Can profit and purpose co-exist? Impact Investing explained

Sandeep Jethwani

Co-Founder

What’s Inside

Related Tags

Stay updated

with our newsletter

Highlights

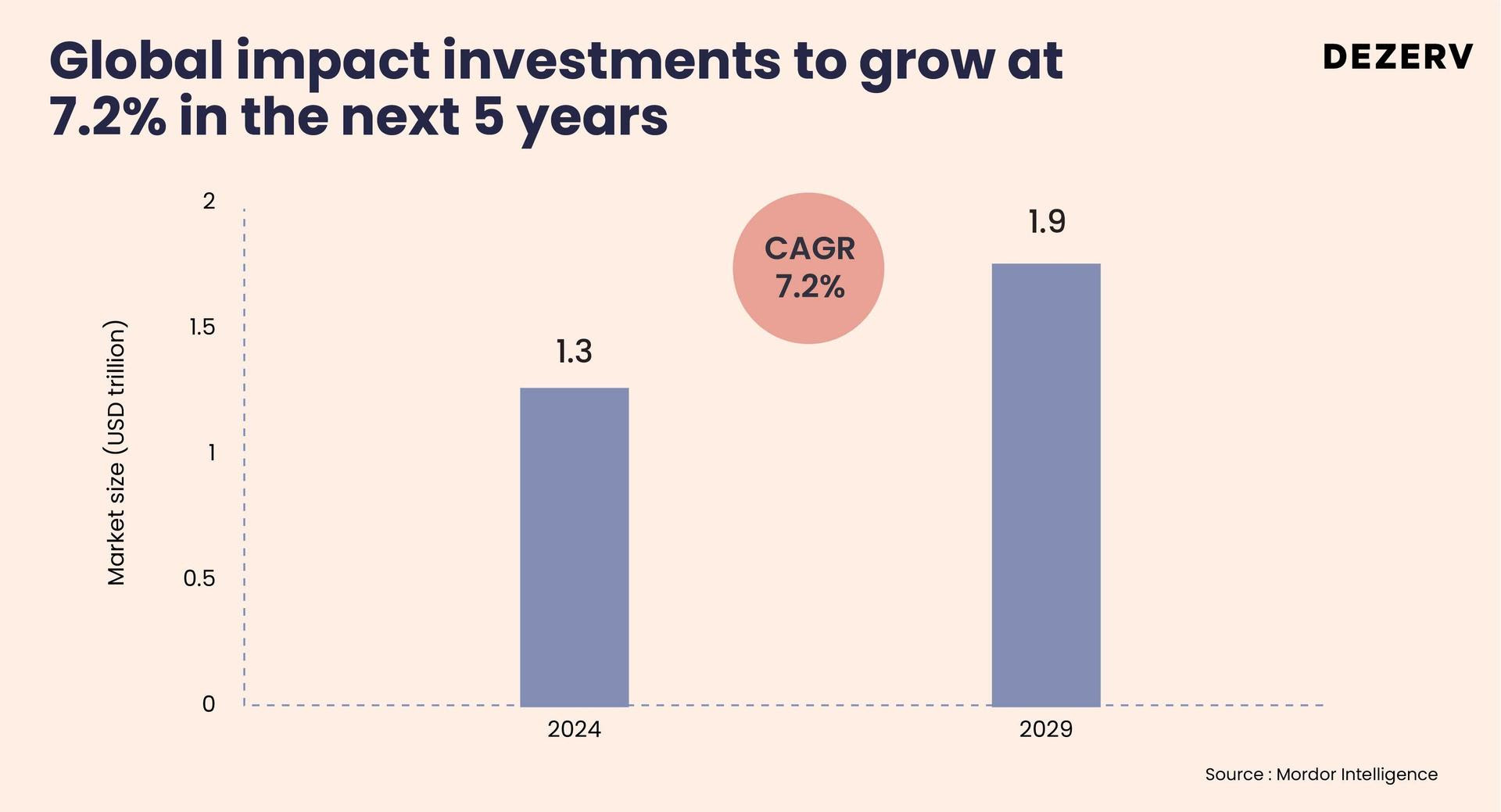

- Global scale: USD 1.33 trillion impact market — set to reach USD 1.88 trillion by 2029 at a 7.71% CAGR

