Performing Credit Cheatsheet

Namrata Patel

Content Writer

What’s Inside

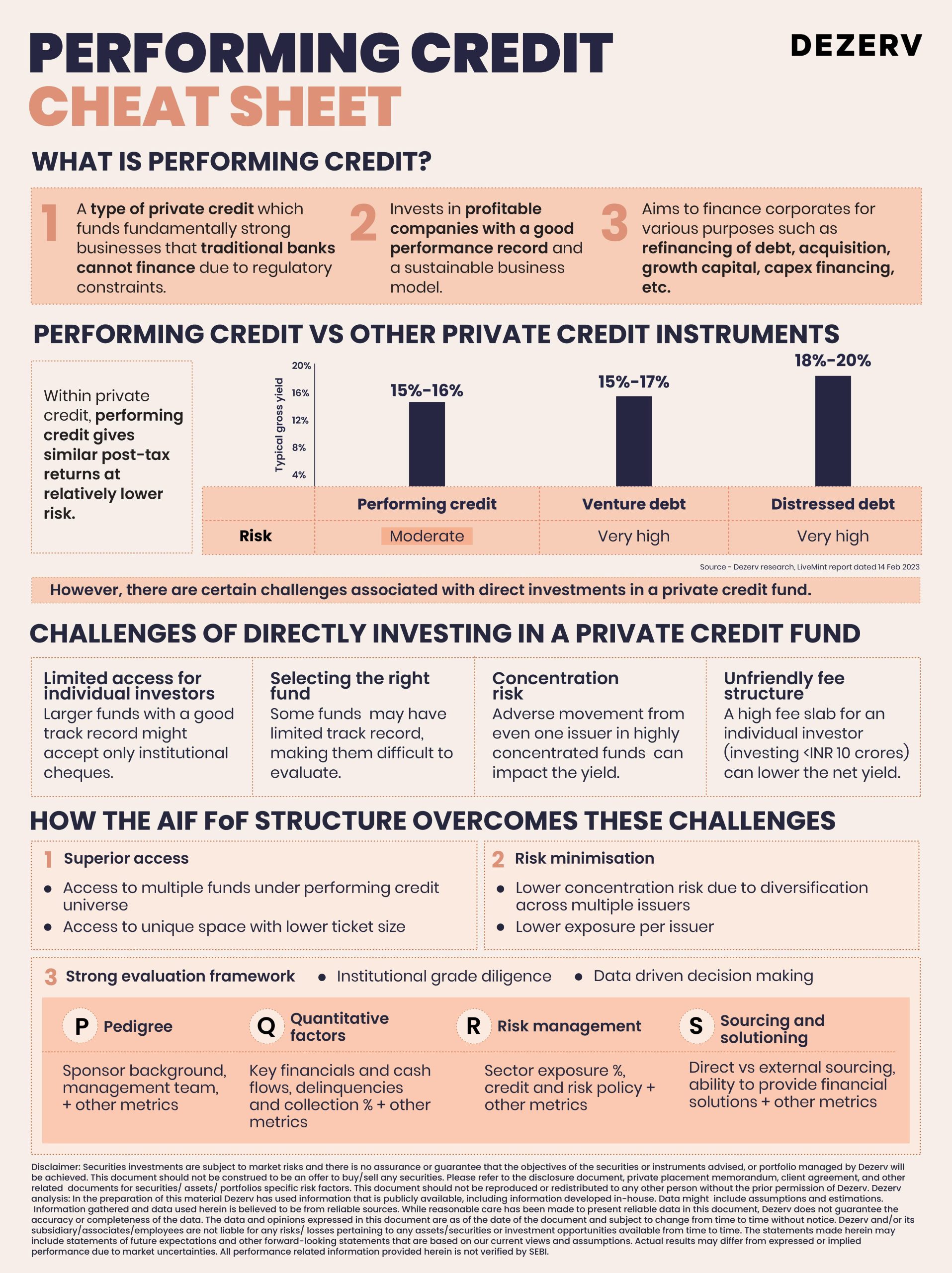

What is performing credit

Performing credit vs other private credit instruments

Challenges of directly investing in a private credit fund

How the AIF FoF Structure overcomes these challenges

Related Tags

Stay updated

with our newsletter

Compared to traditional fixed-income instruments such as fixed deposits, debt mutual funds and bonds, the private credit space aims to deliver higher post-tax returns.

There are 3 popular forms of Private Credit:

1. Venture debt

2. Distressed debt

3. Performing credit

We at Dezerv believe that Performing Credit offers opportunities to make similar returns compared to venture debt and distressed debt with relatively lower risk.

How can you invest in Performing Credit?

The Alternative Investment Funds (AIF) Fund-of-Fund (FoF) structure to invest in Performing Credit has 2 major advantages –

1. Superior access – access to multiple funds under Performing Credit universe

2. Risk minimisation – Lower concentration risk due to diversification across multiple issuers (lower exposure per issuer)

You need to be mindful of the fact that AIFs require a minimum investment of INR 1 crore.

Here’s a simple explainer to help you understand Performing Credit –

Namrata Patel is a Certified Financial Planner and content marketing manager at Dezerv, where she blends her financial expertise with engaging storytelling. Previously a columnist at Mint, Namrata has contributed significantly to Dezerv’s flagship newsletter and various other content IPs.

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.