Fund Overview

Fund Size

₹65,812 Cr

Expense Ratio

0.66%

ISIN

INF204K01K15

Minimum SIP

₹1,000

Exit Load

1.00%

Inception Date

01 Jan 2013

About this fund

As of 05-Mar-26, it has a Net Asset Value (NAV) of ₹178.08, Assets Under Management (AUM) of 65812.16 Crores, and an expense ratio of 0.66%.

- Nippon India Small Cap Fund Direct Growth has given a CAGR return of 23.54% since inception.

- The fund's asset allocation comprises around 95.74% in equities, 0.00% in debts, and 4.26% in cash & cash equivalents.

- You can start investing in Nippon India Small Cap Fund Direct Growth with a SIP of ₹1000 or a Lumpsum investment of ₹5000.

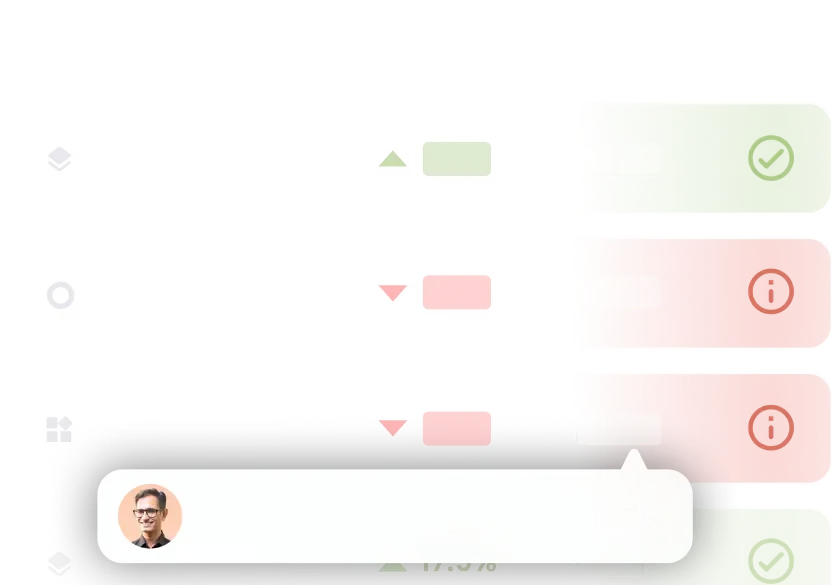

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

+11.12%

+11.45% (Cat Avg.)

3 Years

+20.61%

+17.56% (Cat Avg.)

5 Years

+22.68%

+18.08% (Cat Avg.)

10 Years

+22.16%

+17.41% (Cat Avg.)

Since Inception

+23.54%

— (Cat Avg.)

Portfolio Summaryas of 31st January 2026

| Equity | ₹63,009.72 Cr | 95.74% |

| Others | ₹2,802.44 Cr | 4.26% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Triparty Repo | Cash - Repurchase Agreement | ₹2,733.56 Cr | 4.15% |