- India funding: 377 impact enterprises raised USD 5.8 billion in FY22 — signalling robust growth in equity investments

- Sector focus: Financial inclusion topped with USD 1,456 million in funding — highlighting priority for underserved communities

- Returns track record: Impact investments delivered ~30% IRR over the last decade — proving profit and purpose can align

Welcome to the latest edition of the Create Wealth newsletter.

Can profit and purpose co-exist?

As the world continues to strive for inclusive and sustainable development, impact investing stands out as a powerful vehicle for channelling resources to address pressing social and environmental issues.

From renewable energy projects and affordable healthcare initiatives to financial inclusion and education programs, impact investors actively support enterprises that create tangible and measurable positive impacts on communities and society.

Globally, the impact investing market is valued at a massive USD 1.33 trillion and is expected to grow at a CAGR of 7.71% for the next 5 years, to touch USD 1.88 trillion by 2029.

There is a vast need and scope for impact investing in India. As the impact investment ecosystem in India matures, we are witnessing a growing collaboration among various stakeholders, including government bodies, philanthropic organisations, corporations, and financial institutions.

However, driving change on a colossal scale requires the deployment of immense public and private capital.

In this edition of the Create Wealth newsletter, we answer the question – “Can profit and purpose co-exist?”

We will cover:

- What is impact investing?

- The surge of impact investing in India

- Stage-wise impact investment trends

- Sector-wise impact investment trends

- India’s unique prospects for impact investing

- The future of impact investing in India

Let’s dive in

What is impact investing?

Impact investing is an investment strategy aiming to create a positive social or environmental impact while generating financial returns.

It differs from traditional philanthropy because it includes an expectation of financial returns that are at least comparable to market returns.

Impact investing covers –

- Setting up water treatment and purification facilities

- Providing affordable housing for low-income communities

- Setting up substance abuse treatment facilities and employment centres.

- Offering loans to empower small business owners in developing countries

- Investing in green conservation or carbon offsetting activities

These are just some of the activities that benefit society in some way or the other, thus meaningfully impacting society.

The surge of impact investing in India

There’s a critical need to tackle environmental and social issues in emerging markets, given that they house 86% of the global population and nine of the top ten cities most vulnerable to climate change.

India enjoys considerable investor confidence as the largest investment destination among all emerging markets.

Until now, much of the focus has been on early-stage investments in solutions that weren’t necessarily scalable. Yet, there’s a positive shift underway.

Impact investing in India is expanding beyond financial inclusion, entering sectors like agriculture, technology for social good, healthcare, education, and livelihoods.

The Indian impact investing market has witnessed remarkable growth in recent years.

In the fiscal year 2022, 377 Indian impact enterprises attracted approximately USD 5.8 billion in equity investments across 411 transactions.

2022 saw a healthy flow of capital, although a decline of about USD 1 billion was attributed to a reduction in large-ticket transactions, reflecting a more cautious investing sentiment amidst a tightened funding environment.

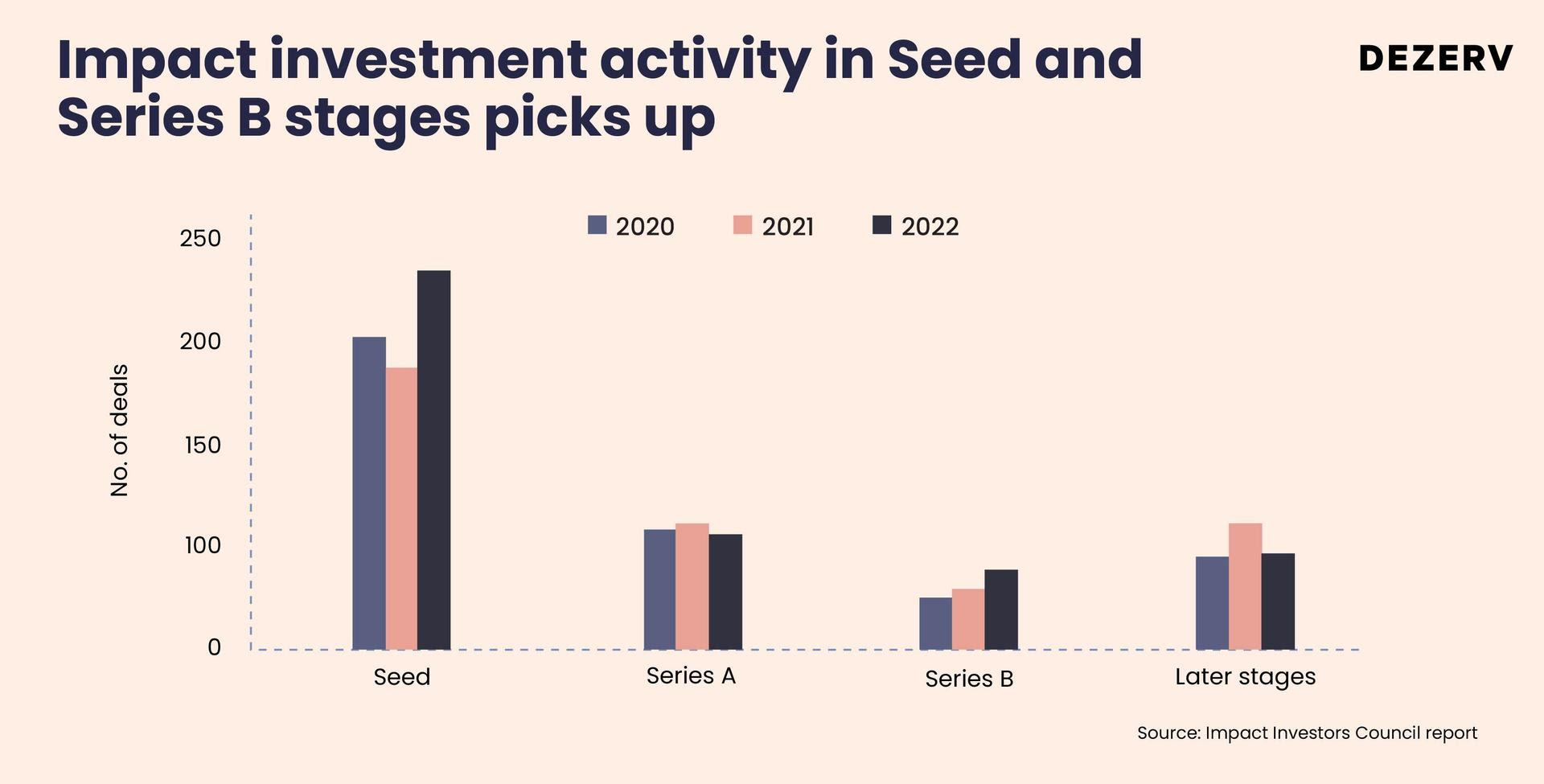

- Seed stage: Experienced a ~35% increase in transactions, indicating rising investor confidence in early-stage, tech-driven models with innovative solutions across sectors.

- Series A and B: Showed strong momentum in funding enterprises with proven business models, especially in agriculture, with a notable annual increase in Series B transactions since 2020.

This trend underscores a focus on scaling enterprises that have demonstrated initial success and are ready to expand their impact. - Later Stages: Observed a significant decline in the number and value of transactions, reflecting a cautious investor approach amid a tighter funding environment and global venture capital slowdown.

This suggests a strategic shift in impact investing towards early-stage innovations and growth-phase enterprises rather than concentrating on mature, late-stage companies.

Co-investing trends

Increased co-investment between impact investors and commercial investors through club deals has been a notable trend in recent years.

The frequency of such collaborative investments has almost doubled since 2020, indicating a growing recognition of the synergies between achieving social impact and financial returns.

This trend towards co-investing not only diversifies the funding base for impact enterprises but also enhances their credibility and potential for scale by leveraging the strengths of both impact-focused and commercially oriented investors.

Sector-wise impact investment trends

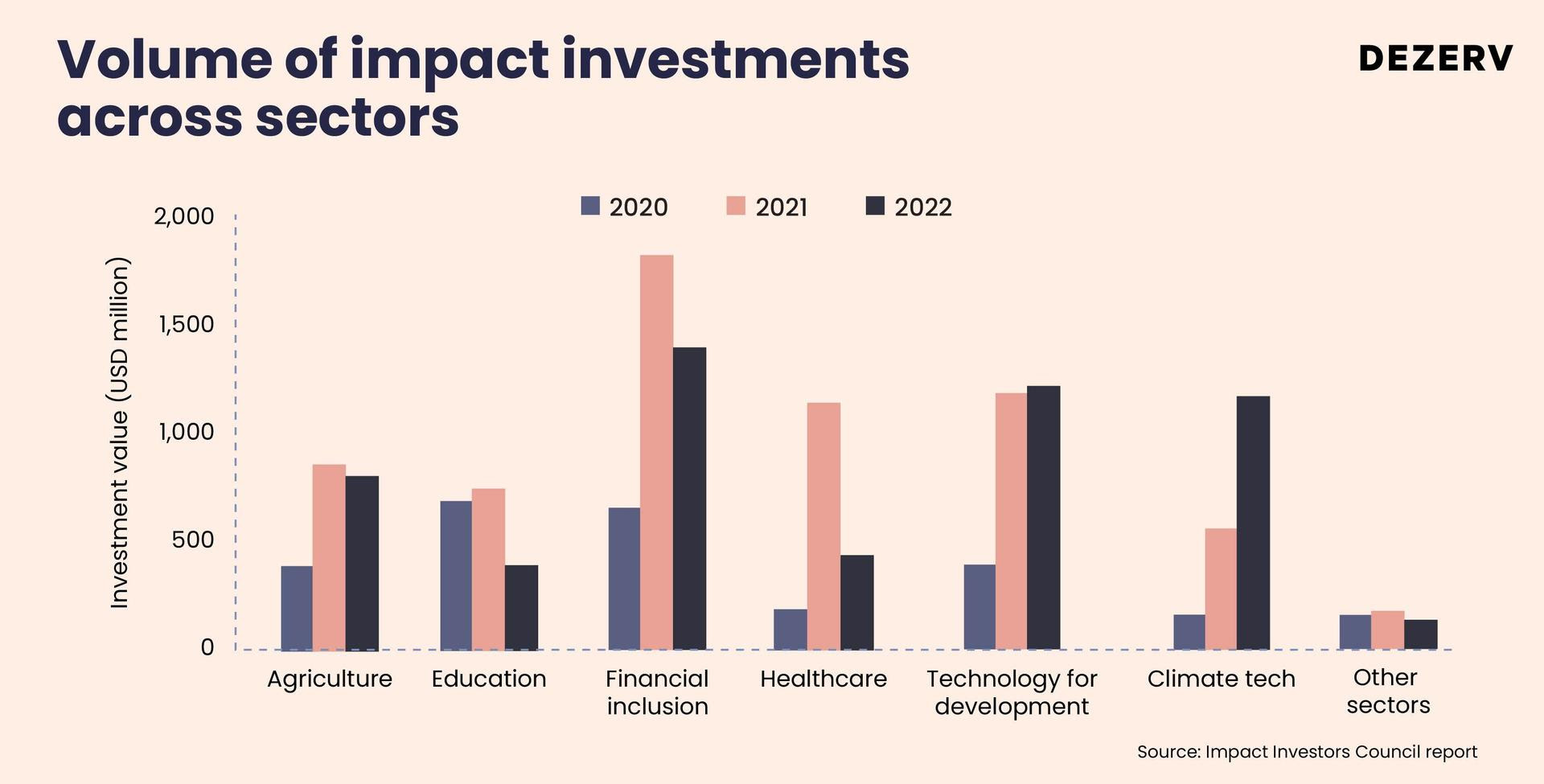

In 2022, the distribution of impact investment funds across various sectors in India has seen notable trends and growth over the last few years.

- Financial Inclusion: Led the sectors with USD 1,456 million, emphasising the focus on bridging the financial gap for underserved communities.

- Technology for Development (Tech4Dev): Received USD 1,269 million, showcasing the growing emphasis on leveraging technology to address wide-ranging developmental issues.

- Climate-tech: Emerged as a standout sector with USD 1,214 million, driven by the increasing need for sustainable solutions to combat climate change.

- Agriculture: Received USD 846 million, reflecting the sector’s critical role in ensuring food security and sustainable agricultural practices.

- Healthcare: Saw USD 449 million in investments, highlighting the sector’s urgency, especially in the wake of global health challenges.

- Education: Attracted USD 423 million, underscoring the importance of educational innovations in enhancing accessibility and quality.

These trends indicate a strategic alignment of impact investments with critical developmental goals, emphasising sectors that offer significant growth potential and the opportunity to address some of India’s and the world’s most pressing challenges.

India’s unique prospects for impact investing

According to the World Economic Forum, several factors contribute to India’s evolving impact investment landscape, distinguishing it from other emerging markets:

- Demographic advantage: India offers a unique demographic advantage as the world’s most populous country.

Its young and skilled talent pool coupled with rapid internet and 5G technology penetration, presents a significant opportunity for impact-driven enterprises to serve previously overlooked customer groups. - Impact-oriented business models: The digital revolution in India has facilitated tech-enabled businesses in delivering impact across various sectors, including climate tech and the future of work.

This shift from traditional microfinance to tech-driven models like sustainable mobility highlights the diversification and progressive innovation within the Indian market. - Potential to drive impact: Contrary to the belief that social or environmental good comes at the expense of financial gain, the Indian market demonstrates that it’s possible to achieve both.

An analysis by the Impact Investors Council (IIC) indicates that equity impact investments in India have shown an impressive internal rate of return of around 30% over the past decade, impacting over 500 million lives. - Maturing ecosystem: As the Indian impact investing ecosystem continues to mature, stakeholders are actively collaborating to create a conducive environment for such investments..This includes the rise of initiatives like the IIC, whose objective is to boost the flow of private capital into social impact initiatives.

The future of impact investing in India

As we look ahead, the trajectory of impact investments in India is poised for a promising and transformative future.

The landscape has maturely evolved, with a clear focus on sectors that potentially deliver financial returns while delivering significant social and environmental impact.

The trends observed over the past few years lay a robust foundation for what lies ahead:

- Expect a broader diversification of investments across emerging sectors, with climate-tech and sustainable innovations leading the charge.

- The rise in co-investing trends between impact and commercial investors is set to foster a more integrated ecosystem, enhancing the scalability and sustainability of impact enterprises.

- With technology playing a pivotal role in addressing complex challenges, Tech4Dev initiatives will continue to attract significant attention and funding.

- Enhanced government policies and initiatives to support the impact investment ecosystem will further catalyse growth and innovation.

The Indian impact investing market is at a critical juncture, with the potential to drive substantial economic growth and make significant strides in achieving social as well as environmental objectives.

The commitment of investors, entrepreneurs, and policymakers to this cause is more vital than ever.

As we continue to navigate the complexities of the global and local markets, the principles of impact investing will remain a guiding light, ensuring that the pursuit of financial returns keeps sight of the broader goal of creating a sustainable and equitable future for all.

Sandeep Jethwani is an IIM Bangalore alumnus with over 19 years of experience in scaling one of India's leading wealth management firms, where he managed $3.5 billion in assets. At Dezerv, he drives the company's vision, strategic initiatives, and operational execution, leveraging his deep understanding of HNIs, UHNIs, and family offices.

- Apr 6, 2025

- 6 mins read

Beyond life and health insurance: What Wealth Creators are doing differently

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.