NRIs trust Dezerv to invest in India

NRIs trust Dezerv to invest in India

Proven track record (20.33% TWRR since inception)

Dedicated investment experts for NRIs

Effortless account opening & onboarding

₹1 cr invested in Sep-2022 would have been:

As of 31st Aug, 2025

₹1 cr invested in Sep-2022 would have been:

₹1 cr invested in Sep-2022 would have been:

As of 31st Aug, 2025

SEBI Registered: INP000007377

SEBI Registered: INP000007377

Funds are held with ICICI / Nuvama custodian bank

Funds are held with ICICI / Nuvama custodian bank

ISO 27001

Certified

ISO 27001 Certified

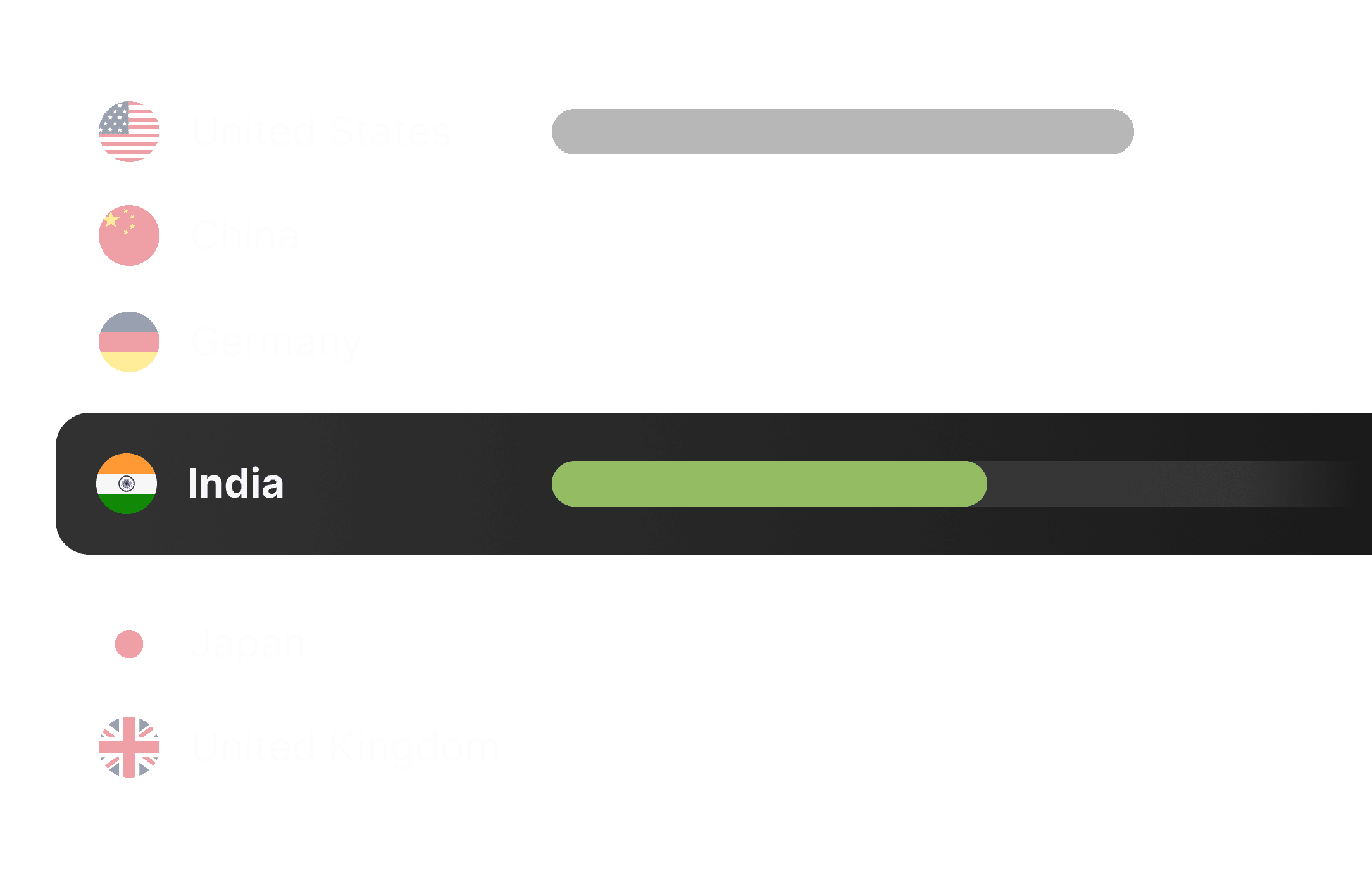

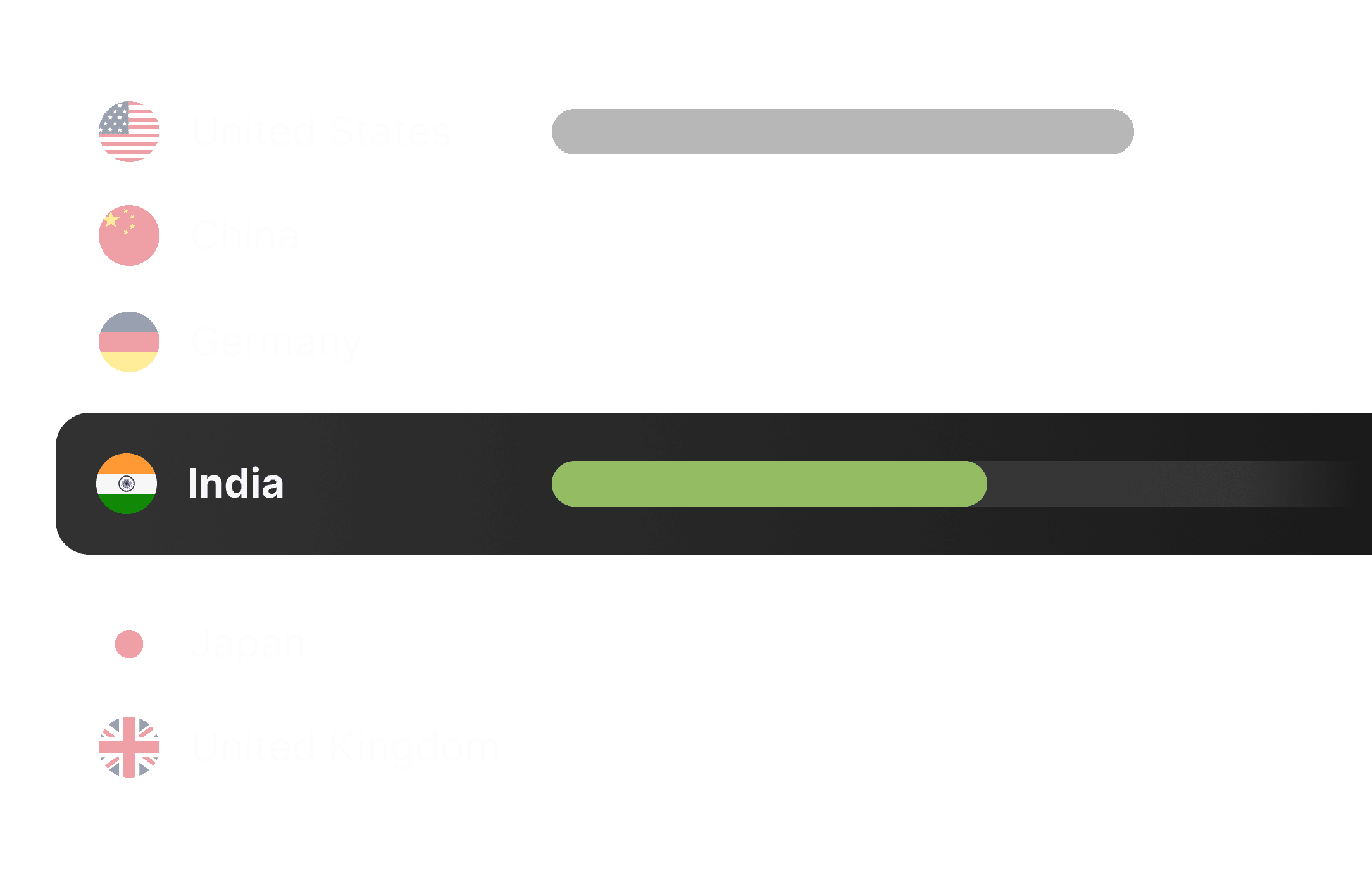

4th Largest Economy

India's economic growth creates wealth-building opportunities that you shouldn't miss. (As on 16th June, 2025 - source)

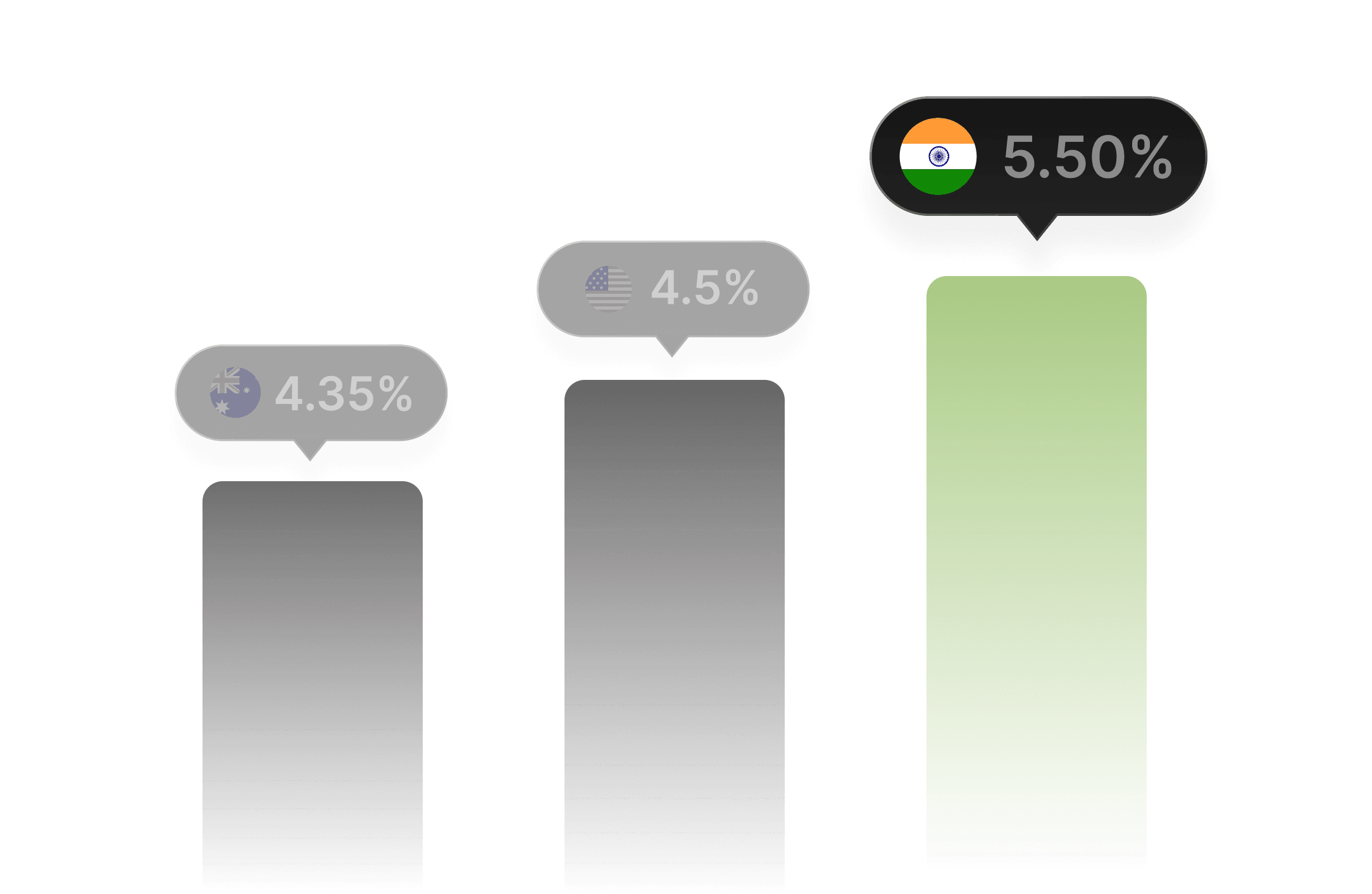

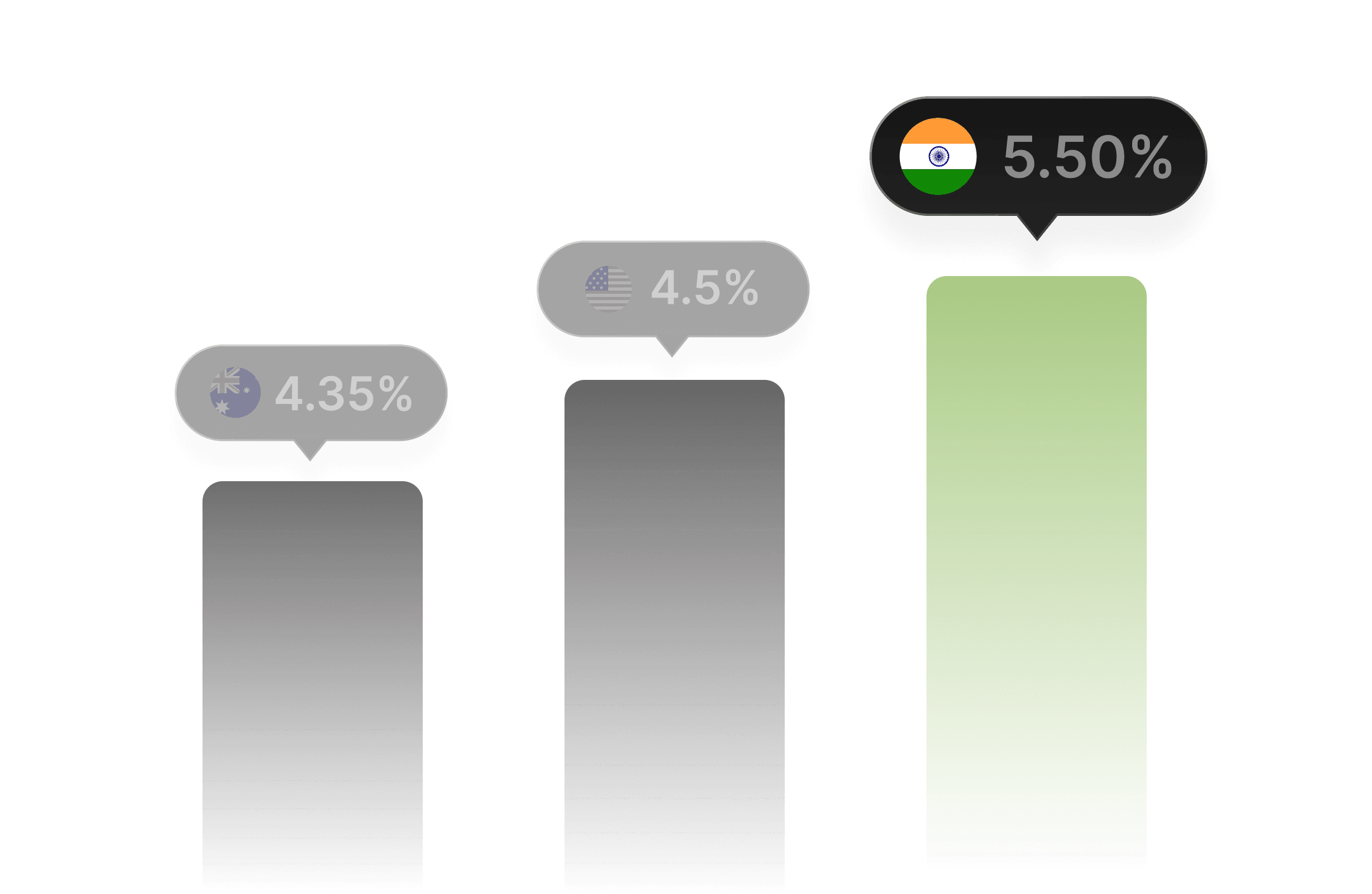

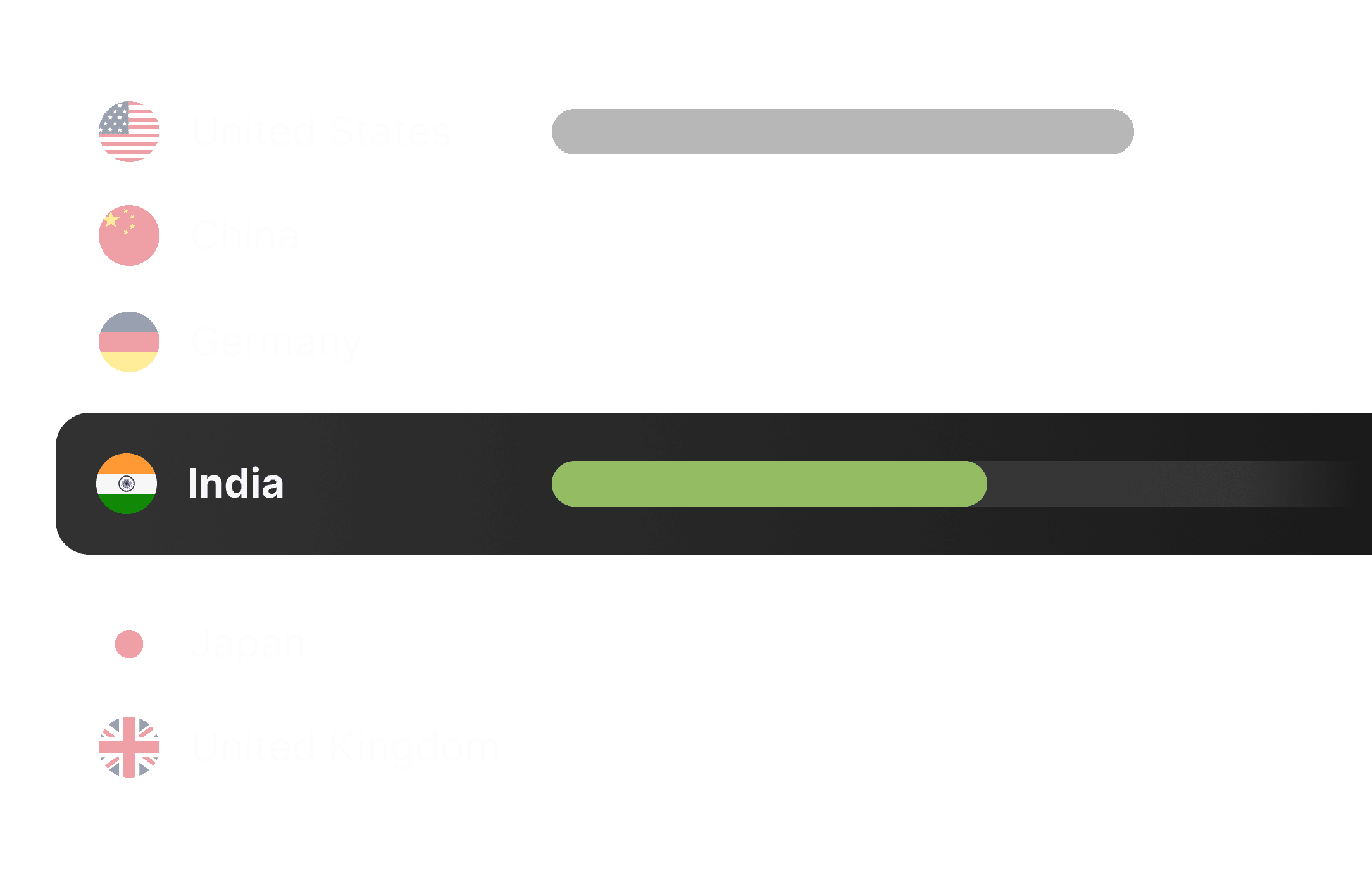

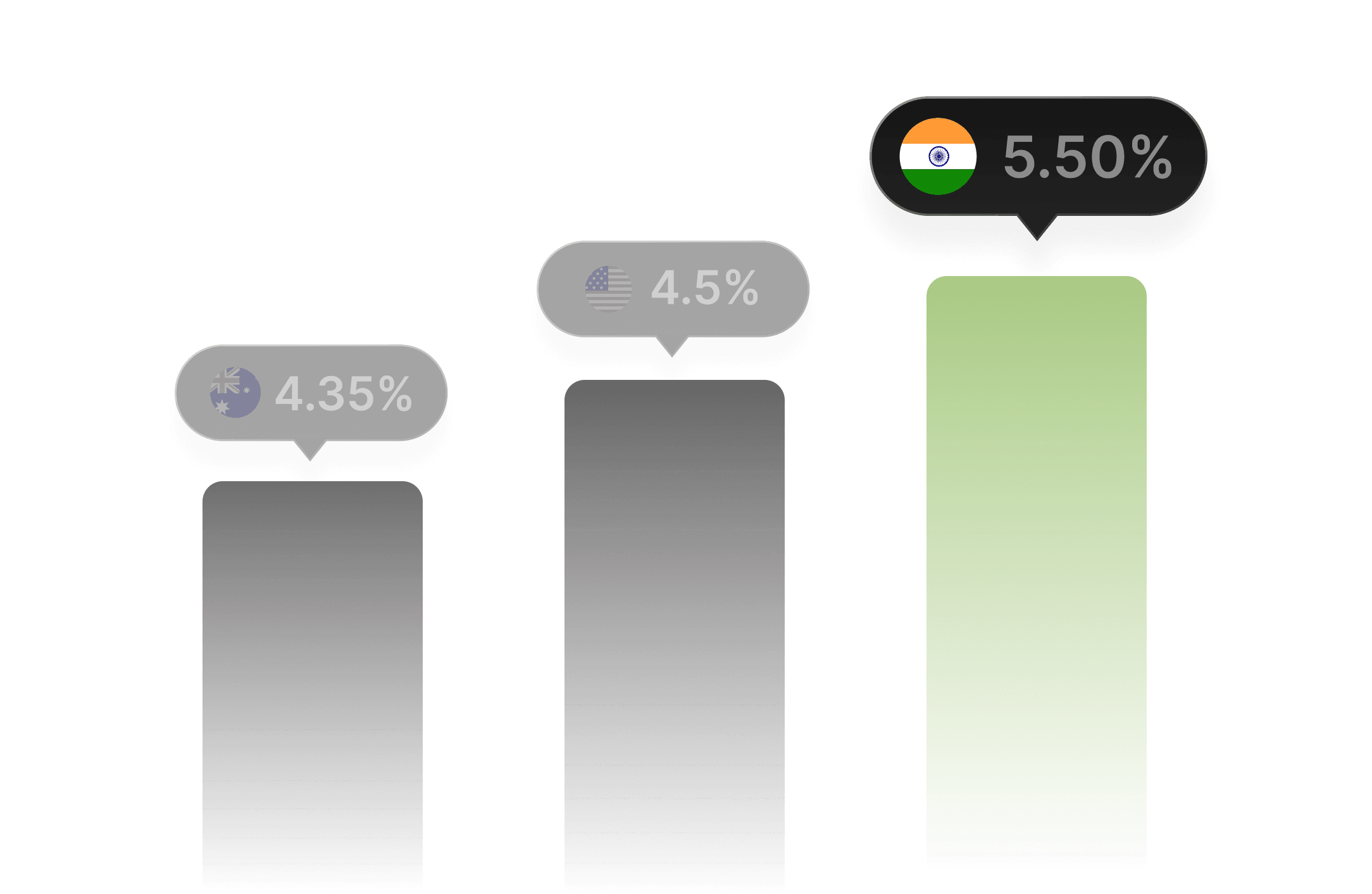

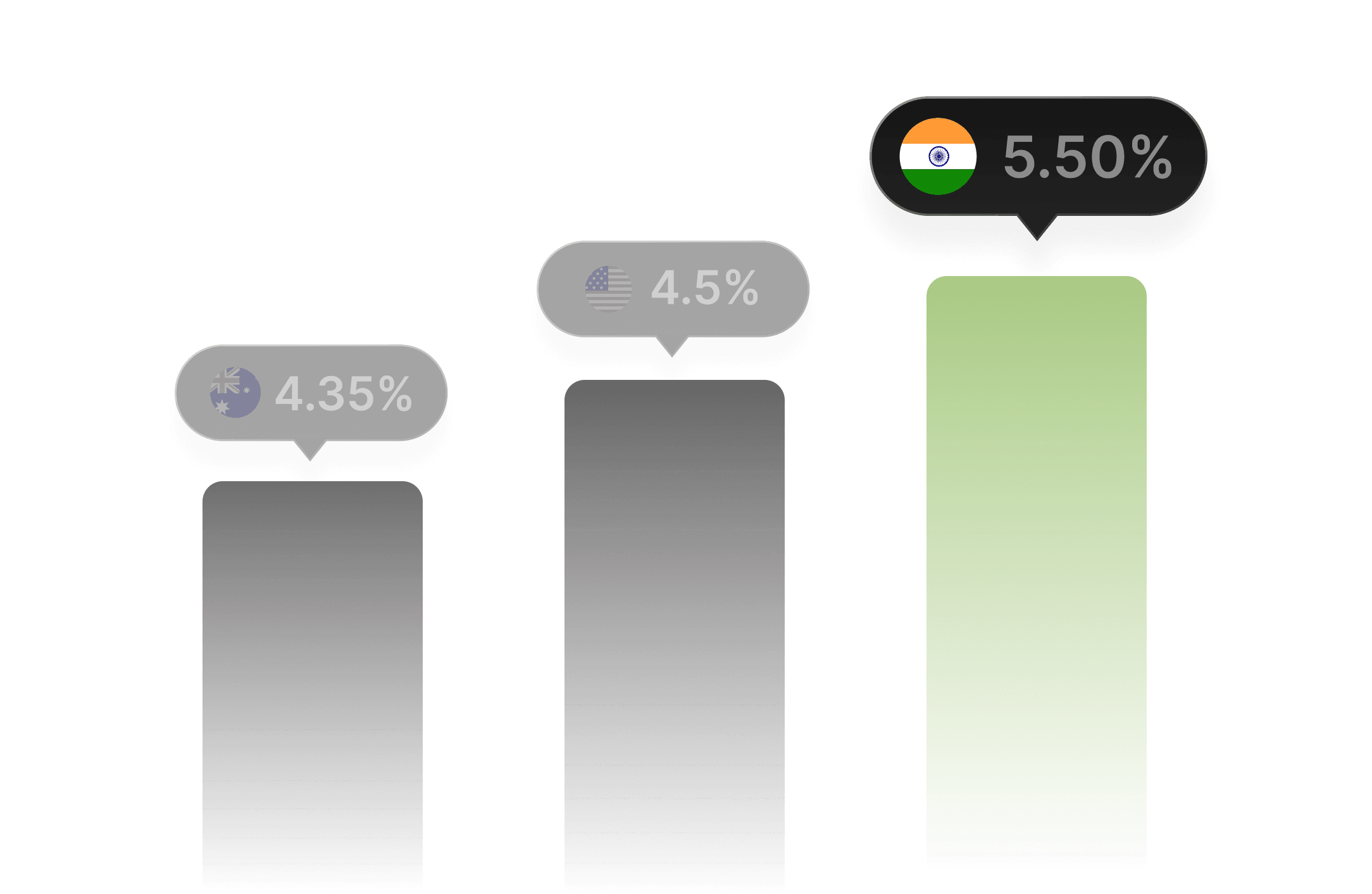

India’s Repo Rate Stands Higher

5.50% repo rate drives attractive fixed income returns (As on 06 June 2025 - source)

All Time High Inflows

NRIs have sent $138 billion in remittances to

India in 2024-25. (As on 16th June 2025 source)

Why NRIs are investing in India now?

4th Largest Economy

India's economic growth creates wealth-building opportunities that you shouldn't miss. (As on 16th June 2025 - source)

India’s Repo Rate Stands Higher

5.50% repo rate drives attractive fixed income returns (As on 06 June 2025 - source)

All Time High Inflows

NRIs have sent $138 billion in remittances to

India in 2024-25. (As on 16th June 2025 source)

Common Challenges faced by NRIs when

investing in India

Common Challenges faced by NRIs when

investing in India

Common Challenges faced by NRIs when investing in India

Common Challenges faced by NRIs when investing in India

Complex Paperwork

Complex Paperwork

Endless paperwork, multiple verifications, and constant follow-ups.

Inadequate Support

Inadequate Support

RMs might not be available in your time zone.

Tax Compliance

Tax Compliance

Navigating complex international tax rules is overwhelming.

Limited Investment Options

Limited Investment Options

Fewer and in-efficient investment solutions for you and your family.

Why choose Dezerv as your Investment Partner?

Why choose Dezerv as your Investment Partner?

Why choose Dezerv as your Investment Partner?

Expertise you can trust

Expertise you can trust

20+ years of experience and managing 13,000 Cr+ assets.

Dedicated Support

Dedicated Support

Expert support that works around your schedule, across time zones, from KYC to NRE/NRO setup, via phone and digital platforms.

Transparency & Tax compliant solutions

Transparency & Tax compliant solutions

Transparent reporting of investments, returns and fees. No lock-in period, 100% tax-compliant, with timely reports