| Multi Commodity Exchange of India Ltd | Equity | ₹2,219.28 Cr | 3.37% |

| HDFC Bank Ltd | Equity | ₹1,421.75 Cr | 2.16% |

| State Bank of India | Equity | ₹1,114.62 Cr | 1.69% |

| Karur Vysya Bank Ltd | Equity | ₹1,082.43 Cr | 1.64% |

| Axis Bank Ltd | Equity | ₹819.22 Cr | 1.24% |

| eClerx Services Ltd | Equity | ₹796.65 Cr | 1.21% |

| Bharat Heavy Electricals Ltd | Equity | ₹775.16 Cr | 1.18% |

| Emami Ltd | Equity | ₹771.58 Cr | 1.17% |

| Zydus Wellness Ltd | Equity | ₹764.26 Cr | 1.16% |

| TD Power Systems Ltd | Equity | ₹742.5 Cr | 1.13% |

| Apar Industries Ltd | Equity | ₹703.07 Cr | 1.07% |

| Kirloskar Brothers Ltd | Equity | ₹700.47 Cr | 1.06% |

| NLC India Ltd | Equity | ₹699.32 Cr | 1.06% |

| Hindustan Unilever Ltd | Equity | ₹651.15 Cr | 0.99% |

| ITC Ltd | Equity | ₹637.21 Cr | 0.97% |

| Tube Investments of India Ltd Ordinary Shares | Equity | ₹583.59 Cr | 0.89% |

| Radico Khaitan Ltd | Equity | ₹578.51 Cr | 0.88% |

| Ramco Cements Ltd | Equity | ₹569.12 Cr | 0.86% |

| AstraZeneca Pharma India Ltd | Equity | ₹564.19 Cr | 0.86% |

| Pfizer Ltd | Equity | ₹550.42 Cr | 0.84% |

| ELANTAS Beck India Ltd | Equity | ₹541.16 Cr | 0.82% |

| Paradeep Phosphates Ltd | Equity | ₹529.4 Cr | 0.80% |

| Aster DM Healthcare Ltd Ordinary Shares | Equity | ₹525.8 Cr | 0.80% |

| Whirlpool of India Ltd | Equity | ₹523.89 Cr | 0.80% |

| Asahi India Glass Ltd | Equity | ₹511.2 Cr | 0.78% |

| Sundaram Fasteners Ltd | Equity | ₹505.13 Cr | 0.77% |

| NIIT Learning Systems Ltd | Equity | ₹484.39 Cr | 0.74% |

| Sai Life Sciences Ltd | Equity | ₹482.11 Cr | 0.73% |

| AWL Agri Business Ltd | Equity | ₹481.08 Cr | 0.73% |

| TBO Tek Ltd | Equity | ₹477.15 Cr | 0.73% |

| MAS Financial Services Ltd Ordinary Shares | Equity | ₹474.26 Cr | 0.72% |

| Voltamp Transformers Ltd | Equity | ₹473.79 Cr | 0.72% |

| Vedanta Ltd | Equity | ₹473.28 Cr | 0.72% |

| Kirloskar Pneumatic Co Ltd | Equity | ₹468.89 Cr | 0.71% |

| Balrampur Chini Mills Ltd | Equity | ₹467.92 Cr | 0.71% |

| Ajanta Pharma Ltd | Equity | ₹465.82 Cr | 0.71% |

| Orkla India Ltd | Equity | ₹455.09 Cr | 0.69% |

| HDFC Life Insurance Co Ltd | Equity | ₹451 Cr | 0.69% |

| Kirloskar Oil Engines Ltd | Equity | ₹436.19 Cr | 0.66% |

| PhysicsWallah Ltd | Equity | ₹425.08 Cr | 0.65% |

| Reliance Industries Ltd | Equity | ₹418.62 Cr | 0.64% |

| Kalpataru Projects International Ltd | Equity | ₹414.45 Cr | 0.63% |

| ICRA Ltd | Equity | ₹413.79 Cr | 0.63% |

| Tata Consumer Products Ltd | Equity | ₹409.19 Cr | 0.62% |

| Affle 3i Ltd | Equity | ₹400.36 Cr | 0.61% |

| KFin Technologies Ltd | Equity | ₹399.27 Cr | 0.61% |

