Disrupting the dinner table: How D2C Food Brands are winning in India

Sandeep Jethwani

Co-Founder

Stay updated

with our newsletter

Highlights

- Sector scale: India’s food processing segment to reach USD 470 billion by 2025 (up from USD 263 billion in 2021) — one of the fastest‑growing retail sectors

- D2C funding: D2C F&B startups have attracted USD 9.3 billion in investments over the last two years — underscoring investor confidence

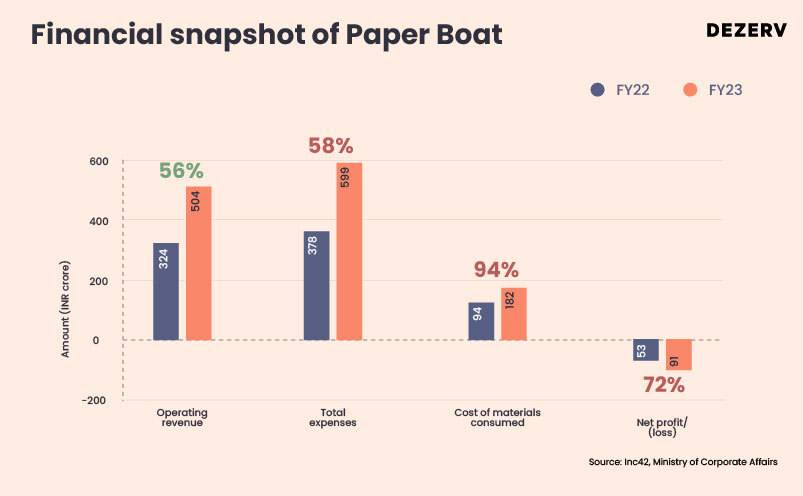

- Revenue growth: iD Fresh Food’s FY23 revenue grew 26% to INR 479 Cr and Paper Boat’s climbed 56% to INR 504 Cr — reflecting strong consumer demand

- Profit improvement: Licious cut its net loss by 38% to INR 528.5 Cr in FY23 while growing revenue to INR 748 Cr — highlighting enhanced operational efficiency

This campaign not only highlights the brand’s commitment to quality and cultural roots but also marks its evolution from a local staple to a globally recognised brand.

This transformation is emblematic of a larger shift within the Indian F&B sector—once dominated by global brands making inroads into our local markets, we are now witnessing an era where homegrown heroes like iD Fresh are expanding beyond national borders and setting the stage on the global market.

In this issue, we delve into the dynamic evolution of the F&B industry in India. Join us as we uncover the factors driving this shift and the opportunities it heralds for the future.

A snapshot of India’s F&B sector

India’s Food & Beverage (F&B) sector is one of the fastest-growing segments in the D2C landscape. As per ET Hospitality, as of 2023, industry estimates suggest that the domestic food processing segment alone is expected to reach USD 470 billion by 2025, up from USD 263 billion in 2021.

This growth is underpinned by several key drivers such as –

- Shift in lifestyles

- Rising disposable income

- Rapid urbanisation

- Favourable government policies

Here are some interesting statistics about the F&B sector –

- Currently, the F&B sector contributes significantly to the GDP and accounts for about two-thirds of the total retail market in India.

- By 2027, the market size is projected to expand to nearly USD 504.92 billion.

- This sector supports the livelihood of over 7.3 million people, making it the single largest employment sector in the country.

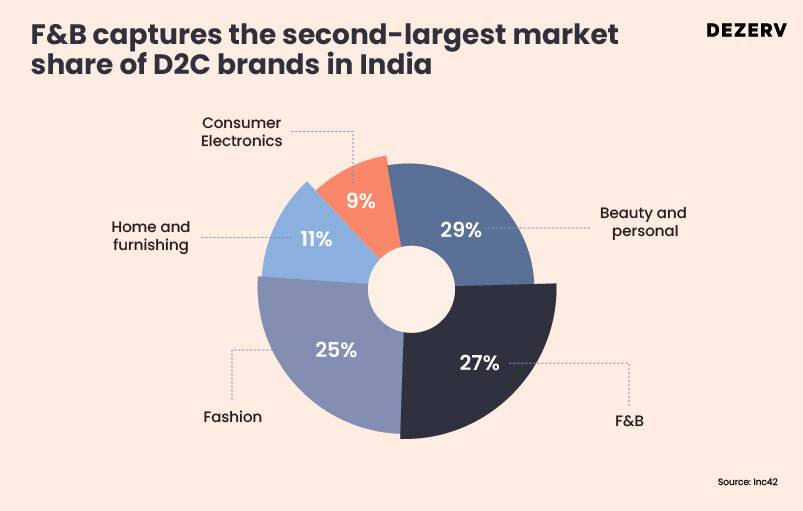

The growth in this segment is largely driven by the burgeoning Direct-to-Consumer (D2C) trend, where innovative startups are introducing diverse product ranges, capturing a 27% share of the market.

The new age of F&B: Rise of D2C brands

The Indian F&B sector, underpinned by a robust D2C model, continues to demonstrate remarkable dynamism and growth. The sector, with companies that manufacture packaged food and beverage products under their own brands, has seen significant financial activity, capturing the attention of investors and consumers alike.

In the last two years alone, the D2C F&B sector has attracted a staggering USD 9.3 billion in investments, indicating a clear vote of confidence from financial markets in the potential of these brands. Prominent companies like Country Delight, Open Secret, and Akshayakalpa lead the charge, representing a blend of innovation and consumer-centric approaches.

Let’s delve deeper into the economics of some of 3 new-age brands.

iD Fresh Food

iD Fresh Food has carved a niche in the ready-to-cook segment with its flagship products like idli and dosa batter. Their range extends to other homestyle staples such as parathas and paneer, catering to a wide demographic that values freshness and authenticity in their daily meals.

iD Fresh Food has effectively utilized Direct-to-Consumer (D2C) channels to bypass traditional retail barriers, creating a direct connection with their consumers. This strategy has not only enabled them to maintain control over their brand experience but also to gather valuable customer data to enhance product offerings.

Through a robust online presence and strategic partnerships with e-commerce platforms, iD Fresh has built a loyal customer base that relies on the convenience and consistency of their products. Their focus on quality and customer service continues to drive repeat purchases and sustain a strong community of brand advocates.

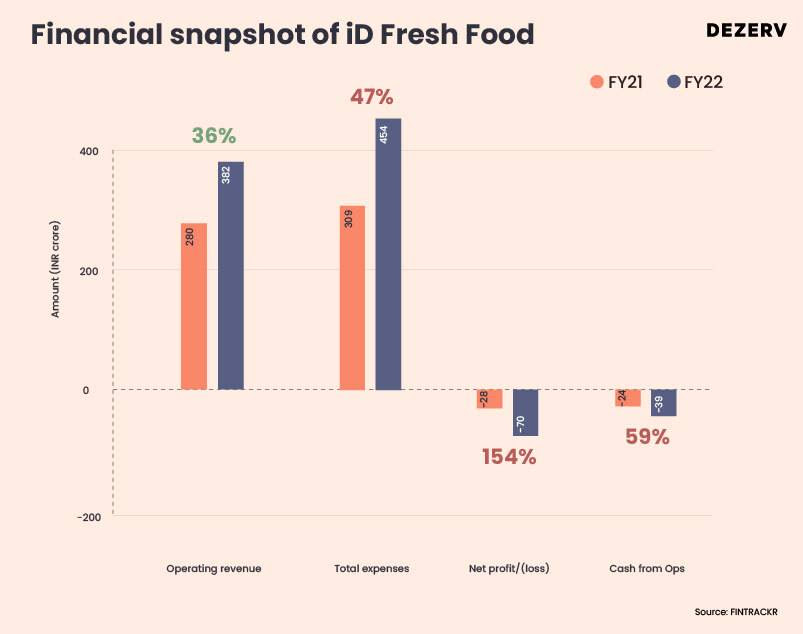

- Operating revenue: We looked into the financials of the company in FY23 and observed a revenue surged by 26% from INR 382 crores in FY22 to INR 479 crore in FY23. reflecting increased consumer demand for convenient cooking solutions.

- Total expenses: The expansion and scaling efforts have led to a rise in total expenses consistently from FY21 to FY23. The increase was primarily due to costs associated with international expansion and new product launches.

- Profitability challenges: Although iD Fresh experienced a surge in revenue, the company encountered challenges in profitability, with losses escalating by 2.5 times in FY22 to INR 70.3 crore, up from INR 27.7 crore in FY21.

However, FY23 marked a significant turnaround with the company reducing its losses to INR 328.8 crore, a substantial 53% decrease from the previous year’s loss of INR 703.7 crore. This improvement highlights enhanced operational efficiency and a reinforced commitment to profitability.

Licious

Licious has distinguished itself in the meat delivery market with its commitment to delivering fresh, high-quality meat and seafood directly to consumers. Licious offers a range of products from fresh chicken and seafood to marinated meats and ready-to-cook delicacies.. Their stringent quality controls and farm-to-fork model cater to health-conscious individuals and families who are particular about the provenance and handling of their food.

Licious harnesses the power of D2C channels to streamline its operations and enhance customer experiences. By controlling the entire supply chain, from sourcing to delivery, Licious ensures product quality and freshness that traditional retail channels often compromise. Their user-friendly website and mobile app facilitate easy ordering and customized selections, enhancing consumer convenience and satisfaction.

Regular promotions, subscription plans, and loyalty rewards further incentivize repeat purchases, helping Licious build a devoted customer base. The direct feedback mechanism enabled through D2C interactions allows Licious to quickly adapt and innovate based on consumer preferences and demands.

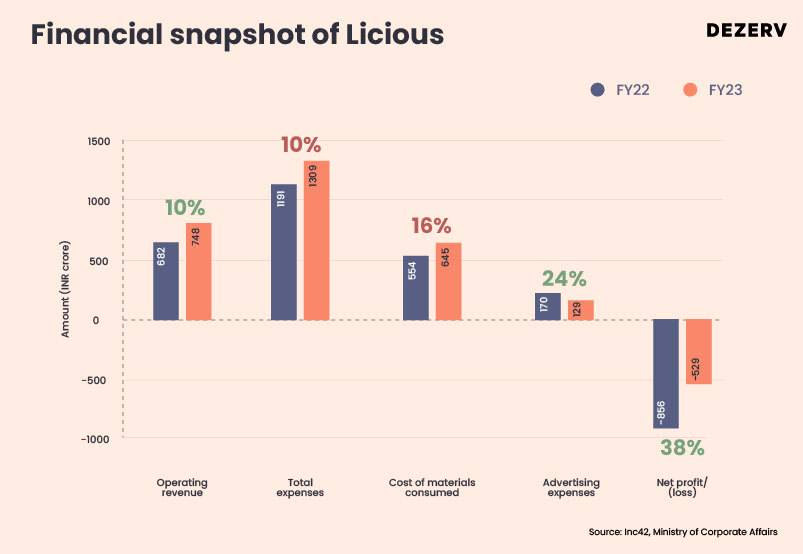

- Operating revenue: Licious achieved an operating revenue of INR 748 crores in FY23, indicating a healthy growth from INR 682 crores in the previous fiscal year.

- Total expenses: Alongside revenue growth, the company’s expenses also saw a rise, totaling INR 1,309.2 crore in FY23, a 9.8% increase from INR 1,191.4 crore in FY22. This increase can be attributed to expanded operations and increased marketing efforts to capture a larger market share.

- Profitability challenges: Despite increasing revenues, Licious managed to reduce its net loss significantly. The net loss decreased by over 38% to INR 528.5 crore in FY23 from INR 855.6 crore in FY22. The improvement in EBITDA margin to -58.9% in FY23 from -115.1% in FY22 shows a substantial enhancement in operational efficiency and a reduction in cash burn.

Paper Boat

Paper Boat has made a mark in the beverage industry by revitalising traditional Indian drinks with a modern twist. Their products, including flavours like aam panna, jaljeera, and kokum, appeal to consumers looking for nostalgic tastes with the convenience of ready-to-drink formats.

Embracing D2C channels, Paper Boat has effectively bypassed traditional retail constraints to connect directly with its audience. This approach has allowed the brand to craft a unique narrative around the cultural significance of its offerings, enhancing consumer engagement through storytelling and interactive marketing campaigns.

Paper Boat’s adept use of D2C channels illustrates how brands can leverage digital marketing and e-commerce to enhance brand recall and foster a community of loyal customers, all while delivering a product that resonates deeply with cultural values and modern preferences.

- Operating revenue: Paper Boat achieved significant growth, with its operating revenue rising 56% from INR 324 crore in FY22 to INR 504 crore in FY23. This growth is attributed to the brand’s strong market positioning and its unique product range that resonates well with consumers looking for nostalgic yet healthy beverage options.

- Total expenses: Alongside its revenue growth, the company’s expenses also saw a significant increase, totaling INR 599 crore in FY23. This 58.4% increase from INR 378 crore in FY22 can be attributed to expanded operations and increased marketing efforts to capture a larger market share amidst growing competition.

- Profitability: Despite the impressive revenue growth, Paper Boat faced challenges in maintaining profitability, with its net loss increasing by 1.7x widening by 71%, from INR 53 crore in FY22 to INR 90.6 crore in FY23. The increased loss reflects a higher cash burn rate, which underscores the aggressive investment in expanding market presence and enhancing brand recognition.

The analysis of these brands’ performance reveals key insights into the shift in the F&B market trends such as:

- Growth despite losses: Many companies in this sector, including iD Fresh Food, Licious, and Paper Boat, are experiencing significant revenue growth while also facing challenges in achieving profitability. This suggests a competitive and investment-heavy phase where companies prioritize market capture and scale over immediate returns.

- Strategic marketing investments: Increased expenses in these companies often correlate with heightened marketing efforts. Investing in brand visibility and consumer engagement is crucial for gaining a larger market share in the competitive F&B industry.

- Improvement in operational efficiency: Despite initial losses, there is a trend towards improved operational efficiencies over time, as seen with Licious and iD Fresh Food. This may indicate that the companies are moving towards more sustainable business models after their initial aggressive expansion phases.

What the future holds for India’s food and beverages market?

As per FNB news, the F&B industry in India is expected to reach nearly USD 504.92 billion by 2027, with a compound annual growth rate (CAGR) of 11.05%.

Here are some trends in the F&B sector in India:

