It is raining unicorns in India as 30 startups enter the $1 billion club in 2021.The startup ecosystem in India is exploding, and attracting the country’s most coveted talent, and no wonder why. One of the most attractive aspects of working for a startup is getting a share of the upside through ESOPs. Yet, when it comes to ESOPs, we often don't understand them well. Most times, candidates look at the total "package" when joining a company, which is seen to be the sum total of the salary/cash compensation and the ESOPs that are allotted. However, there are many reasons why this approach may not be the right way of looking at compensation.

What are ESOPs?

Employee Stock Ownership Plan or ESOP is a way to compensate employees in a startup by making them shareholders of the business. Just like publicly listed companies, startups also have share equity and allocating a proportion of it to employees acts as an incentive for top talent to join and continue working. But remember, ESOPs are stock options. They are not directly stocks in the company. The big difference, as the name suggests, is that you have an option (and not an obligation) to buy the stocks sometime in future at a predefined price. This could be close to 0 in a few cases, or at least at a deeply discounted price.

ESOP value:

Startups grant ESOPs in line with your overall compensation plan and the value of your ESOPs are usually stated in INR lakhs instead of percentage of company’s equity.

Let’s understand this with an example -

1.Company valuation : 100Cr

2.Number of Shares : 1Cr

3.Price per Share : 100 (Company valuation / Number of Shares)

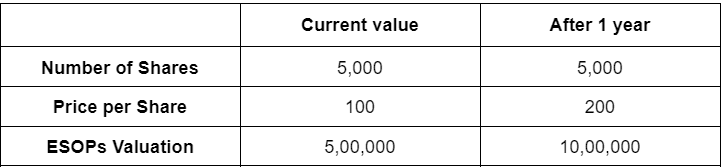

Let’s assume you have been allotted 5000 shares as part of your ESOPs agreement.

1.Number of Shares : 5,000

2.Price per Share : 100

3.Your ESOPs Valuation : 5,00,000

This is the value of your ESOPs on the day they are granted to you. If the company does really well in future, raises funding from external investors and the valuation grows, the price per stock will also go up and so will the total value of your ESOP grant. Assume that 1 year after your ESOPs are granted, the startup raises funds and the price per share doubles to INR 200. This means your ESOPs that were worth INR 5 lakhs are now worth INR 10 lakhs. So if the startup keeps performing well, your ESOPs will also keep increasing in value.

*This assumes that the strike price is almost zero.

Vesting period:

ESOPs are never granted in one go simply because an employee can theoretically resign and take their ESOPs after working for a few months only. To avoid this, there is a specific structure called vesting period. This is the time duration until which an employee has to wait to be capable of receiving the ESOPs. Instead of granting all the stock options upfront, these are vested or unlocked over a period of time in the future. This incentivizes employees to continue working with the startup for a longer duration.

ESOPs are vested yearly or quarterly and the total vesting period in India is usually 4 years. Of course your ESOPs will continue to vest only for the time you are working in the startup. Therefore, if you leave the job in say 2 years, you will receive ESOPs for those 2 years and the other ESOPs will lapse.

Continuing from the previous example -

1. If you are granted 5000 ESOPs and the startup follows a yearly vesting schedule for 4 years then you will receive 1250 ESOPs at the end of each year for 4 years instead of receiving 5000 ESOPs upfront.

2. This is a little impractical as employees may leave mid-year so most startups follow quarterly vesting and in that case, that yearly vesting of 1250 ESOPs is then further divided into 312 ESOPs every 3 months and 314 ESOPs at the end of the year (because ESOPs are granted in whole numbers hence the adjustment).

So does that mean you will receive some ESOPs after the first quarter of joining the startup itself? Not really, because the company wants to grant its valuable stock options only to those people who spend at least some minimum time working with them.

Cliff duration:

Cliff duration or simply cliff, is another caveat within the granting structure to ensure that employees work for a minimum time period before they are eligible for the first ESOPs to be vested. In India, startups usually have a 1 year cliff duration. If you leave your job with the startup before the completion of 1 year, you won’t be granted any ESOPs.

In the example above, you won’t get anything for the first year and at the end of 12 months your 1250 ESOPs will be vested. Going forward, you will have 312 ESOPs vested every 3 months for next 3 years in case of quarterly vesting.

So now, you know the number of ESOPs, the value you will potentially receive, and the period it will take to receive them

Exercise or strike price:

While granting the ESOPs, startups mention the price you will have to pay for converting them into equity. This is called the strike or exercise price and is often a very nominal amount of INR 1 to INR 100. Along with the strike exercise price, the employee must also pay taxes as per their applicable income tax bracket at the time of exercising their options. We will discuss the taxation aspect in detail, later in this video.

So for our ongoing example, you could exercise your 5000 ESOPs for as low as INR 5000 plus taxes and if the startup grows rapidly, these stocks can be potentially worth a lot more!

Exercise period:

Converting your ESOPs into that startup’s equity seems easy on paper by just applying for it, but actually there is a time period associated here. This is called the exercise period. It is the time period within which you need to exercise or convert your stock options into stocks after they are vested; failing to do so would result in your ESOPs getting lapsed. This exercise period varies from as low as just 3 months to sometimes even 5 or 7 years, depending on your startup employer.

To understand this better, let’s say you joined a startup on 1st September 2020.

1.Joining date of Startup: 1st September 2020.

2.Vesting period : 4 years

3.Cliff Period : 1 year

4.Exercise Period : 5 years

5.Vesting Schedule @ 1250 ESOPs yearly:

1.1st lot of ESOPs : September 2021

2.2nd lot of ESOPs : September 2022

3.3rd lot of ESOPs : September 2023

4.4th lot of ESOPs : September 2024

ESOPs into Equity Schedule:

1.1st lot of ESOPs : September 2026

2.2nd lot of ESOPs : September 2027

3.3rd lot of ESOPs : September 2028

4. 4th lot of ESOPs : September 2029

In summary, based on the above structure, you will have time till 1st September 2026 to convert your initial lot of 1250 ESOPs which were vested in September 2021, into equity. Similarly, September 2027 is the time available to convert or exercise the next lot of 1250 ESOPs vested in September 2022 and so on.

5 suggestions for you while looking into ESOPs

1. Comparing ESOPs: You can compare the salary packages that companies offer. But comparing ESOPs of one company with another is like comparing apples with oranges. The companies are in different businesses, at different stages of growth, therefore the upside can vary dramatically.

2.Value of ESOPs: Here too there is confusion. Certain employers communicate the "at-the-money" value(when Strike price is equal to market price) of these options while others communicate "in-the-money"(when the holder can buy these options below its current market price). Make sure you understand what you are being offered first.

3.Vesting and Exercise Periods: Look at what period you will get these options (vesting), and till when you can convert them to equity (exercise). Ideally, vesting should be as early as possible and exercise should be as long as possible!

4. ESOP vs Cash: This is the hard part, and it is personal. First secure for yourself a comfortable lifestyle (so you and your family are secure) and then max out on the ESOPs you can negotiate. But it's OK to compromise on cash if that works for you and you don’t need the liquidity.

5. Taxation: The conversion of stock options into stocks is considered as income generated as per Income Tax laws since you likely pay a very low price or sometimes nothing to get these stocks but can sell and make money out of them. So don't overlook them.