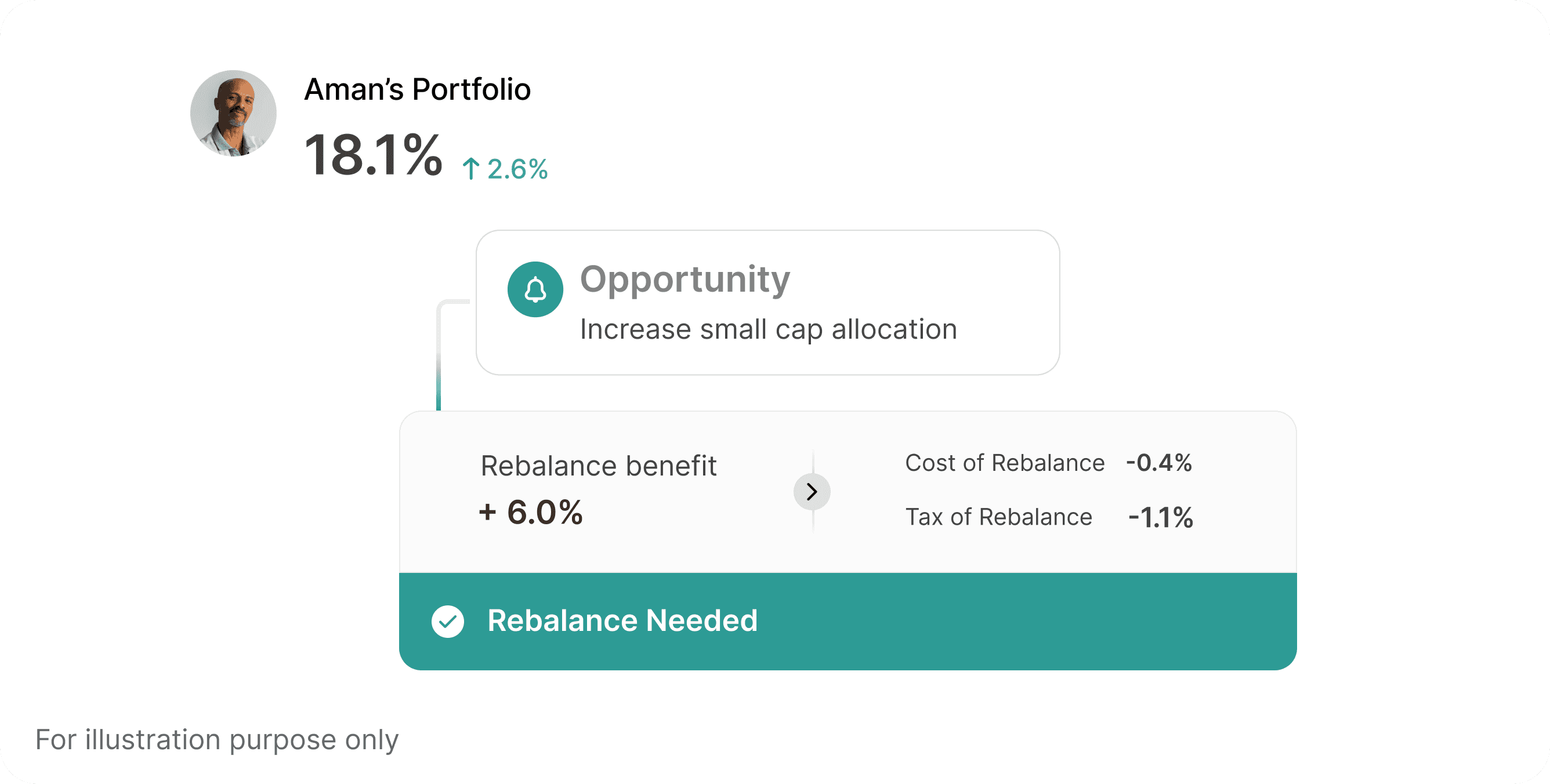

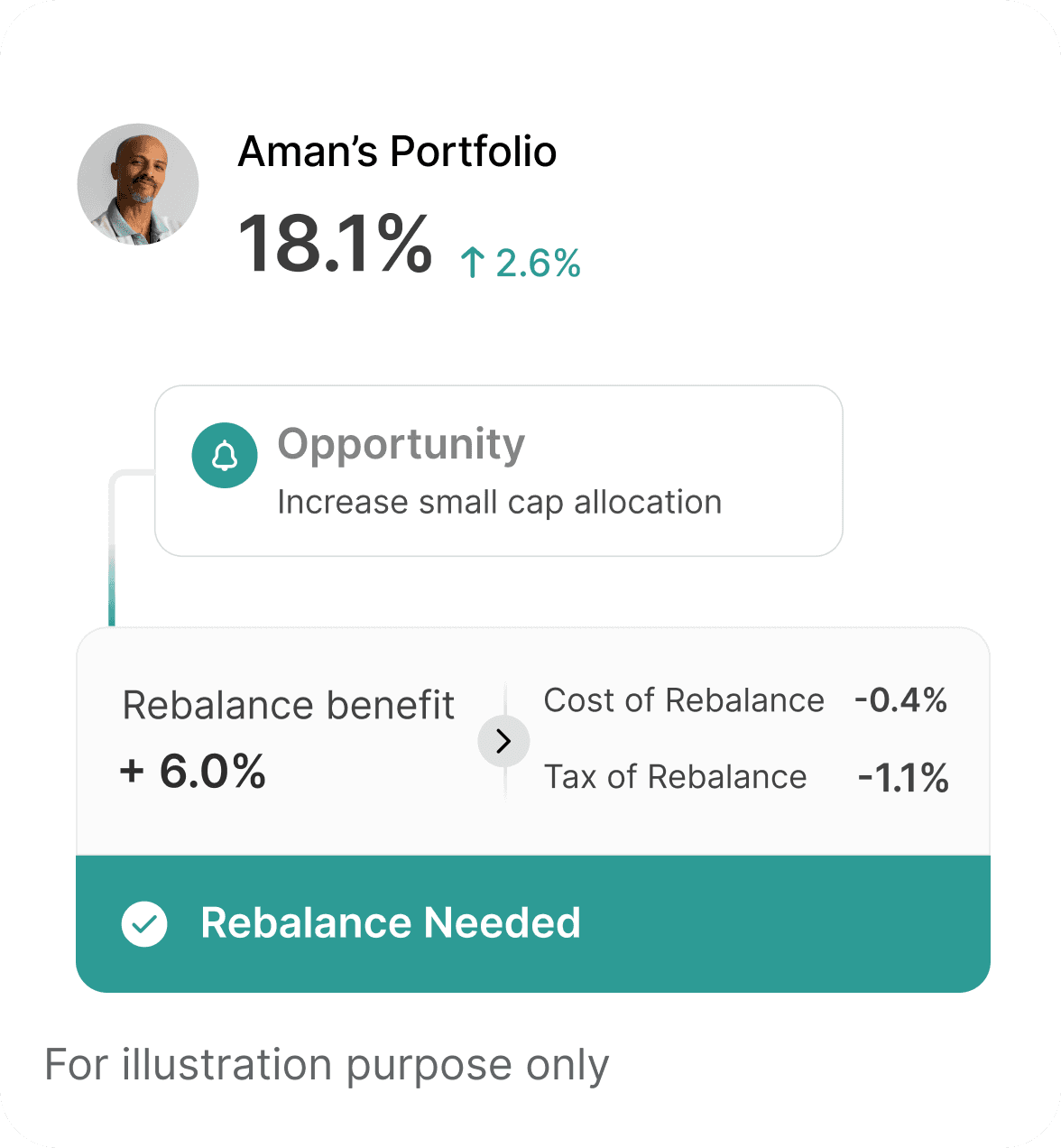

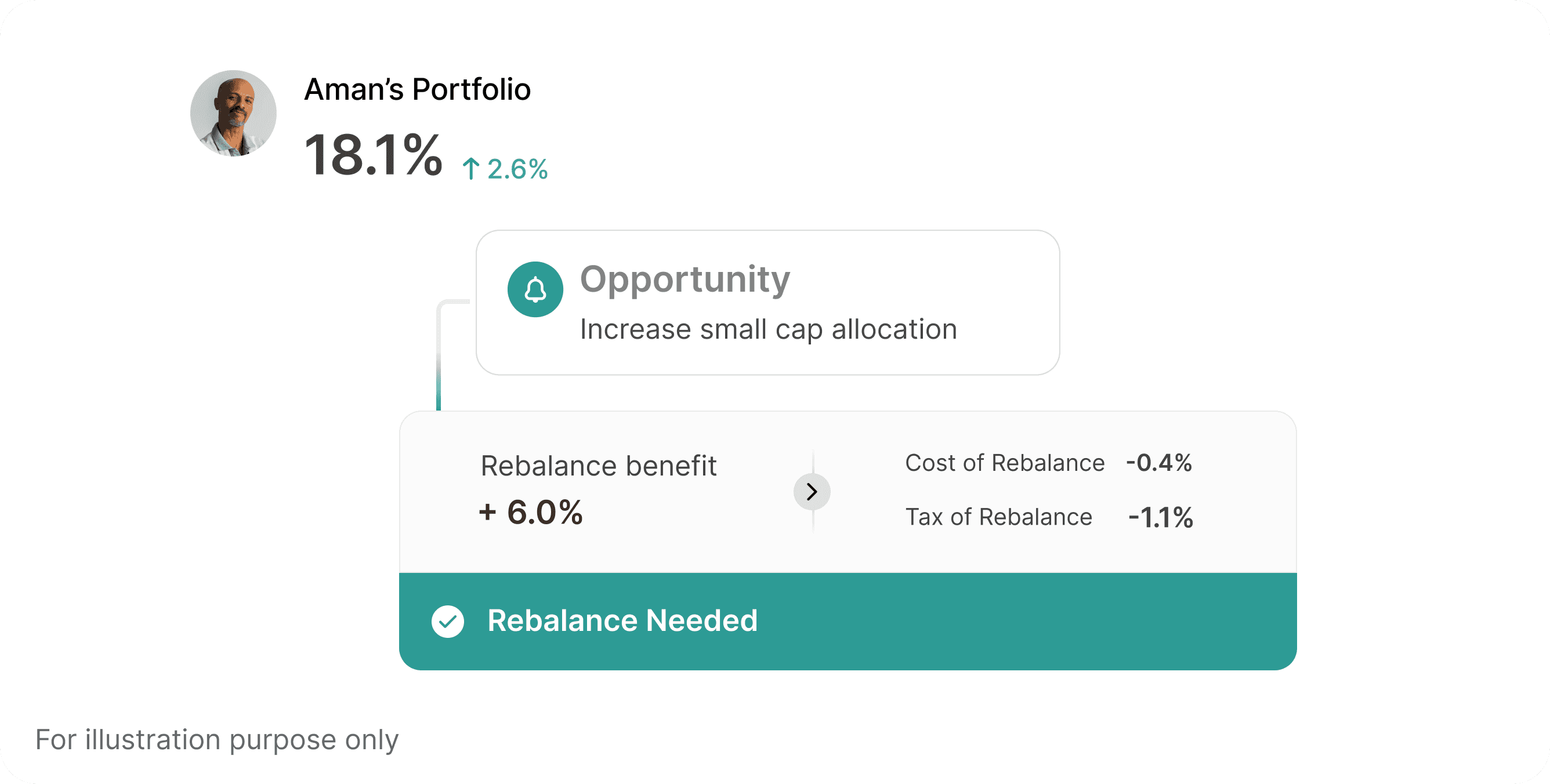

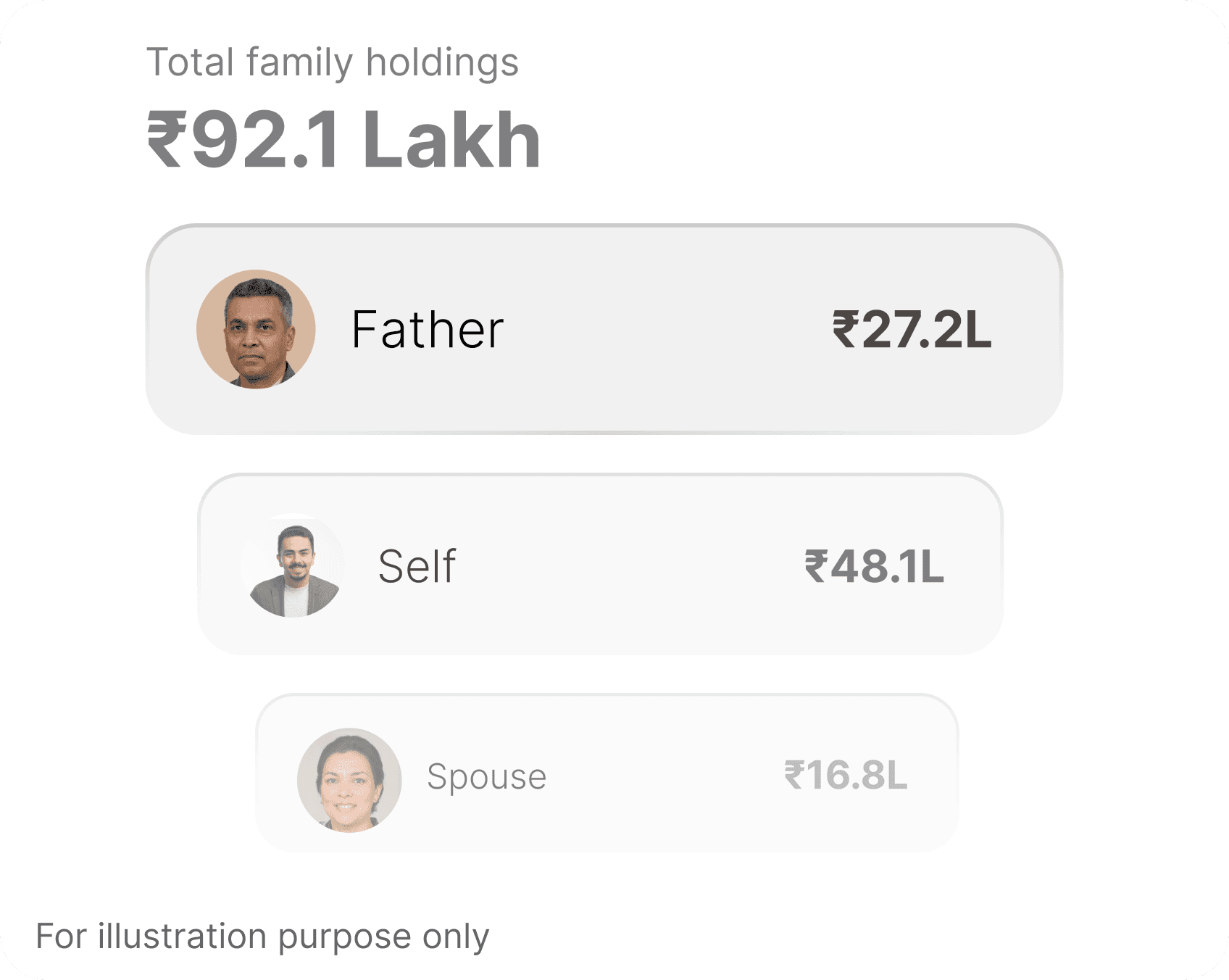

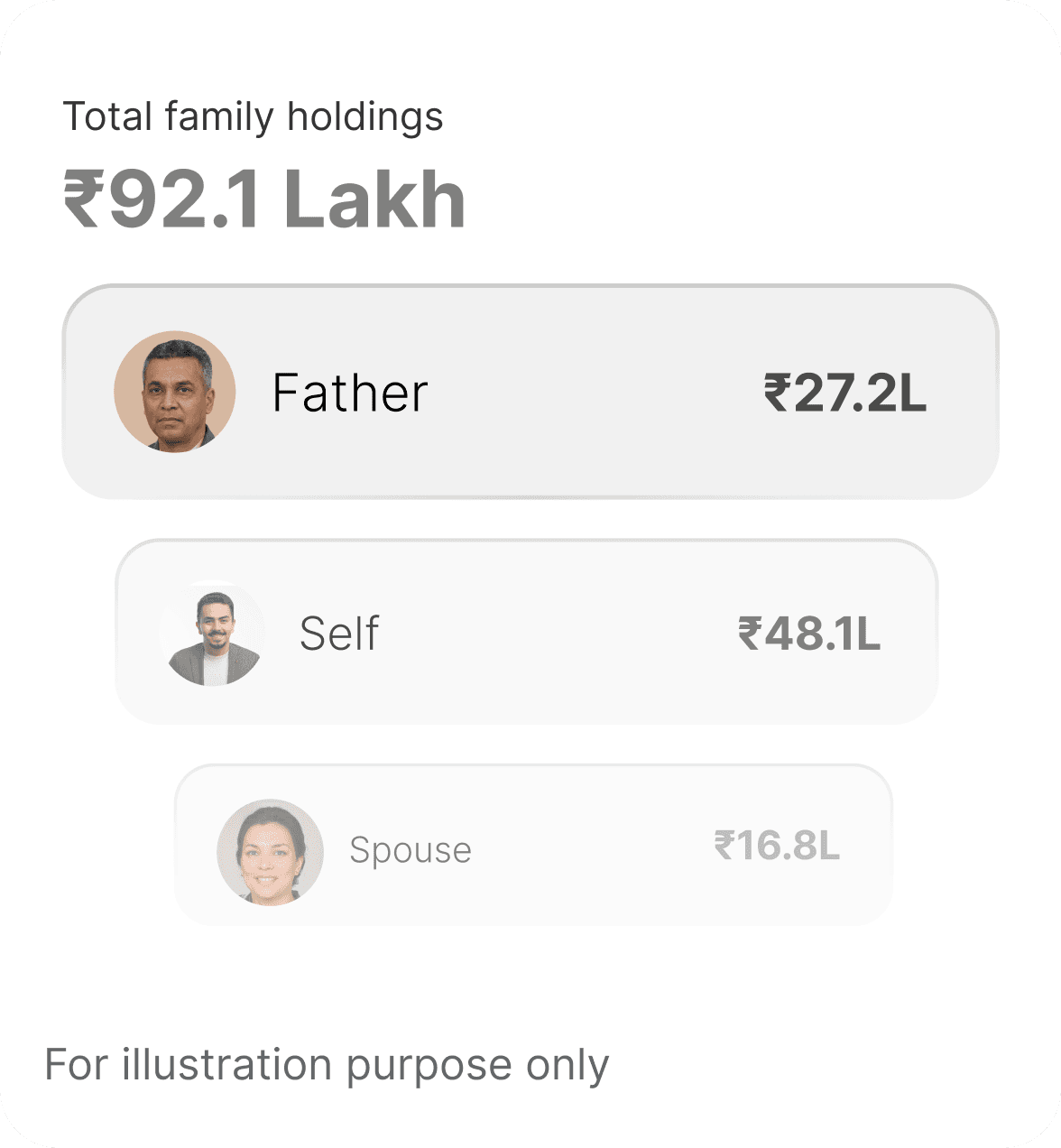

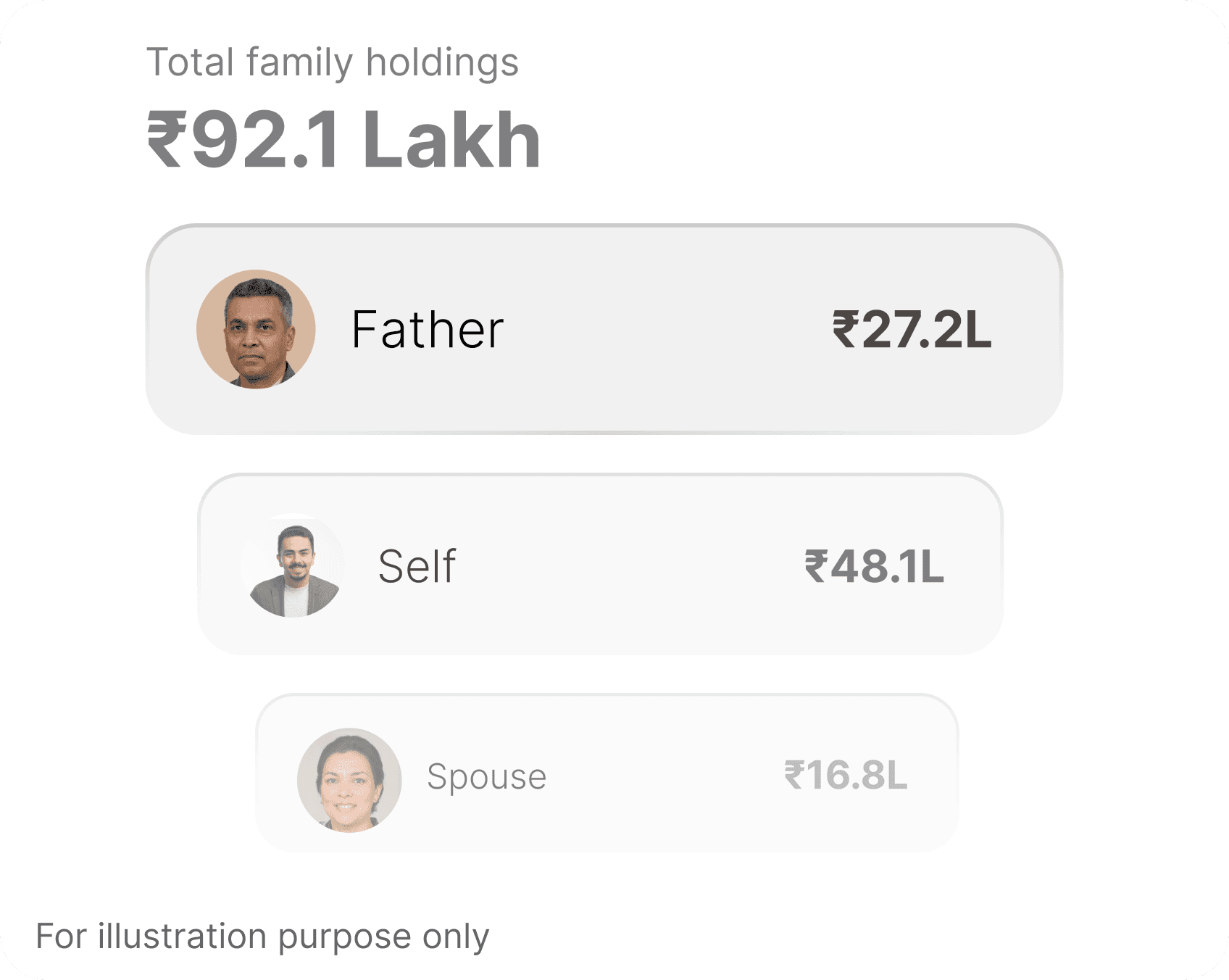

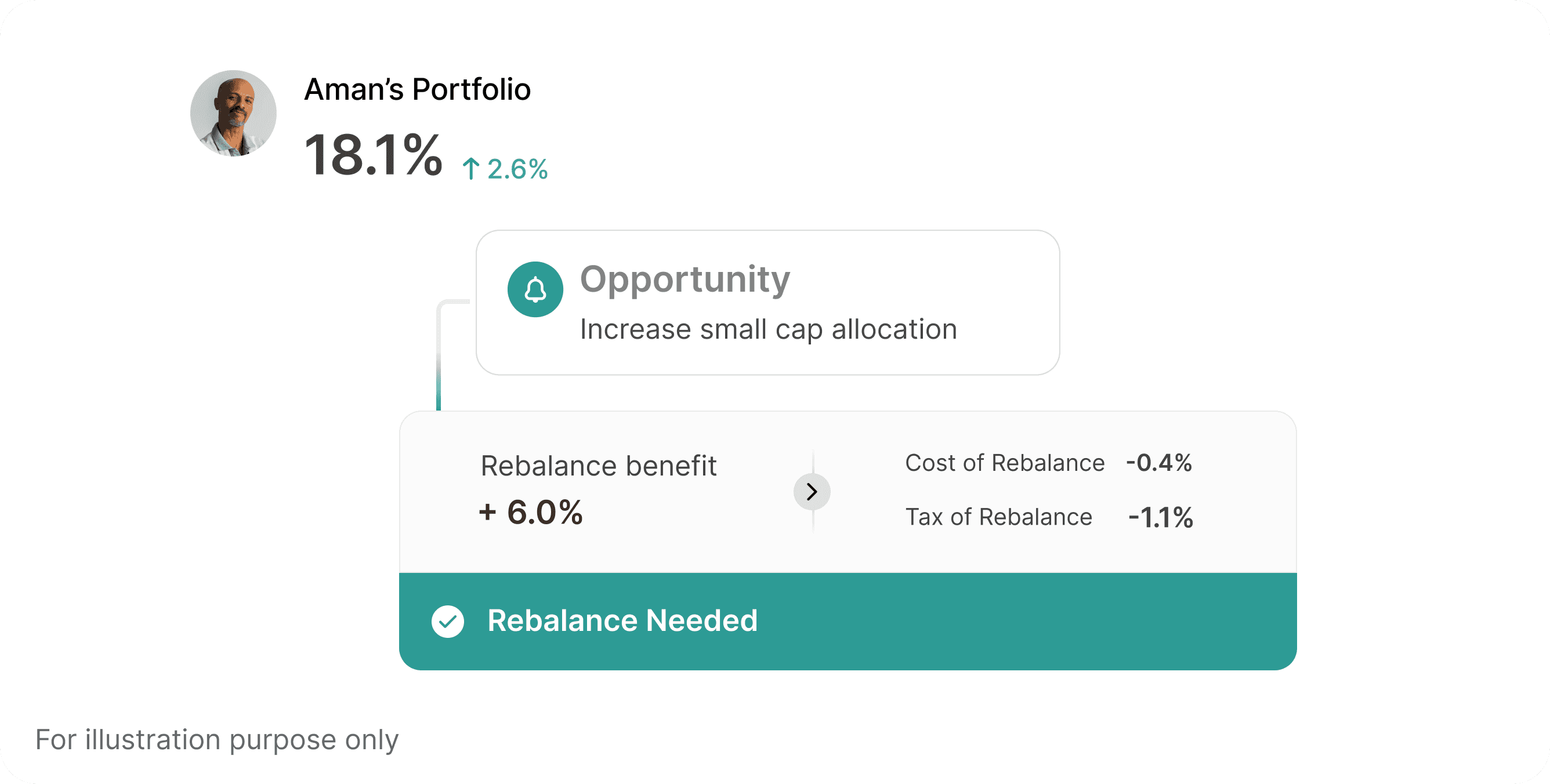

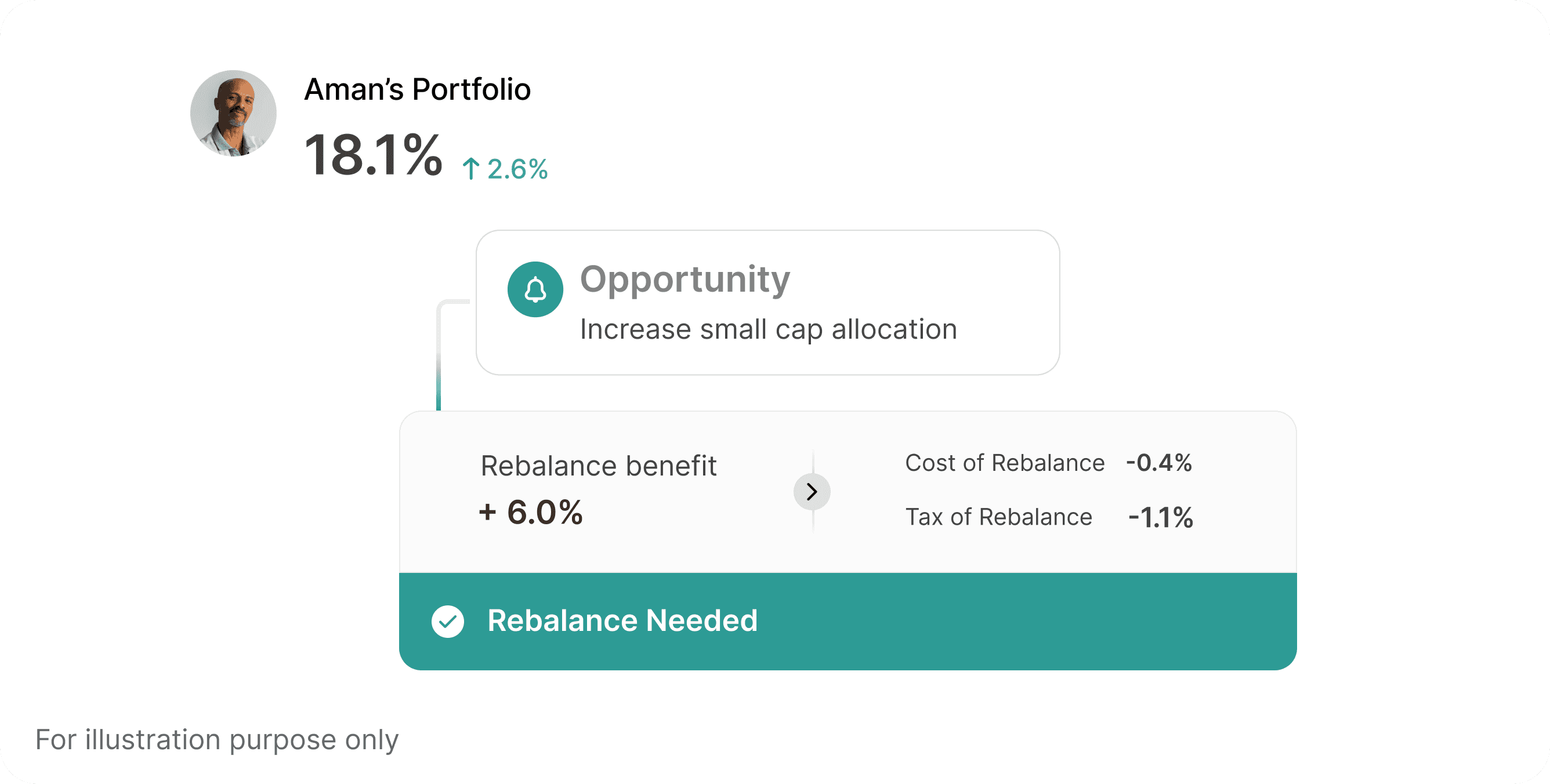

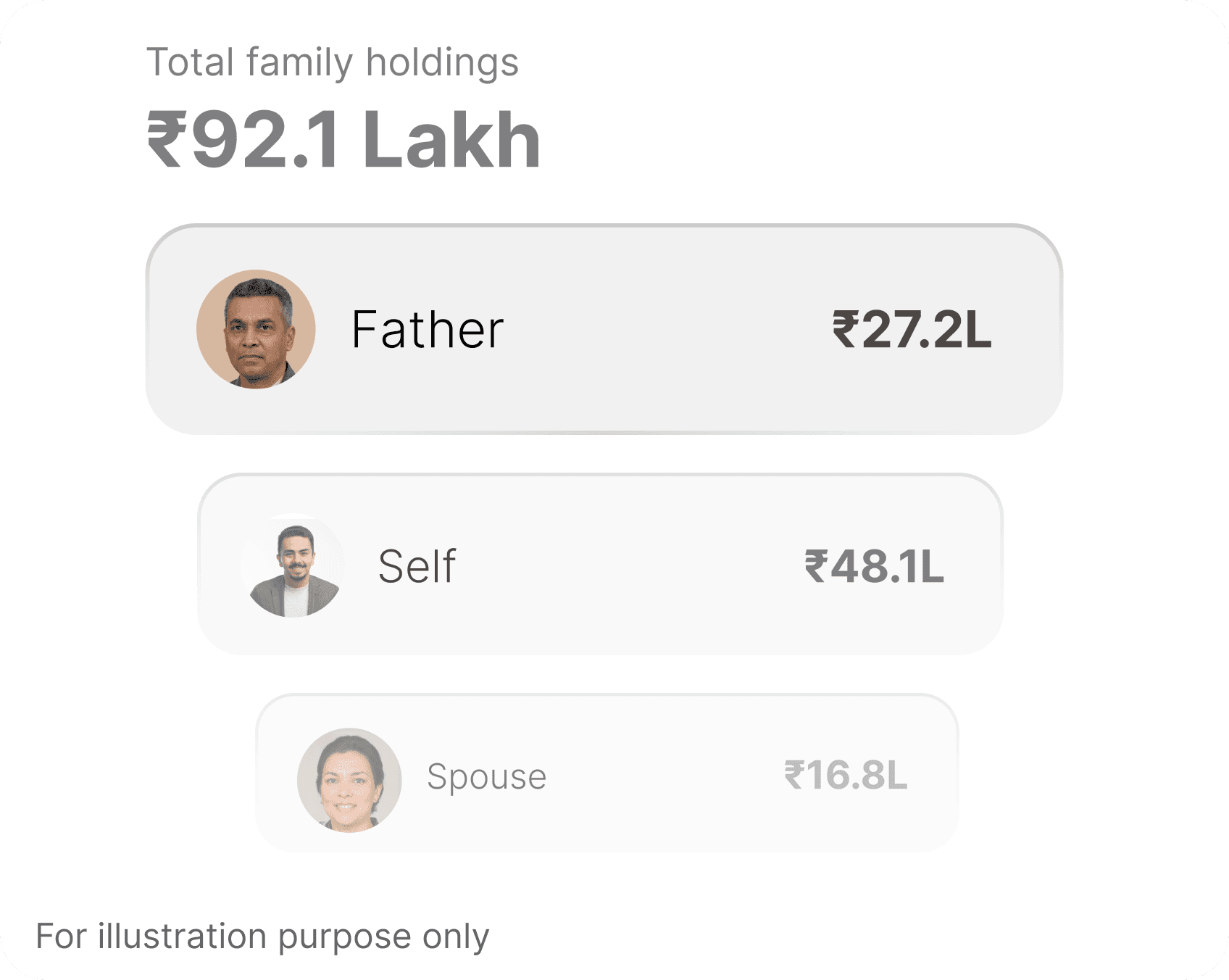

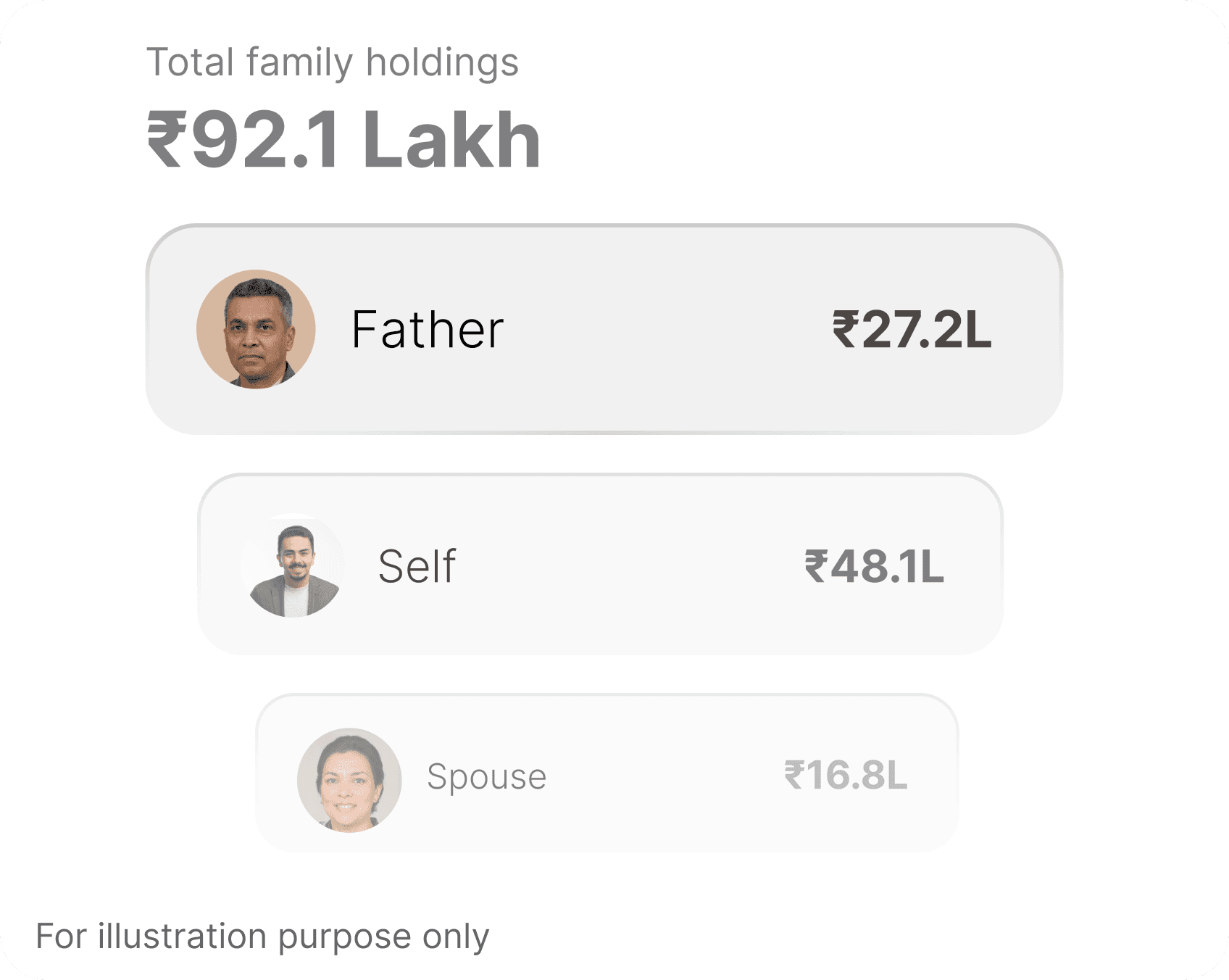

Holistic Portfolio Management

Holistic Portfolio Management

Expert led family investment reviews, real-time tracking on the Wealth Monitor app, and personalized solutions for your financial goals.

Customised Investment

Solutions for NRIs

Customised Investment

Solutions for NRIs

Customised Investment

Solutions for NRIs

Equity PMS

An actively managed portfolio consisting of mutual funds that invest across large-cap, mid-cap, and small-cap stocks

Dezerv has offerings other than PMS as well like Alternative Assets & Private Equity through AIF

Equity PMS

Actively managed equity portfolios, designed for 5+ years, targeting 3% market outperformance.

Dezerv has offerings other than PMS as well like Alternative Assets & Private Equity through AIF

Equity PMS

An actively managed portfolio consisting of mutual funds that invest across large-cap, mid-cap, and small-cap stocks

Hybrid PMS

Actively managed equity & fixed income portfolios designed to help you achieve financial success.

Dezerv has offerings other than PMS as well like Alternative Assets & Private Equity through AIF

NRIs trust Dezerv to invest in India

₹1 cr invested in Sep-2022 would have been:

₹1 cr invested in Sep-2022 would have been:

Proven track record (20.33% TWRR since inception)