| Hindustan Aeronautics Ltd Ordinary Shares | Equity | ₹398.64 Cr | 0.61% |

| Dr Reddy's Laboratories Ltd | Equity | ₹386.41 Cr | 0.59% |

| Crompton Greaves Consumer Electricals Ltd | Equity | ₹372.27 Cr | 0.57% |

| Procter & Gamble Health Ltd | Equity | ₹367.32 Cr | 0.56% |

| Vardhman Textiles Ltd | Equity | ₹366.02 Cr | 0.56% |

| Dixon Technologies (India) Ltd | Equity | ₹365.76 Cr | 0.56% |

| Blue Star Ltd | Equity | ₹363.83 Cr | 0.55% |

| Cyient Ltd | Equity | ₹362.7 Cr | 0.55% |

| PNB Housing Finance Ltd | Equity | ₹356.95 Cr | 0.54% |

| TSF Investments Ltd | Equity | ₹356.4 Cr | 0.54% |

| Timken India Ltd | Equity | ₹348.35 Cr | 0.53% |

| Navin Fluorine International Ltd | Equity | ₹346.04 Cr | 0.53% |

| Ambuja Cements Ltd | Equity | ₹337.51 Cr | 0.51% |

| Central Depository Services (India) Ltd | Equity | ₹335.23 Cr | 0.51% |

| Lumax Auto Technologies Ltd | Equity | ₹334.33 Cr | 0.51% |

| Fine Organic Industries Ltd Ordinary Shares | Equity | ₹333.11 Cr | 0.51% |

| Avalon Technologies Ltd | Equity | ₹332.98 Cr | 0.51% |

| Craftsman Automation Ltd | Equity | ₹332.22 Cr | 0.50% |

| Persistent Systems Ltd | Equity | ₹331.94 Cr | 0.50% |

| Voltas Ltd | Equity | ₹331.58 Cr | 0.50% |

| Gland Pharma Ltd | Equity | ₹328.76 Cr | 0.50% |

| Rategain Travel Technologies Ltd | Equity | ₹325.31 Cr | 0.49% |

| ISGEC Heavy Engineering Ltd | Equity | ₹324.19 Cr | 0.49% |

| Samvardhana Motherson International Ltd | Equity | ₹315.64 Cr | 0.48% |

| Krishna Institute of Medical Sciences Ltd | Equity | ₹309.42 Cr | 0.47% |

| City Union Bank Ltd | Equity | ₹309.31 Cr | 0.47% |

| Coal India Ltd | Equity | ₹308.52 Cr | 0.47% |

| Asian Paints Ltd | Equity | ₹306.14 Cr | 0.47% |

| NTPC Ltd | Equity | ₹304.66 Cr | 0.46% |

| K.P.R. Mill Ltd | Equity | ₹299.84 Cr | 0.46% |

| Gokaldas Exports Ltd | Equity | ₹296.7 Cr | 0.45% |

| JTEKT India Ltd | Equity | ₹289.17 Cr | 0.44% |

| Birla Corp Ltd | Equity | ₹284.8 Cr | 0.43% |

| Tata Power Co Ltd | Equity | ₹282.31 Cr | 0.43% |

| VST Tillers Tractors Ltd | Equity | ₹277.07 Cr | 0.42% |

| MTAR Technologies Ltd | Equity | ₹272.55 Cr | 0.41% |

| eMudhra Ltd | Equity | ₹271.78 Cr | 0.41% |

| Indigo Paints Ltd Ordinary Shares | Equity | ₹271.54 Cr | 0.41% |

| Indian Hotels Co Ltd | Equity | ₹268.03 Cr | 0.41% |

| RBL Bank Ltd | Equity | ₹266.87 Cr | 0.41% |

| Clean Science and Technology Ltd | Equity | ₹266.15 Cr | 0.40% |

| Jyothy Labs Ltd | Equity | ₹265.9 Cr | 0.40% |

| Hitachi Energy India Ltd Ordinary Shares | Equity | ₹265.03 Cr | 0.40% |

| Bajaj Consumer Care Ltd | Equity | ₹264.53 Cr | 0.40% |

| Century Plyboards (India) Ltd | Equity | ₹263.2 Cr | 0.40% |

