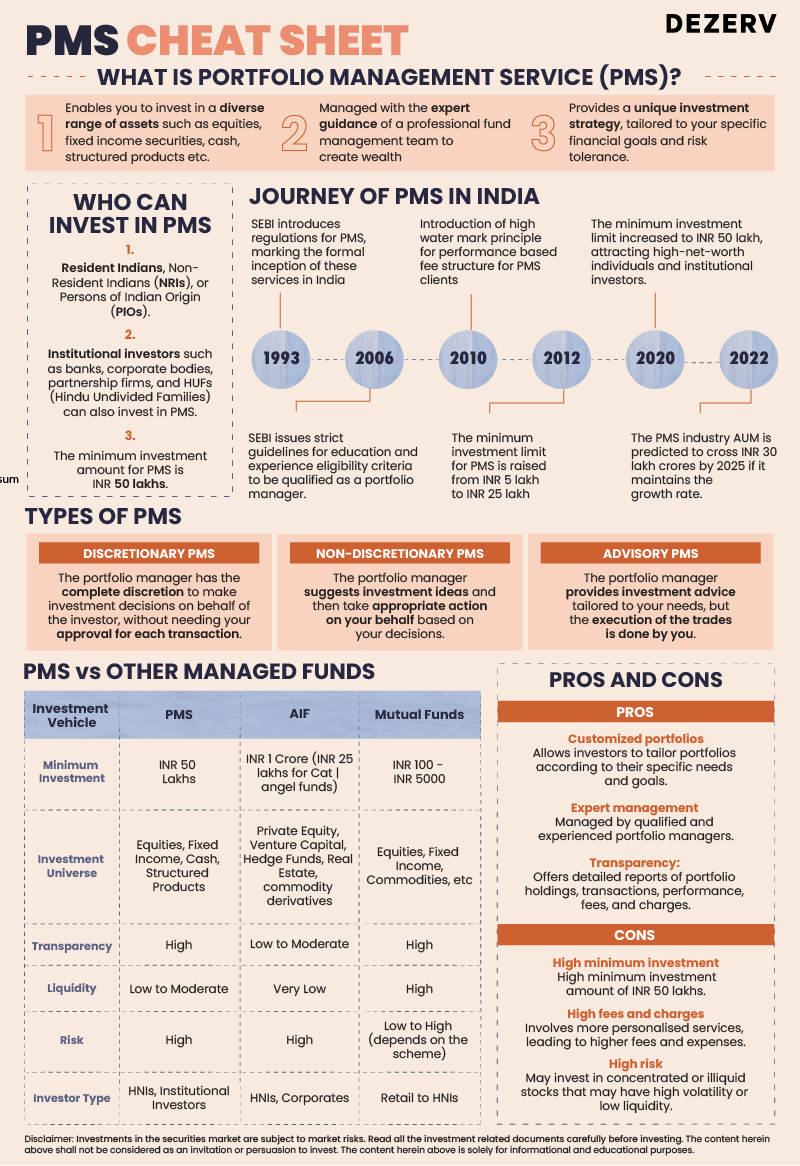

Portfolio Management Services (PMS) Cheatsheet

Namrata Patel

Content Writer

What’s Inside

What is PMS?

Journey of PMS in India

Who can invest in PMS?

Types of PMS

PMS Vs Other Managed PMS

Pros and Cons

Related Tags

Stay updated

with our newsletter

The total AUM of the PMS industry has experienced a significant surge over the past 7 years. From INR 10.45 lakh crores in March 2016, the AUM has nearly tripled, reaching close to INR 28 lakh crores in March 2023.

The remarkable growth story of PMS in India is due to many factors such as increasing net worth and capital amongst Indian investors, access to expert PMS and the high risk appetite of investors. PMS offer a unique and personalised approach to investing, making them an appealing choice for investors.

However, like all investment avenues, they come with their own set of risks. It’s crucial to understand your financial goals, risk tolerance, and investment horizon before diving into the world of PMS.

Here’s a cheat sheet, where I have covered a few other important aspects of PMS.

Namrata Patel is a Certified Financial Planner and content marketing manager at Dezerv, where she blends her financial expertise with engaging storytelling. Previously a columnist at Mint, Namrata has contributed significantly to Dezerv’s flagship newsletter and various other content IPs.

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.