Dedicated investment experts for NRIs

Effortless account opening & onboarding

Dedicated investment experts for NRIs

Proven track record - 25.98% CAGR

Delivered Market-Beating Returns

Dedicated investment experts for NRIs

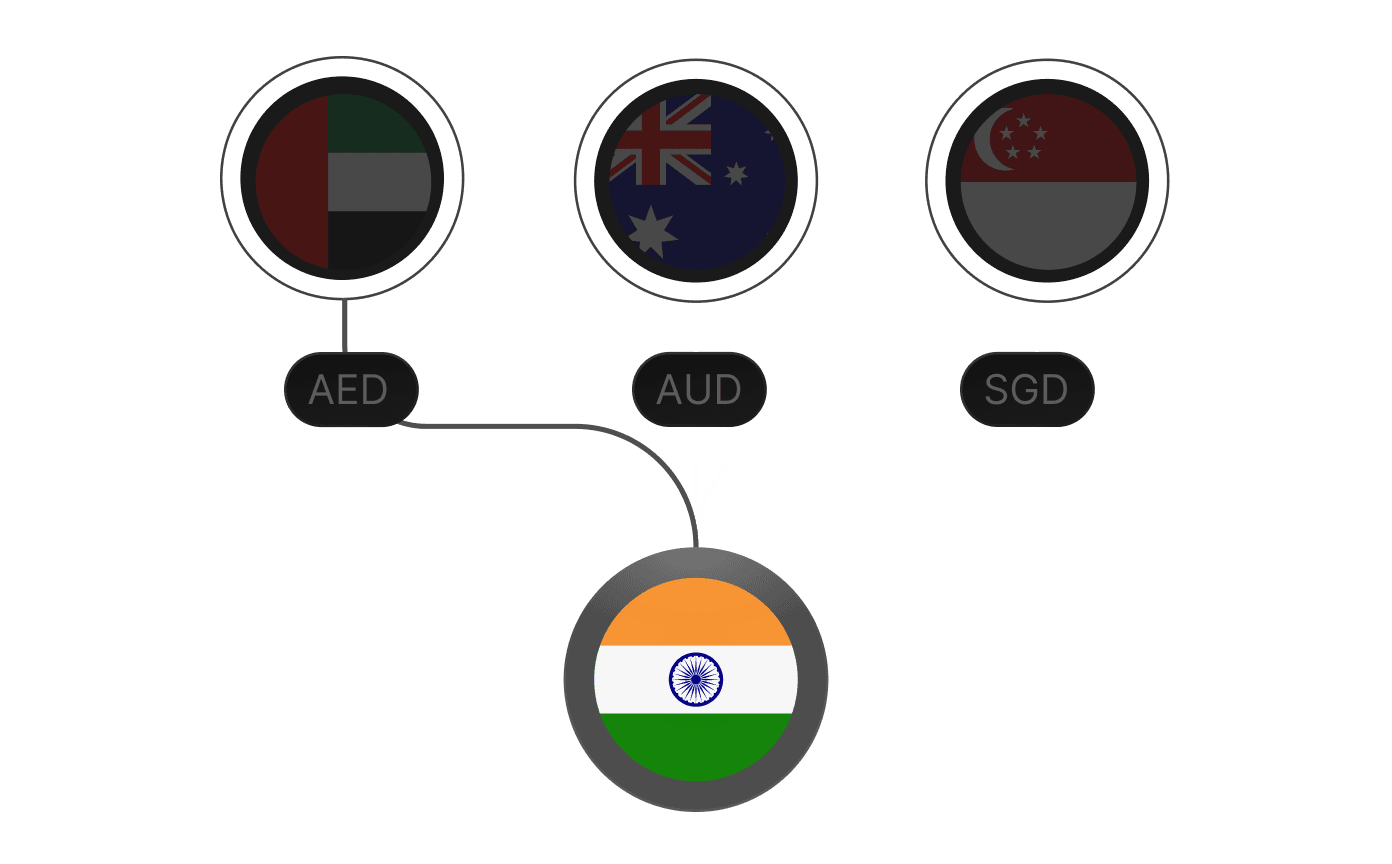

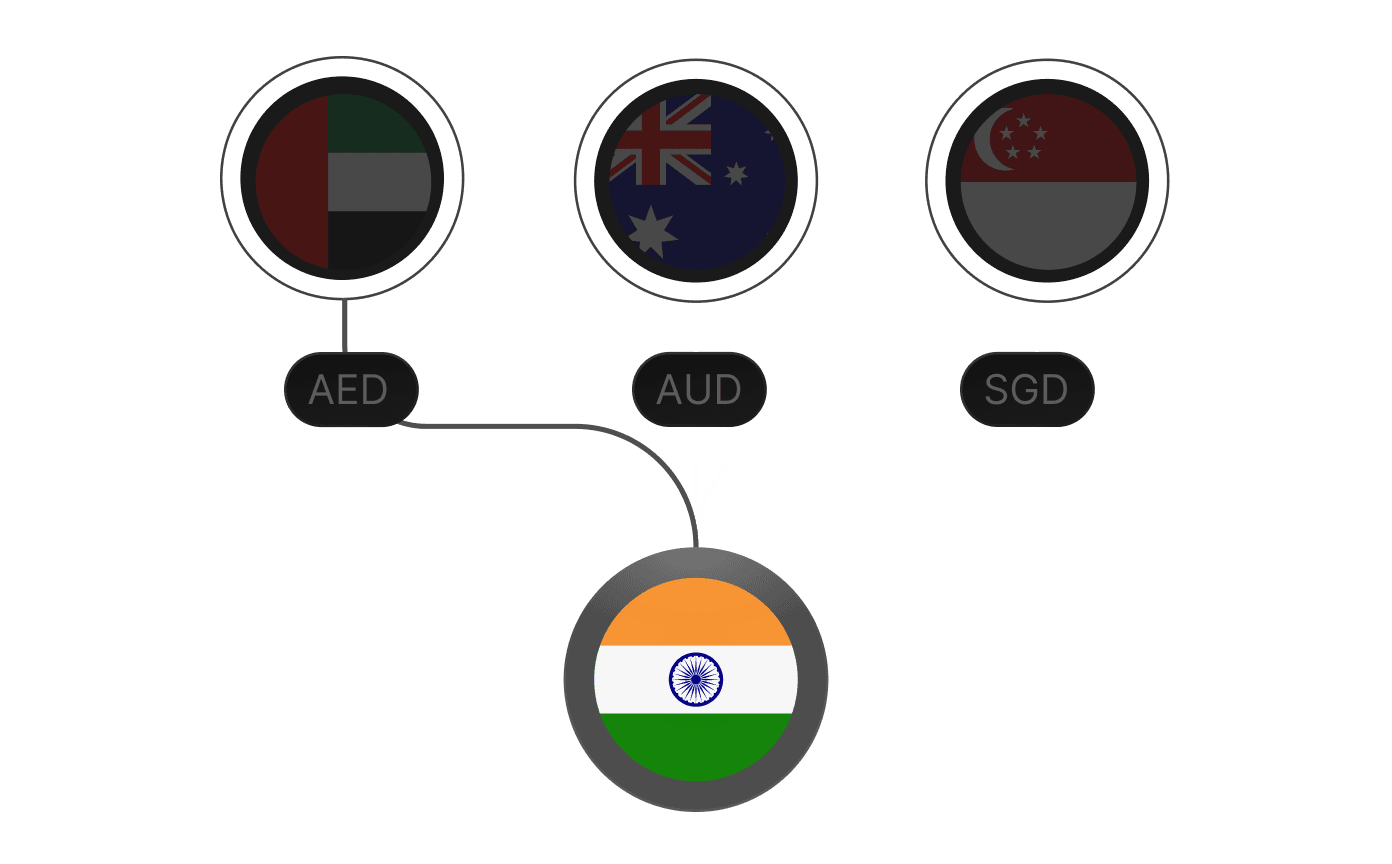

Why NRIs are investing in India now?

4th Largest Economy

India's economic growth creates wealth-building opportunities that you shouldn't miss. (As on 16th June, 2025 - source)

India’s Repo Rate Stands Higher

5.50% repo rate drives attractive fixed income returns (As on 06 June 2025 - source)

All Time High Inflows

NRIs have sent $138 billion in remittances to India in 2024-25. (As on 16th June 2025 source)