| Kajaria Ceramics Ltd | Equity | ₹261.28 Cr | 0.40% |

| HealthCare Global Enterprises Ltd | Equity | ₹260.5 Cr | 0.40% |

| Carborundum Universal Ltd | Equity | ₹257.41 Cr | 0.39% |

| Ion Exchange (India) Ltd | Equity | ₹253.66 Cr | 0.39% |

| Syngene International Ltd | Equity | ₹253.6 Cr | 0.39% |

| Bayer CropScience Ltd | Equity | ₹250.17 Cr | 0.38% |

| Galaxy Surfactants Ltd | Equity | ₹248.51 Cr | 0.38% |

| Genus Power Infrastructures Ltd | Equity | ₹247.37 Cr | 0.38% |

| HDB Financial Services Ltd | Equity | ₹244.36 Cr | 0.37% |

| Linde India Ltd | Equity | ₹240.28 Cr | 0.37% |

| Allied Blenders and Distillers Ltd | Equity | ₹240.02 Cr | 0.36% |

| CARE Ratings Ltd | Equity | ₹236.65 Cr | 0.36% |

| Aditya Birla Lifestyle Brands Ltd | Equity | ₹235 Cr | 0.36% |

| Bharat Dynamics Ltd Ordinary Shares | Equity | ₹234.81 Cr | 0.36% |

| Esab India Ltd | Equity | ₹229.42 Cr | 0.35% |

| Bluestone Jewellery And Lifestyle Ltd | Equity | ₹228.28 Cr | 0.35% |

| Delhivery Ltd | Equity | ₹227 Cr | 0.34% |

| Afcons Infrastructure Ltd | Equity | ₹222.04 Cr | 0.34% |

| Finolex Cables Ltd | Equity | ₹219.58 Cr | 0.33% |

| Aditya Birla Real Estate Ltd | Equity | ₹218.03 Cr | 0.33% |

| Thyrocare Technologies Ltd | Equity | ₹217.05 Cr | 0.33% |

| Astra Microwave Products Ltd | Equity | ₹216.17 Cr | 0.33% |

| Godrej Agrovet Ltd Ordinary Shares | Equity | ₹214.54 Cr | 0.33% |

| Metropolis Healthcare Ltd | Equity | ₹214.52 Cr | 0.33% |

| DLF Ltd | Equity | ₹214.18 Cr | 0.33% |

| Styrenix Performance Materials Ltd | Equity | ₹213.25 Cr | 0.32% |

| Orient Electric Ltd Ordinary Shares | Equity | ₹210.36 Cr | 0.32% |

| RITES Ltd Ordinary Shares | Equity | ₹210.15 Cr | 0.32% |

| Aditya Birla Sun Life AMC Ltd | Equity | ₹208.42 Cr | 0.32% |

| CIE Automotive India Ltd | Equity | ₹207.71 Cr | 0.32% |

| Grindwell Norton Ltd | Equity | ₹205.78 Cr | 0.31% |

| Sapphire Foods India Ltd | Equity | ₹204.6 Cr | 0.31% |

| NTPC Green Energy Ltd | Equity | ₹204.45 Cr | 0.31% |

| TTK Prestige Ltd | Equity | ₹203.75 Cr | 0.31% |

| Aarti Industries Ltd | Equity | ₹199.49 Cr | 0.30% |

| Tejas Networks Ltd | Equity | ₹196.43 Cr | 0.30% |

| Deepak Nitrite Ltd | Equity | ₹193.05 Cr | 0.29% |

| PVR INOX Ltd | Equity | ₹191.52 Cr | 0.29% |

| PG Electroplast Ltd | Equity | ₹189.04 Cr | 0.29% |

| Castrol India Ltd | Equity | ₹185.49 Cr | 0.28% |

| J.B. Chemicals & Pharmaceuticals Ltd | Equity | ₹185.29 Cr | 0.28% |

| AAVAS Financiers Ltd | Equity | ₹184.86 Cr | 0.28% |

| Belrise Industries Ltd | Equity | ₹183.29 Cr | 0.28% |

| Honda India Power Products Ltd | Equity | ₹182.31 Cr | 0.28% |

