A little-known concept is set to shake up the investing landscape in India – the Accredited Investor. For too long, sophisticated investing has been the exclusive purview of institutions, family offices, and Ultra High Net Worth Investors. However, a new wave is democratizing access to unique investment opportunities and putting power back in the hands of individual investors.

At its core, the idea of an Accredited Investor recognizes that not all investors are equal. Some investors possess the financial acumen and risk appetite to go beyond standard investment requirements. Regulators have identified these “informed and sophisticated” investors and decided to extend privileges in alignment with their capital, risk appetite, and financial understanding.

In this edition, we delve into the concept of Accredited Investors, a new investor category introduced by SEBI in August 2021, designed to expand the investment horizons of affluent investors.

What Does it Mean to be an Accredited Investor?

In essence, it’s about showing you have sufficient investment experience and assets to be considered a relatively savvy investor who doesn’t require the same level of hand-holding as the retail investor. Cross the defined thresholds for income and net worth, and you’ll be welcomed into an exclusive club.

The shackles come off in terms of investment size, concentration limits, disclosure requirements, and more. Portfolio managers can go overweight on unlisted securities. Investment advisors can ditch those fee caps, and performance-linked compensation is on the table.

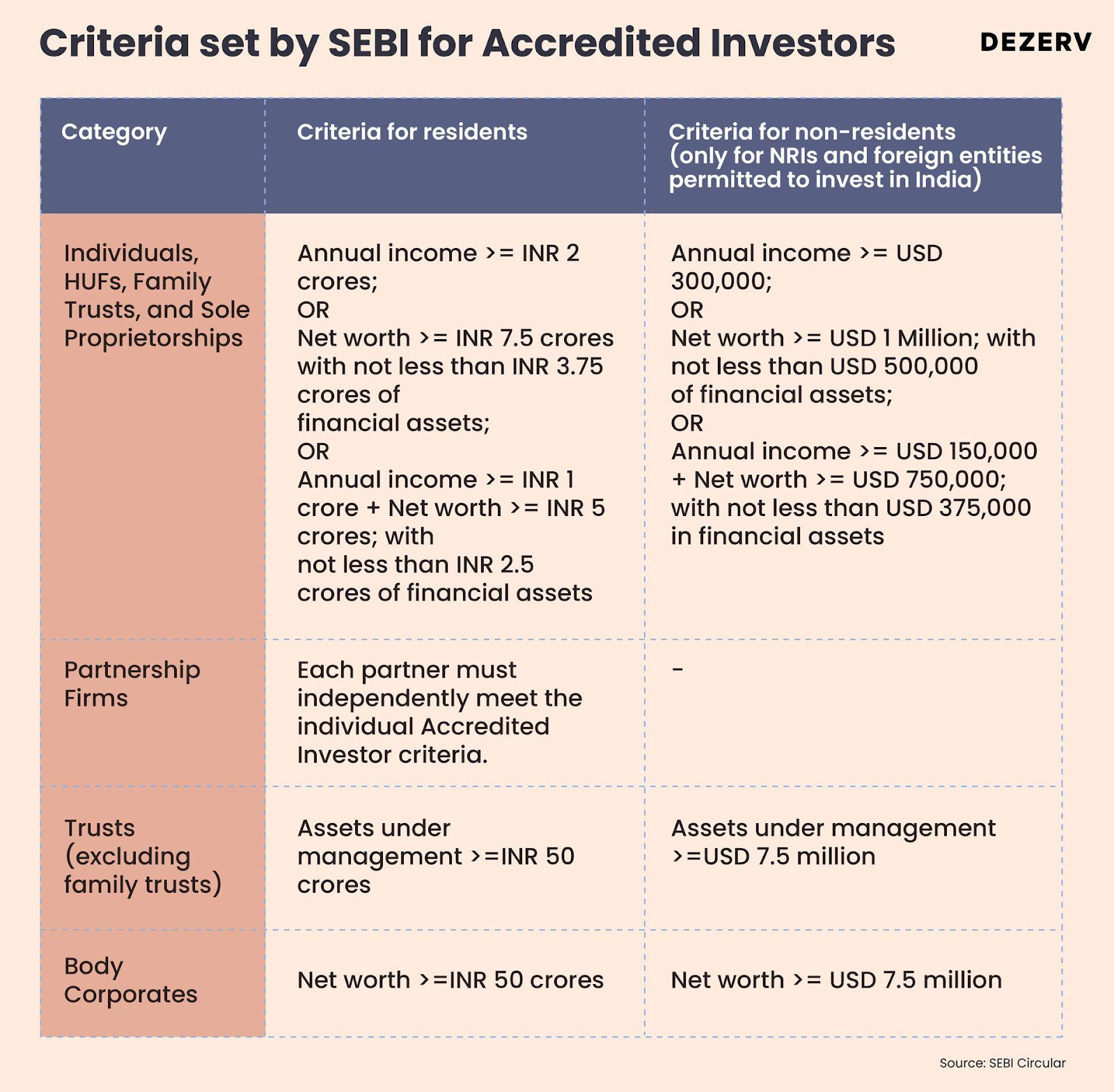

What it takes to become an Accredited Investor

Why Was Accreditation Deemed Necessary?

