% |

| NLC India Ltd | Equity | ₹2.44 Cr | 0.04% |

| Latent View Analytics Ltd | Equity | ₹2.29 Cr | 0.04% |

| Kwality Wall’S (India) Limited** | Equity | ₹1.15 Cr | 0.02% |

Allocation By Market Cap (Equity)

Large Cap Stocks

67.24%

Mid Cap Stocks

10.70%

Small Cap Stocks

20.89%

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Financial Services | ₹1,797.92 Cr | 29.45% |

| Industrials | ₹754.64 Cr | 12.36% |

| Technology | ₹672.83 Cr | 11.02% |

| Consumer Cyclical | ₹655.17 Cr | 10.73% |

| Healthcare | ₹487.19 Cr | 7.98% |

| Energy | ₹392.87 Cr | 6.44% |

| Communication Services | ₹387.23 Cr | 6.34% |

| Consumer Defensive | ₹307.45 Cr | 5.04% |

| Basic Materials | ₹300.45 Cr | 4.92% |

| Utilities | ₹289.76 Cr | 4.75% |

Risk & Performance Ratios

Standard Deviation

This fund

13.24%

Cat. avg.

13.15%

Lower the better

Sharpe Ratio

This fund

0.85

Cat. avg.

0.97

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.70

Higher the better

Fund Managers

Gopal Agrawal

Since December 2020

Dhruv Muchhal

Since June 2023

Additional Scheme Detailsas of 31st December 2025

ISIN INF179KC1AR9 | Expense Ratio 1.83% | Exit Load 1.00% | Fund Size ₹6,105 Cr | Age 5 years 1 month | Lumpsum Minimum ₹100 | Fund Status Open Ended Investment Company | Benchmark Nifty 500 TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Dividend Yield Funds

About the AMC

HDFC Mutual Fund

Total AUM

₹9,00,761 Cr

Address

“HUL House”, 2nd Floor, Mumbai, 400 020

Other Funds by HDFC Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of HDFC Dividend Yield Fund Regular Growth?

What are the returns of HDFC Dividend Yield Fund Regular Growth?

What is the portfolio composition of HDFC Dividend Yield Fund Regular Growth?

Who manages the HDFC Dividend Yield Fund Regular Growth?

- Gopal Agrawal

- Dhruv Muchhal