What you should know before the upcoming IPO season

Sandeep Jethwani

Co-Founder

What’s Inside

Related Tags

Stay updated

with our newsletter

Highlights

- Momentum illusion: The IPO boom feels effortless because demand is visible and immediate. But when outcomes are measured beyond listing day, the median IPO return over the last year is 0%, exposing how misleading momentum-based signals can be.

- Listing gains ≠ wealth creation: While ~72% of IPOs listed above issue price, only ~50% trade above it today. Nearly 94 IPOs have already given up all listing gains, showing that initial pops rarely translate into durable returns.

- Exit-heavy structures: A large share of recent IPO proceeds has come via Offer for Sale (OFS) routes. In these cases, capital flows to existing shareholders, not company balance sheets—shifting the IPO’s role from growth funding to liquidity provision.

- Exit capital is not broken capital: Promoter and PE exits are not failures of the system. In mature markets, exits recycle capital into new ventures, private capex, and long-term pools like family offices—fueling the next investment cycle.

- Valuation changes behaviour: When public markets offer generous multiples, partial stake sales become rational capital allocation decisions, not signals of reduced conviction or operational disengagement by promoters.

- Supply dilutes returns: Heavy and continuous IPO issuance absorbs liquidity. Even strong businesses can underperform in the short term when capital is spread thin across too many new listings.

- Behaviour over analysis: Grey market premiums, oversubscription ratios, and listing-day moves have replaced fundamentals for many investors—turning IPO participation into a behavioural trade rather than an investment decision.

- The enduring rule: IPOs are not shortcuts to wealth. They reward the same traits as secondary markets—patience, valuation discipline, and business quality assessment. The real verdict arrives years after listing, not on day one.

2025 has seen it all.

As the year wraps up, Indian markets have digested everything from sharp rallies to long consolidation phases, from record domestic flows to relentless supply. But if there is one part of the market that has refused to slow down, it is the IPO pipeline.

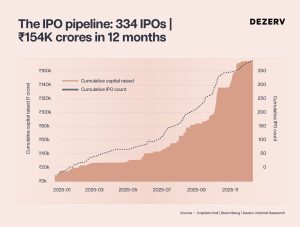

In the last 12 months alone, 344 companies have gone public, raising over ₹1.5 lakh crore. New issues have become a weekly fixture. Oversubscription numbers are flashed like scorecards. Listing day gains are tracked rigorously. For many investors, the IPO market has begun to feel like the easiest place to make money.

Yet, just as this frenzy was peaking, the Chief Economic Adviser, V. Anantha Nageswaran, offered a sobering observation. He noted that IPOs are increasingly being used as exit tools for early investors, a trend that risks weakening market integrity.

It is not often that a public policymaker chooses to weigh in so directly on market behaviour. And when that happens, it is usually worth pausing before forming a view.

Because the reality is rarely as simple as the headline suggests. The IPO market today reveals how differently capital behaves at this stage of the cycle- Capital is abundant, valuations are generous, incentives are shifting, and expectations are being tested. Some of these changes are healthy. Some deserve closer scrutiny.

I have tried to answer a lot of uncomfortable questions in this newsletter-

-After the opening bell, the data tells a colder story

-Are IPOs becoming exit tools?

-Exit capital, promoters, and how mature markets actually work

-What investors must get right from here

Let’s begin

After the opening bell, the data tells a colder story

The enthusiasm around IPOs this year has been driven by one idea above all else: momentum. Strong demand, large oversubscriptions, and quick listing gains have created the impression that this has been an easy phase to participate in. The data is less forgiving.

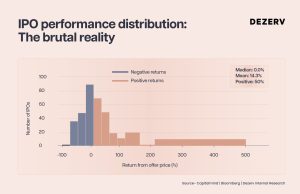

Over the last 12 months, 344 IPOs have raised ₹1.54 lakh crore. Yet when we look at outcomes rather than activity, the picture changes meaningfully. The median return across these IPOs is 0%. The average return is +14%, but that number is doing a poor job of describing reality, lifted by a handful of extreme winners while most issues delivered far more modest results.

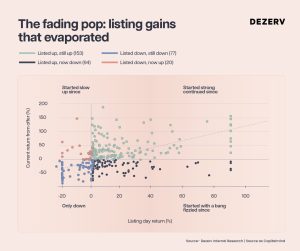

Nearly 72% of IPOs listed above their offer price, reinforcing the perception of strong demand. But that confidence fades quickly over time. Only about 50% of these stocks are trading above their offer price today, and 94 IPOs have already erased their listing gains entirely.

In other words, listing day enthusiasm has not translated into sustained returns for a large part of the market. The initial pop has increasingly become a short-lived event rather than a durable indicator of value.

The dispersion beneath the surface is telling. A small set of IPOs delivered exceptional outcomes. Several struggled. Most settled into mediocrity. When outcomes are this uneven, averages stop being helpful and participation alone stops being a strategy.

This is how heavy supply cycles behave.

When capital is abundant and issuance is constant, demand shows up easily. Prices clear. Subscriptions look impressive. But once the dust settles, returns begin to reflect more fundamental variables — valuation, business quality, and earnings delivery. Which is why the debate has shifted.

When outcomes start diverging this sharply, the conversation moves away from how many IPOs are getting done and towards how these IPOs are being structured. Not all capital raised in the primary market serves the same purpose, and not all participants are playing the same role. To understand what this cycle is truly reflecting, it is essential first to understand where the IPO money is going and who it is intended to serve.

Are IPOs becoming exit tools?

To make sense of this IPO cycle, you have to look past demand and focus on structure.

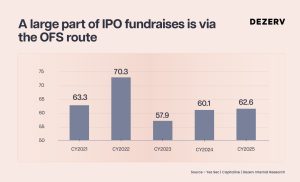

A defining feature of recent listings has been the growing dominance of Offer for Sale(OFS).

In an OFS-led IPO, a part of the issue consists of existing shareholders selling their stake to the public. No new shares are created for that portion. The money does not go into the company’s balance sheet. It goes to promoters, private equity funds, or early investors who are choosing to monetise a part of their holding.

Over the last few years, OFS has consistently accounted for well over 60% of IPO proceeds, touching even higher levels in certain periods. This year is no exception. The public market is increasingly being used as a liquidity window, not just a funding avenue.

This is where the discomfort comes in.

When a smaller portion of IPO proceeds flows directly into capital expenditure, the instinctive reaction is to question intent. Are these listings about building businesses, or about cashing out? Are public market investors being asked to fund growth, or simply facilitate exits?

Here is some food for thought:

- Corporate balance sheets are stronger than they have been in years: Many companies coming to market today have already reduced leverage, improved cash flows, and repaired their finances. For them, survival or repair capital is no longer the primary objective it once was.

- Equity has become a comfortable form of capital: After a decade of balance sheet clean-ups, promoters have consciously avoided debt-heavy growth. In several cases, the bulk of expansion capital was already raised privately, well before the IPO.

- Valuations have moved meaningfully higher: When public markets are willing to assign generous multiples, the cost of equity capital falls sharply. At such levels, monetising a portion of ownership becomes a rational capital allocation decision rather than a signal of fading conviction.

- Public markets are now the natural liquidity bridge: With deeper domestic participation and steady flows, the listed market has become the most efficient venue for ownership transition. What earlier cycles achieved through debt refinancing or promoter pledging is now happening through equity dilution.

- The emergence of technology-heavy businesses has changed ownership structures: Many companies built over the last decade came up in a venture-backed environment, where promoter ownership is relatively modest and shareholding is spread across a clutch of early-stage investors.

- The 2015–2018 venture capital vintages are reaching natural exit windows: Pandemic disruptions delayed exits, but those timelines have now caught up. For these funds, IPOs represent planned liquidity aligned with fund life cycles rather than opportunistic cash-outs.