| Dr. Lal PathLabs Ltd | Equity | ₹181.96 Cr | 0.28% |

| Chambal Fertilisers & Chemicals Ltd | Equity | ₹179.08 Cr | 0.27% |

| Schaeffler India Ltd | Equity | ₹175.41 Cr | 0.27% |

| Lemon Tree Hotels Ltd | Equity | ₹168.24 Cr | 0.26% |

| CESC Ltd | Equity | ₹168 Cr | 0.26% |

| JSW Cement Ltd | Equity | ₹167.17 Cr | 0.25% |

| Narayana Hrudayalaya Ltd | Equity | ₹166.92 Cr | 0.25% |

| Shadowfax Technologies Ltd | Equity | ₹165.22 Cr | 0.25% |

| Zensar Technologies Ltd | Equity | ₹162.33 Cr | 0.25% |

| FDC Ltd | Equity | ₹161.5 Cr | 0.25% |

| Sansera Engineering Ltd | Equity | ₹161.25 Cr | 0.25% |

| ACME Solar Holdings Ltd | Equity | ₹159.76 Cr | 0.24% |

| Leela Palaces Hotels and Resorts Ltd | Equity | ₹155.27 Cr | 0.24% |

| Harsha Engineers International Ltd | Equity | ₹155.22 Cr | 0.24% |

| DOMS Industries Ltd | Equity | ₹155.05 Cr | 0.24% |

| Kaynes Technology India Ltd | Equity | ₹155.04 Cr | 0.24% |

| Can Fin Homes Ltd | Equity | ₹153.32 Cr | 0.23% |

| L.G.Balakrishnan & Bros Ltd | Equity | ₹152.18 Cr | 0.23% |

| UTI Asset Management Co Ltd | Equity | ₹146.8 Cr | 0.22% |

| Praj Industries Ltd | Equity | ₹146.58 Cr | 0.22% |

| Texmaco Rail & Engineering Ltd | Equity | ₹145.74 Cr | 0.22% |

| Vesuvius India Ltd | Equity | ₹142.66 Cr | 0.22% |

| Automotive Axles Ltd | Equity | ₹142.39 Cr | 0.22% |

| H.G. Infra Engineering Ltd Ordinary Shares | Equity | ₹142.14 Cr | 0.22% |

| LIC Housing Finance Ltd | Equity | ₹140.96 Cr | 0.21% |

| Sumitomo Chemical India Ltd Ordinary Shares | Equity | ₹139.22 Cr | 0.21% |

| Brigade Enterprises Ltd | Equity | ₹137.87 Cr | 0.21% |

| Inox Wind Ltd | Equity | ₹137.3 Cr | 0.21% |

| Data Patterns (India) Ltd | Equity | ₹135.88 Cr | 0.21% |

| West Coast Paper Mills Ltd | Equity | ₹134.69 Cr | 0.20% |

| Jindal Saw Ltd | Equity | ₹133.02 Cr | 0.20% |

| Siemens Energy India Ltd | Equity | ₹129.83 Cr | 0.20% |

| Canara Robeco Asset Management Co Ltd | Equity | ₹128.37 Cr | 0.20% |

| Bajaj Electricals Ltd | Equity | ₹128.21 Cr | 0.19% |

| LMW Ltd | Equity | ₹125.39 Cr | 0.19% |

| Sandhar Technologies Ltd Ordinary Shares | Equity | ₹121.49 Cr | 0.18% |

| Landmark Cars Ltd | Equity | ₹121.49 Cr | 0.18% |

| Birlasoft Ltd | Equity | ₹121.3 Cr | 0.18% |

| Vindhya Telelinks Ltd | Equity | ₹119 Cr | 0.18% |

| Seamec Ltd | Equity | ₹115.99 Cr | 0.18% |

| KEC International Ltd | Equity | ₹115.47 Cr | 0.18% |

| G R Infraprojects Ltd | Equity | ₹114.87 Cr | 0.17% |

| Just Dial Ltd | Equity | ₹112.85 Cr | 0.17% |

| ICICI Prudential Asset Management Co Ltd | Equity | ₹112.25 Cr | 0.17% |

| Sudarshan Chemical Industries Ltd | Equity | ₹106.84 Cr | 0.16% |

