Today there are a variety of options available for resident Indians to invest in the US. The question in many investors' minds is if they should diversify some of their funds in U.S. stocks. To help make this decision, it is important to understand the differences between the two markets.

For our discussion, we will compare S&P 500 (U.S.) and Nifty 500 (India) as well as the stocks represented in these indexes. Both indexes follow the free-float market-cap methodology and represent the largest 500 companies with approximately 80-85% large-caps and 15-20% in mid-caps. Free float market cap represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments.

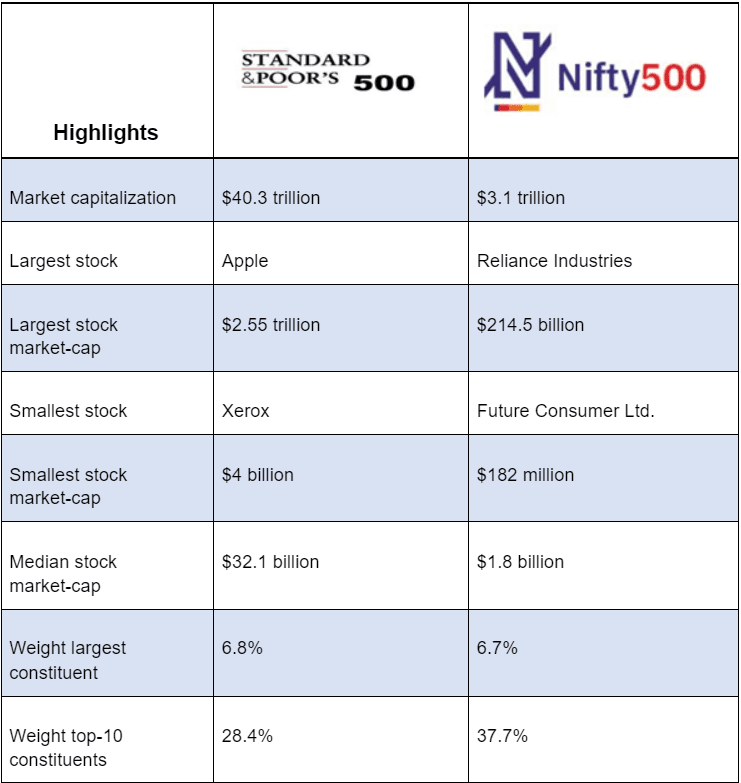

Key differences in the Indian and US stock market

The U.S. is home to nine of the top 10 largest publicly listed companies in the world. As a matured economy the sector construct of S&P 500 companies has changed drastically over the past 50 years. For example, back in 2005 Information Technology & Communication Services together (“Technology”) represented only 20% of the Index. However, at the end of 2020 these two sectors represented more than 40% of the Index. In comparison, at the end of 2020 these sectors represented only 15% of the Indian Nifty 500 Index. Also, what is striking is that India’s publicly-listed Technology companies represent less than 1% of the global technology sector market cap. Investors looking for growth in the Information Technology sector would be better served investing in the US based on the sheer size and number of opportunities available.

On the other hand, with initiatives such as demonetization and digitization, the Indian economy has added new bank, demat, and e-wallet accounts at the fastest pace ever. The banking sector in Nifty 500 is the largest sector with 31% of the weight. Investors looking for growth in the banking sector would be better served investing in Indian vs the US basis the growth in the Indian consumption and rising per capita income.

S&P 500 companies are more global in nature than Indian companies. E.g. These companies derive more than 40% of their revenues outside of the United States. In comparison, Nifty 500 companies derive 27% of their revenues outside of India. Hence, investing in U.S. stocks also gives exposure to international economies, markets, and consumers.

SECTOR-WISE BREAKDOWN OF INDIAN AND US STOCKS:-

Top-10 constituents - Apple, Microsoft, Amazon, Facebook, Alphabet Class A, Alphabet Class C, Tesla, Nvidia ,Berkshire Hathaway, JPMorgan Chase

Top-10 constituents - Reliance Industries, HDFC Bank, Infosys, HDFC, ICICI Bank, Tata Consultancy Services, Kotak Mahindra Bank, Hindustan Unilever, Axis Bank ,Larsen & Toubro

STOCK PERFORMANCE OVER PAST 15 YEARS

If we look at the below table then one may conclude that over the past 15 years investing all of your funds in the U.S. equities would have been the best outcome i.e. One would have earned higher returns with lower volatility. There were several factors that lead to the outperformance of US equities over Indian equities in that time period e.g. accommodative fiscal and monetary policies, stronger USD, rise of global technology titans etc.

However, if you increase the time horizon to 20 years (see below) then the Indian equities provide you with better absolute returns. So, extrapolating the past 15 years' performance of U.S. markets is no indication that the U.S. will continue to outperform India. However, for Indian investors allocating a portion of their wealth to the largest market in the world has many benefits as highlighted below.

Benefits of investing in US stock markets:

1. Investment opportunity / diversification

India represents only 3% of the global market capitalization while the U.S. represents more than 50%. In addition, the U.S. stocks universe provides access to a variety of themes that were historically not available in India e.g. within Information Technology the U.S. provides access to industries such as hardware, software-as-service, financial technology, semiconductors, etc.

2. Correlation

Historically, U.S. equities have shown a lower correlation in relation to Indian markets. Correlations measure the degree to how two stocks or two markets behave in the same way. A score of one means the markets are perfectly correlated and zero means there is no impact on one another. There are many reasons why the two stocks markets may be low correlated. For example,

1.GDP and companies' profits are less dependent on each other,

2.The monetary system of the U.S. is more closely aligned with other Western developed economies.

3.In an emerging market economy like India, the difference in interest rates and currency exchange, as well as other factors beyond market control such as geopolitical, operational, and legal risks play a larger role.

3. USD INR exchange

As an emerging economy, the Indian currency has depreciated vs the USD by over 70% in the last 20 years. Even if both markets performed exactly the same during a given period, then the annual depreciation of the Indian rupee to USD of 3.5% over the past 20 years would have made U.S. equities look superior. There are several reasons why the Indian currency may depreciate e.g. lower export revenues, higher reliance on imports e.g. Oil which depletes foreign reserves, reduction in interest rates, etc.

Should we prioritize Indian or US stocks?

There are several advantages of investing in the U.S. equity markets along with India. Both markets bring a unique perspective to the investing landscape with a vivid investment universe, lower correlation, and better risk-adjusted returns. Before investing in foreign markets, the investor must consider additional factors such as currency exchange, costs associated with investing, taxation, and most importantly your familiarity with the markets. Investors who do not understand or do not have the time to research U.S. stocks must look at options such as investing in actively managed offshore funds, fund of funds, or passive index funds.

Author: Team dezerv.

Follow us on: