Private Credit Cheatsheet

Priyansh Mathur

Product Manager

What’s Inside

What is Private Credit?

Why Private Credit

Private Credit vs Other Debt Instruments

Types of Private Credit

Dezerv View

Related Tags

Stay updated

with our newsletter

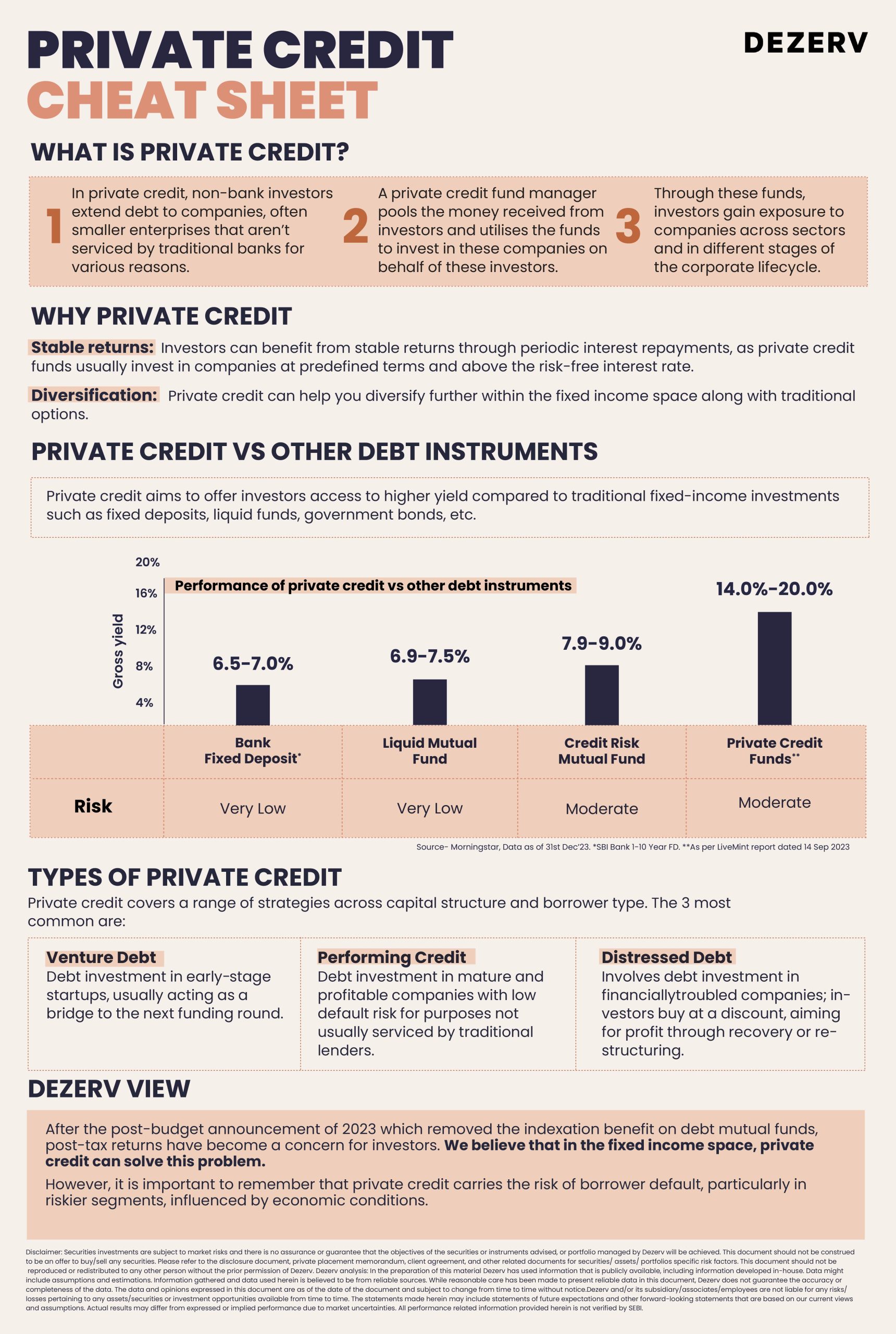

Private credit is when non-bank investors extend debt to companies, often smaller enterprises that aren’t serviced by traditional banks for various reasons.

Private credit assets in India are expected to reach a staggering USD 70-80 billion by 2028.

Compared to other traditional instruments within the fixed income space, private credit emerges as a strategic option for affluent Indians for the 2 reasons-

1. Stability: Investors get access to stable returns as the companies they’re invested in make periodic interest repayments as per predetermined terms.

2. Diversification: Private credit also allows investors to diversify within the fixed income space and manage risk-reward effectively.

Priyansh Mathur is a Product Manager at Dezerv with specialized expertise in financial content and digital marketing. With a NISM VA Mutual Fund Distributors certification and extensive experience managing high-volume content operations in the financial sector, Priyansh combines technical SEO knowledge with financial acumen to create accessible, informative content.

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.