Motilal Oswal S&P BSE Healthcare ETF

EquitySector - HealthcareVery High Risk

NAV (04-Feb-26)

Returns (Since Inception)

Fund Overview

Fund Size

₹40 Cr

Expense Ratio

0.23%

ISIN

INF247L01BB1

Minimum SIP

-

Exit Load

-

Inception Date

29 Jul 2022

About this fund

As of 04-Feb-26, it has a Net Asset Value (NAV) of ₹42.68, Assets Under Management (AUM) of 39.51 Crores, and an expense ratio of 0.23%.

- Motilal Oswal S&P BSE Healthcare ETF has given a CAGR return of 19.34% since inception.

- The fund's asset allocation comprises around 99.88% in equities, 0.00% in debts, and 0.12% in cash & cash equivalents.

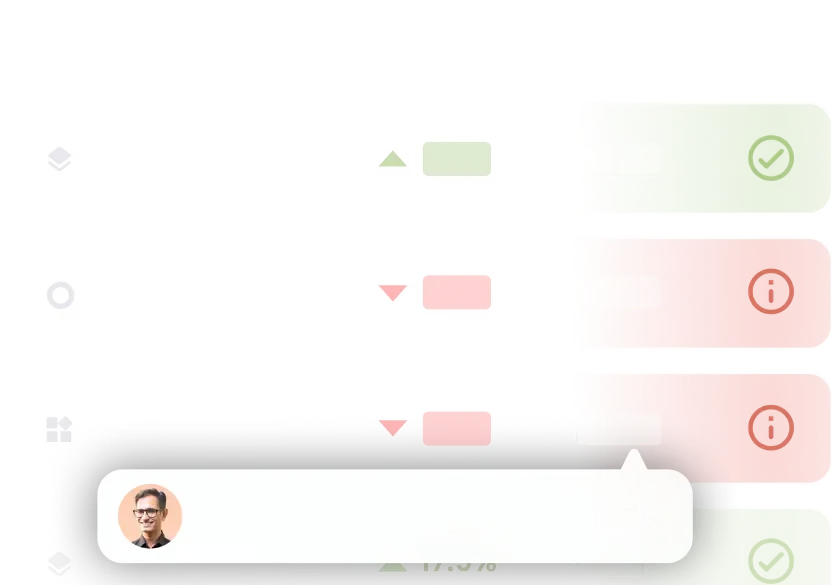

Performance against Category Average

In this section, we compare the returns of the scheme with the category average over various periods. Periods for which the fund has outperformed its category average are marked in green, otherwise red.

1 Year

-0.56%

+1.48% (Cat Avg.)

3 Years

+24.38%

+22.89% (Cat Avg.)

Since Inception

+19.34%

— (Cat Avg.)