| Sanofi Consumer Healthcare India Ltd | Equity | ₹106.71 Cr | 0.16% |

| Greenlam Industries Ltd | Equity | ₹106.12 Cr | 0.16% |

| CreditAccess Grameen Ltd Ordinary Shares | Equity | ₹105.32 Cr | 0.16% |

| Piramal Finance Ltd | Equity | ₹104.61 Cr | 0.16% |

| Sonata Software Ltd | Equity | ₹100.22 Cr | 0.15% |

| Fujiyama Power Systems Ltd | Equity | ₹99.52 Cr | 0.15% |

| Raymond Lifestyle Ltd | Equity | ₹98.11 Cr | 0.15% |

| Mishra Dhatu Nigam Ltd Ordinary Shares | Equity | ₹97.16 Cr | 0.15% |

| Max Estates Ltd | Equity | ₹96.7 Cr | 0.15% |

| Equitas Small Finance Bank Ltd Ordinary Shares | Equity | ₹96.28 Cr | 0.15% |

| Bajel Projects Ltd | Equity | ₹95.15 Cr | 0.14% |

| Campus Activewear Ltd | Equity | ₹94.48 Cr | 0.14% |

| Union Bank of India | Equity | ₹92.47 Cr | 0.14% |

| Rainbow Childrens Medicare Ltd | Equity | ₹89.35 Cr | 0.14% |

| Sharda Motor Industries Ltd | Equity | ₹88.52 Cr | 0.13% |

| RHI Magnesita India Ltd | Equity | ₹88.32 Cr | 0.13% |

| Sanofi India Ltd | Equity | ₹85.98 Cr | 0.13% |

| NIIT Ltd | Equity | ₹83 Cr | 0.13% |

| JK Lakshmi Cement Ltd | Equity | ₹82.5 Cr | 0.13% |

| Vedant Fashions Ltd | Equity | ₹79.04 Cr | 0.12% |

| Subros Ltd | Equity | ₹78.31 Cr | 0.12% |

| Archean Chemical Industries Ltd | Equity | ₹77.74 Cr | 0.12% |

| KPIT Technologies Ltd | Equity | ₹77.46 Cr | 0.12% |

| Go Fashion (India) Ltd | Equity | ₹76.55 Cr | 0.12% |

| Bharat Coking Coal Ltd | Equity | ₹72.67 Cr | 0.11% |

| PNC Infratech Ltd | Equity | ₹71.62 Cr | 0.11% |

| Divgi TorqTransfer Systems Ltd | Equity | ₹70.8 Cr | 0.11% |

| Saatvik Green Energy Ltd | Equity | ₹69.95 Cr | 0.11% |

| Kirloskar Ferrous Industries Ltd | Equity | ₹68.63 Cr | 0.10% |

| Net Current Assets | Cash | ₹67.48 Cr | 0.10% |

| 3M India Ltd | Equity | ₹62.38 Cr | 0.09% |

| Venus Pipes & Tubes Ltd | Equity | ₹61.45 Cr | 0.09% |

| Hatsun Agro Product Ltd | Equity | ₹57.52 Cr | 0.09% |

| Urban Co Ltd | Equity | ₹57.18 Cr | 0.09% |

| IndiaMART InterMESH Ltd | Equity | ₹57.02 Cr | 0.09% |

| Indoco Remedies Ltd | Equity | ₹56.43 Cr | 0.09% |

| Sanathan Textiles Ltd | Equity | ₹55.87 Cr | 0.08% |

| Polyplex Corp Ltd | Equity | ₹55.73 Cr | 0.08% |

| Protean eGov Technologies Ltd | Equity | ₹55.04 Cr | 0.08% |

| Aditya Birla Fashion and Retail Ltd | Equity | ₹51.5 Cr | 0.08% |

| Pokarna Ltd | Equity | ₹50.61 Cr | 0.08% |

| Rishabh Instruments Ltd | Equity | ₹49.84 Cr | 0.08% |

| Bata India Ltd | Equity | ₹47.85 Cr | 0.07% |

| Raymond Ltd | Equity | ₹47.05 Cr | 0.07% |

| Cyient DLM Ltd | Equity | ₹47.05 Cr | 0.07% |

| Stanley Lifestyles Ltd | Equity | ₹46.44 Cr | 0.07% |

