Wealth Monitor Cheatsheet

Namrata Patel

Content Writer

What’s Inside

How affluent Indians invest in mutual funds

Asset allocation

Portfolio construct

Model of investing

Key to wealth creation

Related Tags

Stay updated

with our newsletter

At Dezerv, we’re obsessed with data. While there are numerous reports on mutual fund investing behaviour, we wanted to delve deeper into the investing habits of India’s wealth creators.

So, we sifted through thousands of data points to understand how India’s affluent and emerging HNIs invest in mutual funds. The insights we uncovered were both fascinating and alarming.

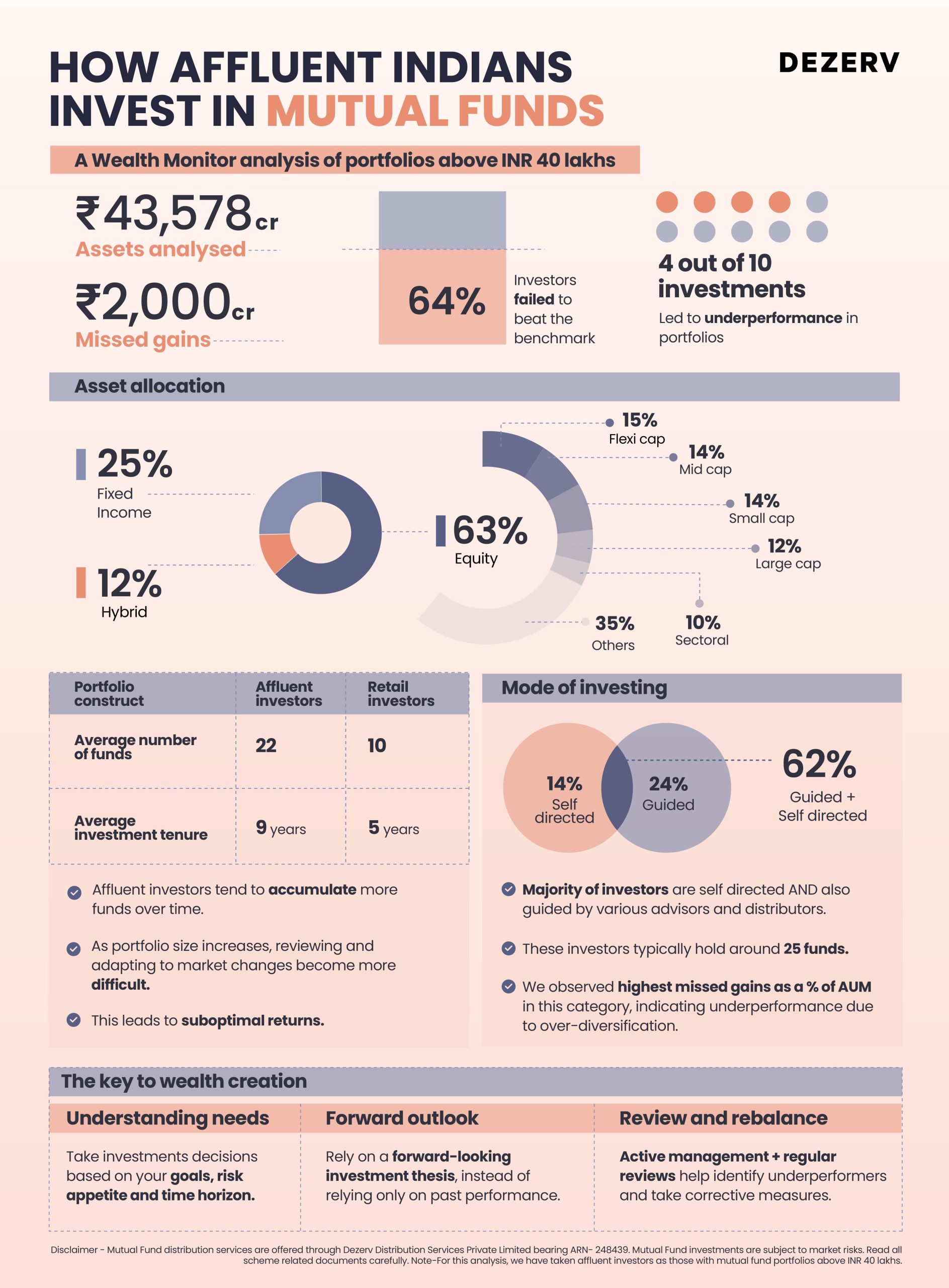

We analysed over INR 43,000 crore in assets of portfolios above INR 40 lakhs and found that nearly 65% of them failed to beat the market benchmark. Surprisingly, 4 out of 10 investments were responsible for this underperformance.

This shows that while picking winners is crucial, avoiding losers is equally important. Even a few underperforming investments can significantly drag down your portfolio.

As we delved deeper, we realised that underperformance is primarily driven by three factors:

1. Reliance on past performance to make investment decisions.

2. Suboptimal asset allocation.

3. Inability to adapt to changing market conditions.

Now, we’re excited to share our findings on what is leading to wealth creation and destruction in mutual fund investing.

Our team has created this infographic to lay out the data and help you understand the investing styles of India’s wealth creators. We invite you to take a look and share your thoughts in the comments.

What do you think is happening in these portfolios?

Namrata Patel is a Certified Financial Planner and content marketing manager at Dezerv, where she blends her financial expertise with engaging storytelling. Previously a columnist at Mint, Namrata has contributed significantly to Dezerv’s flagship newsletter and various other content IPs.

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.