Portfolio Summaryas of 31st December 2025

| Equity | ₹39.46 Cr | 99.88% |

| Others | ₹0.05 Cr | 0.12% |

Top Holdings

All Holdings

Equity

Debt & Others

| Name | Type | Amount | Holdings |

|---|---|---|---|

| Sun Pharmaceuticals Industries Ltd | Equity | ₹5.29 Cr | 13.40% |

| Cipla Ltd | Equity | ₹2.49 Cr | 6.30% |

| Divi's Laboratories Ltd | Equity | ₹2.38 Cr | 6.01% |

| Dr Reddy's Laboratories Ltd | Equity | ₹2.26 Cr | 5.71% |

| Max Healthcare Institute Ltd Ordinary Shares | Equity | ₹2.25 Cr | 5.70% |

| Apollo Hospitals Enterprise Ltd | Equity | ₹2.1 Cr | 5.31% |

| Lupin Ltd | Equity | ₹1.49 Cr | 3.77% |

| Fortis Healthcare Ltd | Equity | ₹1.34 Cr | 3.40% |

| Laurus Labs Ltd | Equity | ₹1.26 Cr | 3.18% |

| Torrent Pharmaceuticals Ltd | Equity | ₹1.17 Cr | 2.97% |

| Aurobindo Pharma Ltd | Equity | ₹0.96 Cr | 2.43% |

| Alkem Laboratories Ltd | Equity | ₹0.94 Cr | 2.38% |

| Glenmark Pharmaceuticals Ltd | Equity | ₹0.89 Cr | 2.25% |

| Mankind Pharma Ltd | Equity | ₹0.71 Cr | 1.81% |

| Biocon Ltd | Equity | ₹0.69 Cr | 1.75% |

| Zydus Lifesciences Ltd | Equity | ₹0.67 Cr | 1.70% |

| Ipca Laboratories Ltd | Equity | ₹0.58 Cr | 1.47% |

| Abbott India Ltd | Equity | ₹0.45 Cr | 1.14% |

| Krishna Institute of Medical Sciences Ltd | Equity | ₹0.44 Cr | 1.11% |

| J.B. Chemicals & Pharmaceuticals Ltd | Equity | ₹0.43 Cr | 1.09% |

| Aster DM Healthcare Ltd Ordinary Shares | Equity | ₹0.42 Cr | 1.06% |

| Gland Pharma Ltd | Equity | ₹0.4 Cr | 1.00% |

| Neuland Laboratories Ltd | Equity | ₹0.38 Cr | 0.97% |

| Narayana Hrudayalaya Ltd | Equity | ₹0.37 Cr | 0.94% |

| Sai Life Sciences Ltd | Equity | ₹0.36 Cr | 0.91% |

| Syngene International Ltd | Equity | ₹0.36 Cr | 0.91% |

| Wockhardt Ltd | Equity | ₹0.35 Cr | 0.88% |

| Ajanta Pharma Ltd | Equity | ₹0.34 Cr | 0.87% |

| Dr. Lal PathLabs Ltd | Equity | ₹0.33 Cr | 0.84% |

| Piramal Pharma Ltd | Equity | ₹0.31 Cr | 0.78% |

| GlaxoSmithKline Pharmaceuticals Ltd | Equity | ₹0.29 Cr | 0.74% |

| Global Health Ltd | Equity | ₹0.29 Cr | 0.73% |

| OneSource Specialty Pharma Ltd | Equity | ₹0.28 Cr | 0.72% |

| Acutaas Chemicals Ltd | Equity | ₹0.26 Cr | 0.65% |