Exit capital, promoters, and how mature markets actually work

Once you step back from the headline debate, one thing becomes clear

IPOs are being judged in isolation, not as part of a capital cycle.

Capital markets do not work in straight lines. They work in loops.

Money comes in, money goes out, and money gets redeployed. The discomfort around IPO exits arises when we focus only on the point of exit, without asking what happens next or why this timing makes sense.

Think for a moment: Where does the exit capital actually go?

It certainly does not sit idle.

- The rise of family offices: Liquidity events have created a new pool of long-term capital now deploying into private businesses, early-stage ventures, structured credit, and long-duration equity.

- Private equity and venture capital recycling: Exits are not endpoints but resets, with capital flowing back into new fund vintages, strategies, and sectors shaping the next growth cycle.

- Exit capital feeding the next capex phase:Proceeds are being redeployed into private expansion, entrepreneurship, and equity-funded investment, supporting early signs of a private capex revival.

Why promoters selling some stake is not a betrayal

The second misunderstanding is around promoter intent.

- Valuations change incentives: When markets offer rich multiples, creating partial liquidity becomes a rational capital allocation decision, not a loss of conviction.

- Skin in the game does not disappear: Promoters typically remain deeply invested in day-to-day operations, with significant ownership, reputational capital, and execution risk still firmly tied to the business.

- Ownership dilution is not operational disengagement: Selling a portion of equity does not mean stepping away. For most promoters, the business remains their primary economic and professional commitment.

In mature markets, ownership transitions and capital recycling are not signs of weakness.

They are signs of a system that has grown large enough to absorb them.

What investors must get right from here

It is worth saying this upfront. A meaningful number of IPOs from this cycle will go on to become long-term wealth creators.

India’s growth runway is real. Several businesses coming to market today are well run, scalable, and aligned with durable demand. Over time, some of these listings will reward patient investors handsomely.

But no busy market cycle is without excess.

When issuance is heavy and capital is abundant, the ecosystem stretches. Supply starts to absorb liquidity. Scrutiny weakens at the margins. Short-term behaviour begins to crowd out long-term thinking.

This is the tension investors need to navigate.

- Irrational pricing driven by hype and storytelling: In parts of the IPO market, pricing has been set by narratives rather than numbers. Growth stories have been stretched, risks downplayed, and valuations pushed to astronomical levels leaving little margin for error

- Supply absorbing liquidity: The volume of IPO issuance has been large enough to soak up market liquidity. Even strong businesses can struggle in the near term when capital is spread thin, contributing to index consolidation despite healthy earnings growth.

- Excesses in parts of the SME segment: Weaker disclosures, thin liquidity, and aggressive promotion make price discovery fragile. In these pockets, small errors can quickly turn into large losses.

- Behavioural noise overpowering analysis: Grey market premiums, subscription multiples, and listing-day moves have become shortcuts for decision-making. Oversubscription reflects momentary demand, not business durability or valuation comfort.

None of this suggests avoiding IPOs altogether. It suggests approaching them with the same discipline one would apply to any other equity investment.In markets like these, the rule is old and unchanged: buyer beware.

In Summary

2025 has not been short of opportunity, but it has tested discernment. When capital is plentiful, valuations forgiving, and stories compelling, the hardest thing to do is slow down and ask what you are you really paying for?

Public markets are not designed to reward speed. They reward patience, selectivity, and an understanding of cycles. IPOs are simply a concentrated version of that truth. Some will compound quietly over time. Many will not. The difference will not be decided on listing day. It will be decided much later, by fundamentals doing their work.

In markets like these, that is worth remembering.

Sandeep Jethwani is an IIM Bangalore alumnus with over 19 years of experience in scaling one of India's leading wealth management firms, where he managed $3.5 billion in assets. At Dezerv, he drives the company's vision, strategic initiatives, and operational execution, leveraging his deep understanding of HNIs, UHNIs, and family offices.

- Apr 6, 2025

- 6 mins read

Beyond life and health insurance: What Wealth Creators are doing differently

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.