The Accredited Investor framework is not just a gift to the wealthy – it represents a calculated move by SEBI to enhance overall market efficiency. By loosening the reins on sophisticated investors, the regulators have unlocked a pivotal pressure release valve for the entire financial ecosystem.

SEBI does a great job of protecting the interests of retail investors. But what about the seasoned market veterans who don’t require that same level of hand-holding? Under the AI framework, SEBI has found an elegant solution. Those passing the accreditation criteria gain the ability to invest in unlisted and unregistered securities at their own risk.

The accreditation process itself adds a critical layer of checks and balances. Only those demonstrating adequate risk awareness and net worth can enter these special investing channels.

Understanding how to create a Will is another essential aspect of managing and preserving your wealth.

Benefits of Becoming an Accredited Investor

There are two major benefits for Accredited Investors:

- Easier Access to Exclusive Investments: Accredited Investors get the opportunity to invest in private placements, venture capital, private equity, hedge funds, and other alternative investments that are not available to the general public.

- Greater Control: Accredited Investors often have more control over their investment choices, as they can directly invest in specific opportunities or work with private investment managers.

Being accredited has perks for different types of investors in various investment options like Alternative Investment Funds (AIFs), Portfolio Management Services (PMS), and individuals seeking guidance from investment advisors. Here are the key benefits:

For Those Investing Through Alternative Investment Funds (AIFs)

- Lower minimum ticket size of less than ₹1 crore.

- Large Value Accredited Funds (AI Funds) specifically for accredited investors with a minimum capital commitment of INR 70 crore enjoy the privilege of allocating a higher percentage of their assets under management (AUM) into individual companies within AIF category I & II (50%) and category III (20%), compared to regular investors who must adhere to a 25% and 10% allocation, respectively.

- AI funds benefit from an extended AIF life of more than 2 years from the tenure stated in the PPM (Private Placement Memorandum).

For Those Investing Through Portfolio Management Services (PMS)

- Those falling under the accredited category come with a minimum ticket size below INR 50 lakh.

- Large Value PMS AI investors (with a minimum investment of INR 10 crore) gain the advantage of placing 100% of their investment in unlisted securities, fostering a more diversified portfolio compared to the 25% limit for regular investors with a INR 50 lakh minimum ticket size.

- These distinctions in criteria for larger investors—like AI funds with minimum capital commitments of INR 70 crore in AIFs and PMS AI investors with INR 10 crore—grant them substantial relaxations and advantages.

For individual investors, Accredited status permits greater flexibility when engaging professional investment managers compared to regular investors. While fee negotiations remain bilateral for both categories, Accredited Investors may have a more flexible fee arrangement. Conversely, regular investors face a capped fee structure, limited to a maximum of 2.5% of assets under advice or INR 1.25 lakh when it comes to engaging with Registered Investment Advisors.

Challenges for Accredited Investors

While the accreditation program offers numerous benefits and advantages, it hasn’t fully gained traction in India. Several roadblocks are keeping investors from applying for accreditation, such as:

- Limited Duration: Accreditation is valid for a maximum of three years. Extending this duration could make it more attractive and easier for investors to get accredited.

- Optional Accreditation: Unlike in the USA, accreditation in India isn’t mandatory for accessing VC, PE, and hedge funds. Requiring accreditation for these asset classes could enhance investor protection and ensure a more equitable investment landscape.

- Reliance on Accreditation Agencies: SEBI relies on Accreditation Agencies for accreditation, whereas other jurisdictions conduct due diligence through the vehicles/funds in which investors are placing their money. Since this would be a relatively small part of the Accreditation Agency business, these agencies may not focus on speed and efficiency in the process of accreditation.

Summary

Reflecting on the Accredited Investor framework, it becomes clear that this isn’t just about giving the wealthy a new set of privileges. It represents a pivotal moment when Indian regulators acknowledged that the traditional “one-size-fits-all” model had run its course.

Make no mistake: becoming an Accredited Investor is about more than just access to complex investment products. It’s an acknowledgement from regulators that you’ve earned the right to invest like a sophisticated professional.