| Granules India Ltd | Equity | ₹0.25 Cr | 0.64% |

| Jubilant Pharmova Ltd | Equity | ₹0.25 Cr | 0.63% |

| Cohance Lifesciences Ltd | Equity | ₹0.25 Cr | 0.63% |

| Natco Pharma Ltd | Equity | ₹0.24 Cr | 0.60% |

| Pfizer Ltd | Equity | ₹0.22 Cr | 0.55% |

| Dr Agarwal’s Health Care Ltd | Equity | ₹0.21 Cr | 0.52% |

| Poly Medicure Ltd | Equity | ₹0.2 Cr | 0.50% |

| Rainbow Childrens Medicare Ltd | Equity | ₹0.19 Cr | 0.48% |

| Eris Lifesciences Ltd Registered Shs | Equity | ₹0.18 Cr | 0.45% |

| Strides Pharma Science Ltd | Equity | ₹0.17 Cr | 0.44% |

| AstraZeneca Pharma India Ltd | Equity | ₹0.16 Cr | 0.42% |

| Indegene Ltd | Equity | ₹0.16 Cr | 0.40% |

| Jupiter Life Line Hospitals Ltd | Equity | ₹0.15 Cr | 0.38% |

| Vijaya Diagnostic Centre Ltd | Equity | ₹0.15 Cr | 0.38% |

| Metropolis Healthcare Ltd | Equity | ₹0.15 Cr | 0.37% |

| Alembic Pharmaceuticals Ltd | Equity | ₹0.14 Cr | 0.34% |

| Procter & Gamble Health Ltd | Equity | ₹0.13 Cr | 0.34% |

| Concord Biotech Ltd | Equity | ₹0.13 Cr | 0.33% |

| Emcure Pharmaceuticals Ltd | Equity | ₹0.12 Cr | 0.31% |

| Aarti Pharmalabs Ltd | Equity | ₹0.11 Cr | 0.29% |

| Marksans Pharma Ltd | Equity | ₹0.11 Cr | 0.28% |

| Sanofi India Ltd | Equity | ₹0.11 Cr | 0.27% |

| Caplin Point Laboratories Ltd | Equity | ₹0.11 Cr | 0.27% |

| Shilpa Medicare Ltd | Equity | ₹0.1 Cr | 0.25% |

| HealthCare Global Enterprises Ltd | Equity | ₹0.1 Cr | 0.25% |

| Sanofi Consumer Healthcare India Ltd | Equity | ₹0.09 Cr | 0.22% |

| Alivus Life Sciences Ltd | Equity | ₹0.08 Cr | 0.21% |

| Kovai Medical Center & Hospital Ltd | Equity | ₹0.08 Cr | 0.20% |

| Yatharth Hospital and Trauma Care Services Ltd | Equity | ₹0.07 Cr | 0.18% |

| Sequent Scientific Ltd | Equity | ₹0.07 Cr | 0.18% |

| Senores Pharmaceuticals Ltd | Equity | ₹0.07 Cr | 0.17% |

| FDC Ltd | Equity | ₹0.06 Cr | 0.15% |

| Thyrocare Technologies Ltd | Equity | ₹0.06 Cr | 0.15% |

| Indraprastha Medical Corp Ltd | Equity | ₹0.06 Cr | 0.15% |

| Supriya Lifescience Ltd | Equity | ₹0.06 Cr | 0.14% |

| Blue Jet Healthcare Ltd | Equity | ₹0.05 Cr | 0.14% |

| Solara Active Pharma Sciences Ltd Ordinary Shares | Equity | ₹0.05 Cr | 0.12% |

| Dishman Carbogen Amics Ltd | Equity | ₹0.05 Cr | 0.12% |

| Net Receivables / (Payables) | Cash | ₹0.05 Cr | 0.12% |

| Aarti Drugs Ltd | Equity | ₹0.04 Cr | 0.11% |

| Advanced Enzyme Technologies Ltd | Equity | ₹0.04 Cr | 0.11% |

| Morepen Laboratories Ltd | Equity | ₹0.04 Cr | 0.11% |

| Gujarat Themis Biosyn Ltd | Equity | ₹0.04 Cr | 0.10% |

| Krsnaa Diagnostics Ltd | Equity | ₹0.04 Cr | 0.10% |

| Sun Pharma Advanced Research Co Ltd | Equity | ₹0.04 Cr | 0.09% |

| Akums Drugs and Pharmaceuticals Ltd | Equity | ₹0.04 Cr | 0.09% |

| Orchid Pharma Ltd | Equity | ₹0.03 Cr | 0.09% |

| Innova Captab Ltd | Equity | ₹0.03 Cr | 0.08% |

| Bliss GVS Pharma Ltd | Equity | ₹0.03 Cr | 0.08% |

| Suven Life Sciences Ltd | Equity | ₹0.03 Cr | 0.08% |

| RPG Life Sciences Ltd | Equity | ₹0.03 Cr | 0.07% |

| IOL Chemicals And Pharmaceuticals Ltd | Equity | ₹0.03 Cr | 0.07% |

| Vimta Labs Ltd | Equity | ₹0.03 Cr | 0.07% |

| Gufic Biosciences Ltd | Equity | ₹0.03 Cr | 0.07% |

| SMS Pharmaceuticals Ltd | Equity | ₹0.03 Cr | 0.07% |

| Unichem Laboratories Ltd | Equity | ₹0.03 Cr | 0.07% |

| Indoco Remedies Ltd | Equity | ₹0.03 Cr | 0.06% |

| Hikal Ltd | Equity | ₹0.02 Cr | 0.06% |

| Artemis Medicare Services Ltd Ordinary Shares | Equity | ₹0.02 Cr | 0.06% |

| 3B BlackBio Dx Ltd | Equity | ₹0.02 Cr | 0.05% |

| Dr Agarwal'S Eye Hospital Ltd | Equity | ₹0.02 Cr | 0.05% |

| Syncom Formulation (India) Ltd | Equity | ₹0.02 Cr | 0.05% |

| Windlas Biotech Ltd | Equity | ₹0.02 Cr | 0.05% |

| Sigachi Industries Ltd | Equity | ₹0.02 Cr | 0.05% |

| Panacea Biotec Ltd | Equity | ₹0.02 Cr | 0.05% |

| Hester Biosciences Ltd | Equity | ₹0.02 Cr | 0.04% |

| Shalby Ltd | Equity | ₹0.02 Cr | 0.04% |

| Fischer Medical Ventures Ltd | Equity | ₹0.02 Cr | 0.04% |

| Bajaj Healthcare Ltd | Equity | ₹0.02 Cr | 0.04% |

| Laxmi Dental Ltd | Equity | ₹0.02 Cr | 0.04% |

| Suraksha Diagnostic Ltd | Equity | ₹0.02 Cr | 0.04% |

| Novartis India Ltd | Equity | ₹0.02 Cr | 0.04% |

| Kwality Pharmaceuticals Ltd | Equity | ₹0.01 Cr | 0.04% |

| Lincoln Pharmaceuticals Ltd | Equity | ₹0.01 Cr | 0.03% |

| Wanbury Ltd | Equity | ₹0.01 Cr | 0.03% |

| Kopran Ltd | Equity | ₹0.01 Cr | 0.03% |

| GPT Healthcare Ltd | Equity | ₹0.01 Cr | 0.03% |

| Jagsonpal Pharmaceuticals Ltd | Equity | ₹0.01 Cr | 0.03% |

| Tarsons Products Ltd | Equity | ₹0.01 Cr | 0.03% |

| Fermenta Biotech Ltd | Equity | ₹0.01 Cr | 0.03% |

| KMC Speciality Hospitals (India) Ltd | Equity | ₹0.01 Cr | 0.02% |

| Themis Medicare Ltd | Equity | ₹0.01 Cr | 0.02% |

| Sastasundar Ventures Ltd | Equity | ₹0.01 Cr | 0.02% |

| Nectar Lifesciences Ltd | Equity | ₹0.01 Cr | 0.02% |

| Anuh Pharma Ltd Shs Dematerialised | Equity | ₹0.01 Cr | 0.02% |

| Shree Ganesh Remedies Ltd Ordinary Shares | Equity | ₹0 Cr | 0.01% |

Allocation By Market Cap (Equity)

Large Cap Stocks

45.41%

Mid Cap Stocks

27.68%

Small Cap Stocks

26.80%

Other Allocation

Equity Sector

Debt & Others

| Sector | Amount | Holdings |

|---|---|---|

| Healthcare | ₹39.16 Cr | 99.13% |

| Basic Materials | ₹0.3 Cr | 0.76% |

Risk & Performance Ratios

Standard Deviation

This fund

16.46%

Cat. avg.

16.18%

Lower the better

Sharpe Ratio

This fund

0.95

Cat. avg.

0.91

Higher the better

Sortino Ratio

This fund

--

Cat. avg.

1.60

Higher the better

Fund Managers

Additional Scheme Detailsas of 31st December 2025

ISIN INF247L01BB1 | Expense Ratio 0.23% | Exit Load - | Fund Size ₹40 Cr | Age 3 years 6 months | Lumpsum Minimum ₹500 | Fund Status Open Ended Investment Company | Benchmark BSE Healthcare TR INR |

Investment Objective

Investment Objective

To seek to generate long-term capital growth from an actively managed portfolio primarily of Equity and Equity Related Securities. Scheme shall invest in Indian equities,foreign equities and related instruments and debt securities.

Tax Treatment

Capital Gains Taxation:

Capital Gains Taxation:

Dividend Taxation:

Dividend Taxation:

Note: As per the Income Tax Budget 2024, mutual funds are subject to capital gains taxation, which includes surcharge and cess based on prevailing income tax rules and the investor’s income. Taxation applies only to realised gains, not notional gains. Please consult your tax advisors to determine the implications or consequences of your investments in such securities.

Similar Sector - Healthcare Funds

About the AMC

Motilal Oswal Mutual Fund

Total AUM

₹1,44,272 Cr

Address

Motilal Oswal Tower, Mumbai, 400 025

Other Funds by Motilal Oswal Mutual Fund

Risk Level

Your principal amount will be at Very High Risk

Still got questions?

We're here to help.

What is the current NAV of Motilal Oswal S&P BSE Healthcare ETF?

What are the returns of Motilal Oswal S&P BSE Healthcare ETF?

What is the portfolio composition of Motilal Oswal S&P BSE Healthcare ETF?

Who manages the Motilal Oswal S&P BSE Healthcare ETF?

- Swapnil Mayekar

- Rakesh Shetty

- Dishant Mehta