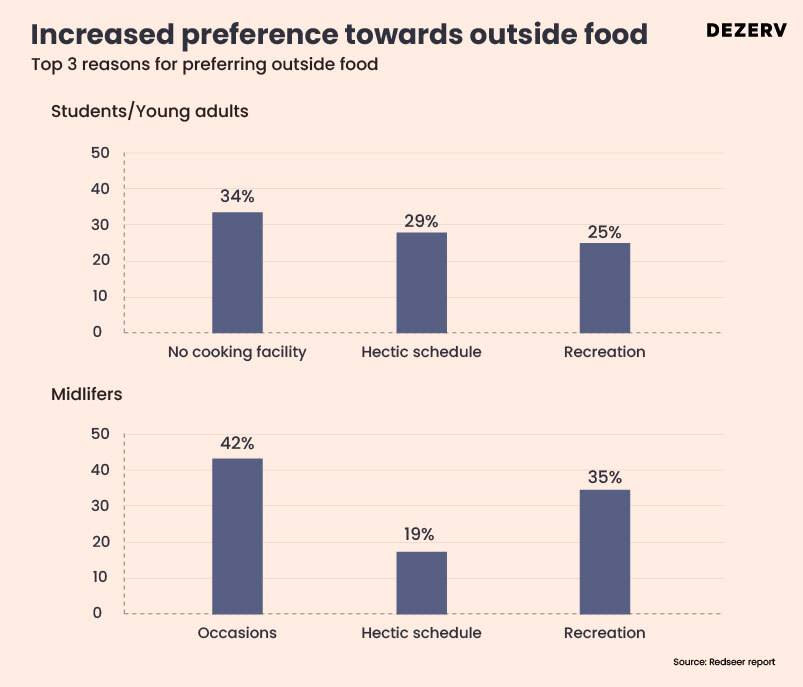

1. Convenience and on-the-go consumption

Driven by the tier 1 and metro cities, the busy lifestyles are boosting demand for convenient food solutions, including ready-to-eat products, meal kits, and mobile ordering.

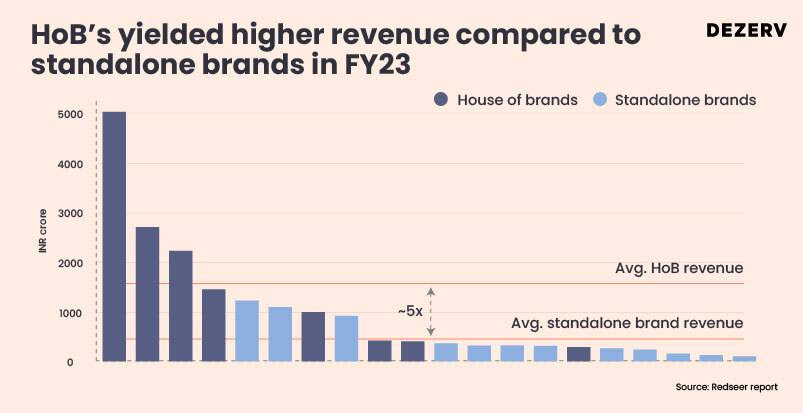

2. Emergence of House of Brands (HOB’s)

The “house of brands” strategy is a practice where multiple brands are owned under one umbrella, which has been pioneered by early players in the Indian food services industry. These players include Curefoods, Rebel Foods, and EatClub, which own diverse cuisines under one roof. The success of HOB’s is attributed to the fact that they rely on average revenue rather than betting on just one brand.

3. Global to local

Consumers are increasingly looking beyond western brands, reversing a long-standing trend. There’s a growing appreciation for local brands such as Slay Coffee, iD Fresh, etc that champion our unique culture and preferences on a global stage.

4. Focus on health

The trend toward health and wellness continues to surge, with an increasing number of consumers opting for organic, gluten-free, or additive-free products. Sustainability and ethical sourcing have also become critical factors in consumer decision-making, influencing how brands shape their products and market themselves.

This rise of Indian D2C brands in the F&B segment exemplifies the exciting shift happening in Indian kitchens.

No more last-minute dashes to the crowded grocery store. D2C brands are enabling us to access high-quality, convenient options delivered straight to our doorsteps.

But here’s the interesting part. This isn’t just about convenience. These brands are redefining what it means to eat Indian food. They’re innovative, health-conscious, and most importantly, understand the value of tradition.

So, the next time you are shopping for groceries or food, explore some homegrown D2C brands. You might just discover a new favourite that brings back cherished memories while perfectly fitting your busy lifestyle.

Sandeep Jethwani is an IIM Bangalore alumnus with over 19 years of experience in scaling one of India's leading wealth management firms, where he managed $3.5 billion in assets. At Dezerv, he drives the company's vision, strategic initiatives, and operational execution, leveraging his deep understanding of HNIs, UHNIs, and family offices.

- Apr 6, 2025

- 6 mins read

Beyond life and health insurance: What Wealth Creators are doing differently

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.