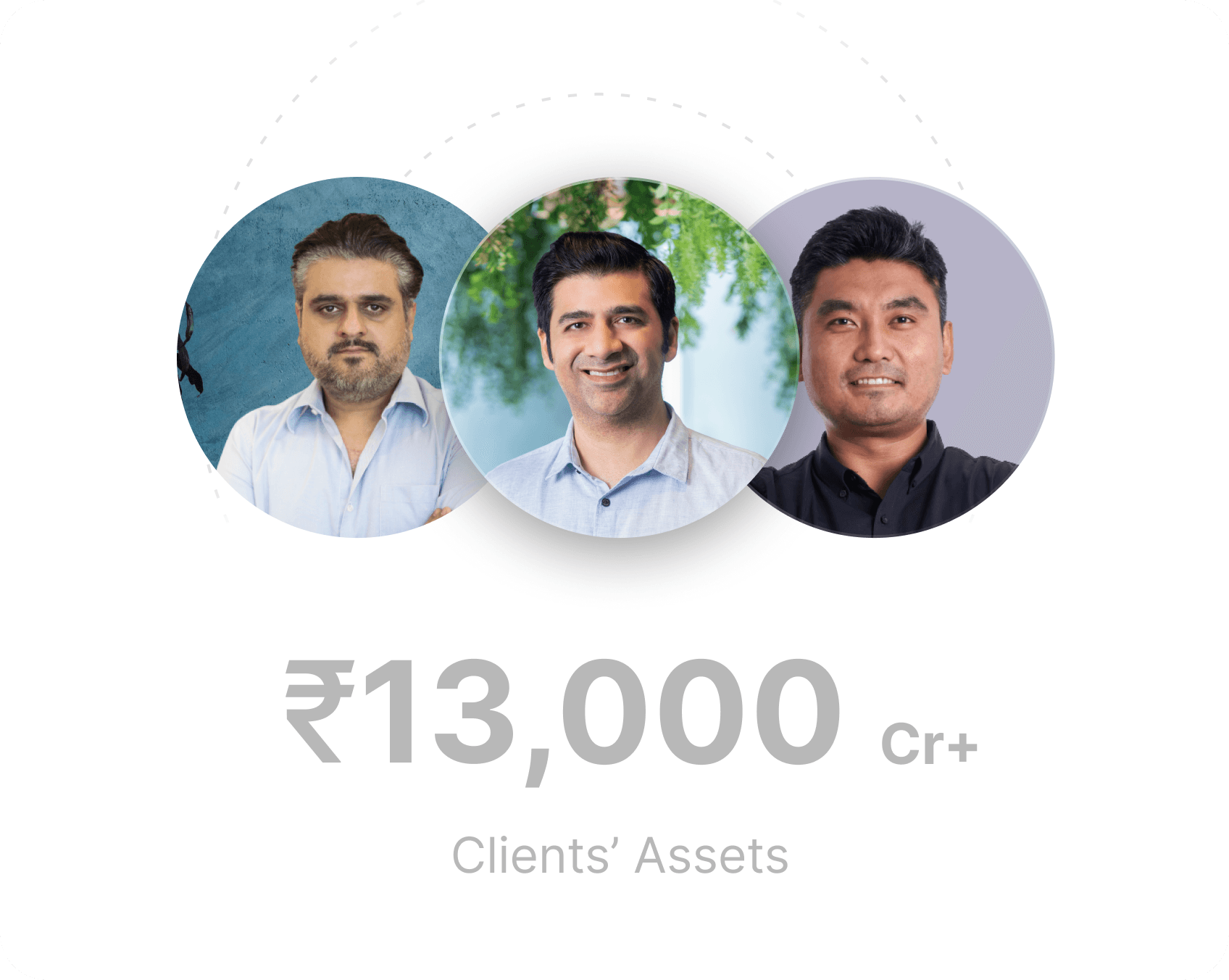

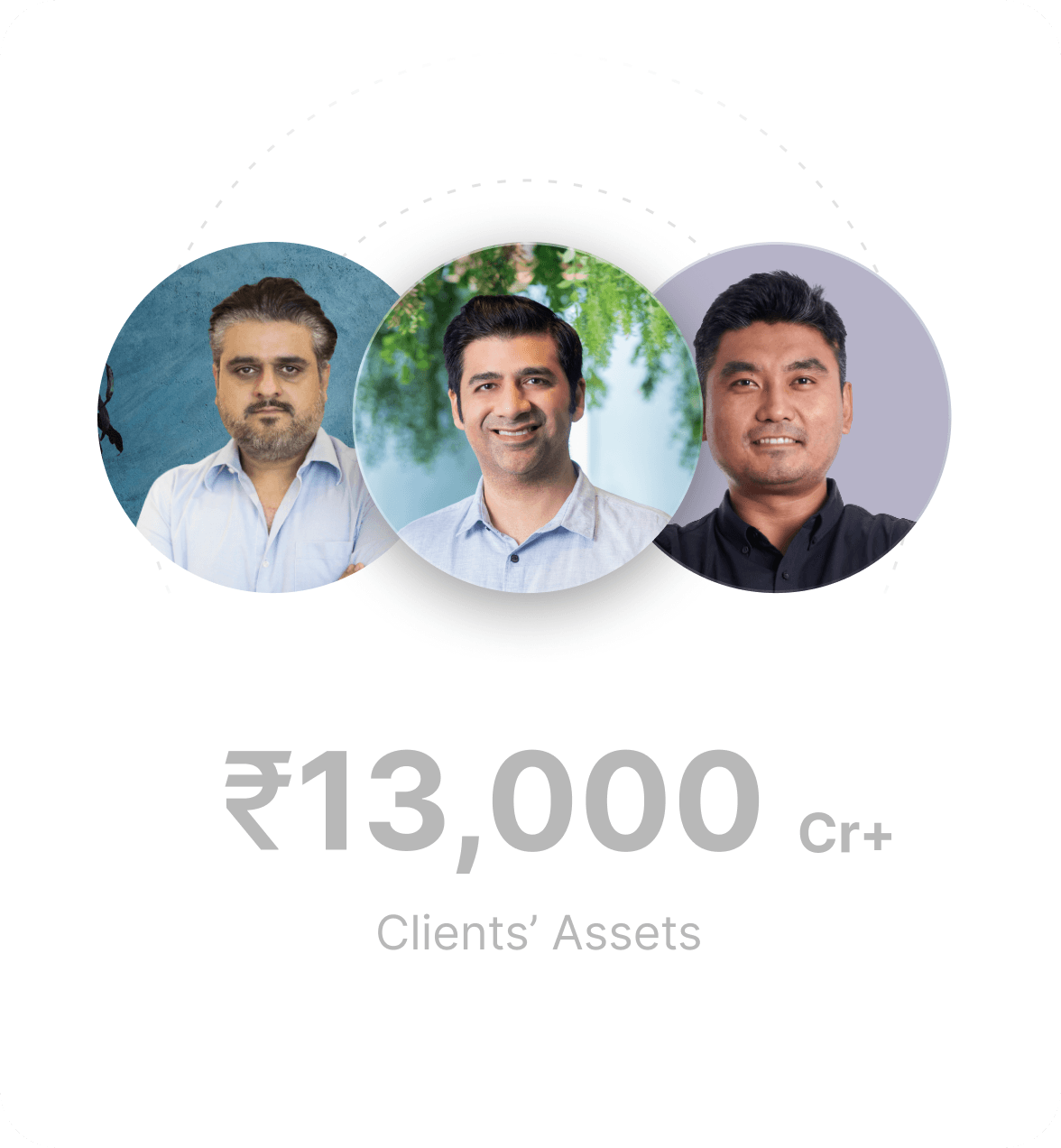

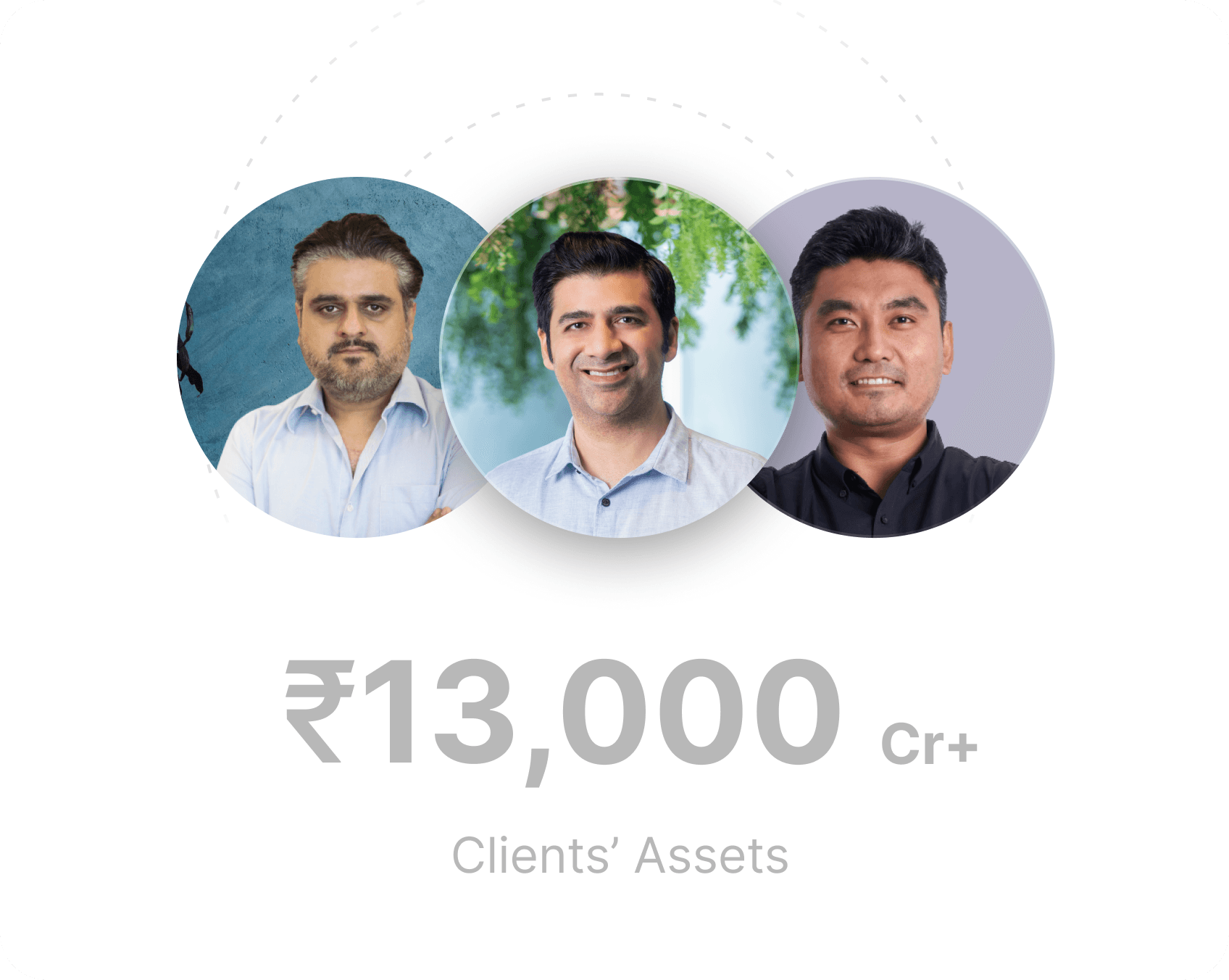

Trusted by wealth creators like you

Trusted by wealth creators like you

Trusted by wealth creators like you

HEAR FROM OUR CLIENTS

HEAR FROM OUR CLIENTS

HEAR FROM OUR CLIENTS

“Dezerv helps me manage both my investments and my parents' portfolio from UAE, giving me peace of mind about my family's financial future.”

Dr. Nikhil Idnani

BCG, UAE

"Delighted with Dezerv's 25% risk-adjusted returns, exceeding my 12-15% target on my Indian investments."

Ankur

Group-IB, Singapore

"During the market dip, I reached my Dezerv investment expert at midnight on a Sunday and got immediate guidance for my portfolio. An impeccable service!"

Pranay Swarup

SuperStuff.ai, USA

"What I love about Dezerv is how they make everything seamless while saving me valuable time for NRIs like me."

"During the market dip, I reached my Dezerv investment expert at midnight on a Sunday and got immediate guidance for my portfolio. An impeccable service!"

Tejas Dighe

Tejas Dighe

Dubai Islamic Bank, Dubai

Dubai Islamic Bank, Dubai

"During the market dip, I reached my Dezerv investment expert at midnight on a Sunday and got immediate guidance for my portfolio. An impeccable service!"

Pranay Swarup

SuperStuff.ai, USA

"Delighted with Dezerv's 25% risk-adjusted returns, exceeding my 12-15% target on my Indian investments."

Ankur

Group-IB, Singapore

“Dezerv helps me manage both my investments and my parents' portfolio from UAE, giving me peace of mind about my family's financial future.”

Dr. Nikhil Idnani

BCG, UAE

Pranay Swarup

SuperStuff.ai, USA

"During the market dip, I reached my Dezerv investment expert at midnight on a Sunday and got immediate guidance for my portfolio. An impeccable service!"

Tejas Dighe

Dubai Islamic Bank, Dubai

"What I love about Dezerv is how they make everything seamless while saving me valuable time for NRIs like me."

Dr. Nikhil Idnani

BCG, UAE

"Dezerv helps me manage both my investments and my parents' portfolio from UAE, giving me peace of mind about my family's financial future."

Ankur

Group-IB, Singapore

"Delighted with Dezerv's 25% risk-adjusted returns, exceeding my 12-15% target on my Indian investments."

How to get started?

How to get started?

Schedule a call with our NRI investment expert

STEP 01

Talk to an expert

STEP 02

Bespoke investments

STEP 03

Onboarding

STEP 04

You are all set

Schedule a call with our NRI investment expert

01.

Talk to an expert

Schedule a call with our NRI investment expert

STEP 01

Talk to an expert

STEP 02

Bespoke investments

STEP 03

Onboarding

STEP 04

You are all set

Schedule a call with our NRI investment expert

STEP 01

Talk to an expert

STEP 02

Bespoke investments

STEP 03

Onboarding

STEP 04

You are all set

How to get started?

Still got questions?

We’re here to help.

Still got questions?

We’re here to help.

Still got questions?

We’re here to help.

What is the minimum investment required to open a PMS account with Dezerv?

The minimum investment amount is ₹50 lakhs

You can invest either as liquid cash or transfer (mutual fund) existing investments worth greater than or equal to 50L

Both NRE and NRO accounts can be used for investing

What problems are faced by wealth management industry?

The minimum investment amount is ₹50 lakhs

You can invest either as liquid cash or transfer (mutual fund) existing investments worth greater than or equal to 50L

Both NRE and NRO accounts can be used for investing

What is the minimum investment required to open a PMS account with Dezerv?

The minimum investment amount is ₹50 lakhs

You can invest either as liquid cash or transfer (mutual fund) existing investments worth greater than or equal to 50L

Both NRE and NRO accounts can be used for investing

What documents do I need to start investing as an NRI?

What documents do I need to start investing as an NRI?

What documents do I need to start investing as an NRI?

How do I track my investments and get regular updates?

How do I track my investments and get regular updates?

How do I track my investments and get regular updates?

How are taxes handled for NRI investments in PMS?

How are taxes handled for NRI investments in PMS?

How are taxes handled for NRI investments in PMS?

Can I withdraw my investments at any time?

Can I withdraw my investments at any time?

Can I withdraw my investments at any time?

Is there any exit load for Dezerv PMS?

Is there any exit load for Dezerv PMS?

Is there any exit load for Dezerv PMS?

How do I get started with Dezerv PMS?

How do I get started with Dezerv PMS?

How do I get started with Dezerv PMS?

What are the returns of the Dezerv ERS PMS Strategy?

What are the returns of the Dezerv ERS PMS Strategy?

What are the returns of the Dezerv ERS PMS Strategy?

You are building India’s future, we would like to build yours.

Our weekly expert newsletter on stories that matter to your money.

ISO 27001 Certified

Compliant with international data standards

Secure and private

Data encrypted with 256-bit AES encryption.

Regulated entity

With licenses from SEBI, APMI and AMFI

©2021-2026 Dezerv. All Rights Reserved

Dezerv Investments Private Limited is a registered as a Portfolio Manager bearing SEBI Registration no. INP000007377 and also acts as an Investment Manager to Dezerv Innovation Fund, Category – I AIF-VCF-Angel Fund bearing SEBI Registration no. IN/AIF1/22-23/1066; Dezerv Alternatives Trust, Category II AIF bearing SEBI Registration no. IN/AIF2/23-24/1345 and Dezerv Alpha Equity Trust, a Category III AIF bearing SEBI Registration no. IN/AIF3/23-24/1467.Distribution services are offered through

Dezerv Distribution Services Private Limited, a wholly owned subsidiary of Dezerv Investments Private Limited vide AMFI Registration no. (ARN)- 248439 and APMI registration no. (APRN)- 00615. Terms and condition of the website are applicable. Privacy Policy of the website is applicable.

You are building India’s future, we would like to build yours.

Download Wealth Monitor App

Our weekly expert newsletter on stories that matter to your money.

Compliant with international data standards

ISO 27001 Certified

With licenses from SEBI, APMI

and AMFI

Regulated entity

Data encrypted with 256-bit AES encryption.

Secure and private

©2021-2026 Dezerv. All Rights Reserved

Dezerv Investments Private Limited is a registered as a Portfolio Manager bearing SEBI Registration no. INP000007377 and also acts as an Investment Manager to Dezerv Innovation Fund, Category – I AIF-VCF-Angel Fund bearing SEBI Registration no. IN/AIF1/22-23/1066; Dezerv Alternatives Trust, Category II AIF bearing SEBI Registration no. IN/AIF2/23-24/1345 and Dezerv Alpha Equity Trust, a Category III AIF bearing SEBI Registration no. IN/AIF3/23-24/1467.Distribution services are offered through

Dezerv Distribution Services Private Limited, a wholly owned subsidiary of Dezerv Investments Private Limited vide AMFI Registration no. (ARN)- 248439 and APMI registration no. (APRN)- 00615. Terms and condition of the website are applicable. Privacy Policy of the website is applicable.

You are building India’s future, we would like to build yours.

Our weekly expert newsletter on stories that matter to your money.

Download Wealth Monitor App

KNOWLEDGE REPOSITORY

ABOUT

LEGAL

Compliant with international data standards

ISO 27001 Certified

With licenses from SEBI, APMI and AMFI

Regulated entity

Data encrypted with 256-bit AES encryption.

Secure and private

©2021-2026 Dezerv. All Rights Reserved

Dezerv Investments Private Limited is a registered as a Portfolio Manager bearing SEBI Registration no. INP000007377 and also acts as an Investment Manager to Dezerv Innovation Fund, Category – I AIF-VCF-Angel Fund bearing SEBI Registration no. IN/AIF1/22-23/1066; Dezerv Alternatives Trust, Category II AIF bearing SEBI Registration no. IN/AIF2/23-24/1345 and Dezerv Alpha Equity Trust, a Category III AIF bearing SEBI Registration no. IN/AIF3/23-24/1467.Distribution services are offered through

Dezerv Distribution Services Private Limited, a wholly owned subsidiary of Dezerv Investments Private Limited vide AMFI Registration no. (ARN)- 248439 and APMI registration no. (APRN)- 00615. Terms and condition of the website are applicable. Privacy Policy of the website is applicable.

Why choose Dezerv as your Investment Partner?

Expertise you can trust

20+ years of experience and managing 13,000 Cr+ assets.

Dedicated Support

Expert support that works around your schedule, across time zones, from KYC to NRE/NRO setup, via phone and digital platforms.

Transparency & Tax compliant solutions

Transparent reporting of investments, returns and fees. No lock-in period, 100% tax-compliant, with timely reports

Holistic Portfolio Management

Expert led family investment reviews, real-time tracking on the Wealth Monitor app, and personalized solutions for your financial goals.