| Aeroflex Industries Ltd | Equity | ₹43.32 Cr | 0.07% |

| Raymond Realty Ltd | Equity | ₹41.57 Cr | 0.06% |

| Aequs Ltd | Equity | ₹33.92 Cr | 0.05% |

| PTC India Ltd | Equity | ₹33.43 Cr | 0.05% |

| Fineotex Chemical Ltd | Equity | ₹33.1 Cr | 0.05% |

| Aditya Infotech Ltd | Equity | ₹32.24 Cr | 0.05% |

| Astec Lifesciences Ltd | Equity | ₹30.29 Cr | 0.05% |

| National Securities Depository Ltd | Equity | ₹28.9 Cr | 0.04% |

| P N Gadgil Jewellers Ltd | Equity | ₹28.26 Cr | 0.04% |

| Studds Accessories Ltd | Equity | ₹28 Cr | 0.04% |

| R K Swamy Ltd | Equity | ₹11.47 Cr | 0.02% |

| Credo Brands Marketing Ltd | Equity | ₹9.47 Cr | 0.01% |

| Kwality Walls (India) Limited** | Equity | ₹8.53 Cr | 0.01% |

| Cash Margin - Ccil | Cash - Repurchase Agreement | ₹1.4 Cr | 0.00% |

Allocation By Market Cap (Equity)

Large Cap Stocks

14.97%

Mid Cap Stocks

13.26%

Small Cap Stocks

67.14%

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Industrials | ₹13,075.87 Cr | 19.87% |

| Financial Services | ₹11,604.7 Cr | 17.63% |

| Consumer Cyclical | ₹8,981.39 Cr | 13.65% |

| Consumer Defensive | ₹7,250.97 Cr | 11.02% |

| Basic Materials | ₹7,236.85 Cr | 11.00% |

| Healthcare | ₹5,960.04 Cr | 9.06% |

| Technology | ₹4,420.25 Cr | 6.72% |

| Utilities | ₹2,076.91 Cr | 3.16% |

| Energy | ₹912.64 Cr | 1.39% |

| Communication Services | ₹773.21 Cr | 1.17% |

| Real Estate | ₹708.36 Cr | 1.08% |

Risk & Performance Ratios

Standard Deviation

This fund

16.75%

Cat. avg.

17.13%

Lower the better

Sharpe Ratio

This fund

0.92

Cat. avg.

0.77

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.22

Higher the better

Fund Managers

Samir Rachh

Since January 2017

Kinjal Desai

Since May 2018

Lokesh Maru

Since September 2025

Divya Sharma

Since September 2025

Additional Scheme Detailsas of 31st January 2026

ISIN INF204K01K15 | Expense Ratio 0.66% | Exit Load 1.00% | Fund Size ₹65,812 Cr | Age 13 years 2 months | Lumpsum Minimum ₹5,000 | Fund Status Open Ended Investment Company | Benchmark Nifty Smallcap 250 TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Small-Cap Funds

About the AMC

Nippon India Mutual Fund

Total AUM

₹7,53,043 Cr

Address

4th Floor, Tower A, Peninsula Business Park, Mumbai, 400 013

Other Funds by Nippon India Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of Nippon India Small Cap Fund Direct Growth?

What are the returns of Nippon India Small Cap Fund Direct Growth?

What is the portfolio composition of Nippon India Small Cap Fund Direct Growth?

Who manages the Nippon India Small Cap Fund Direct Growth?

- Samir Rachh

- Kinjal Desai

- Lokesh Maru

- Divya Sharma