What’s Inside

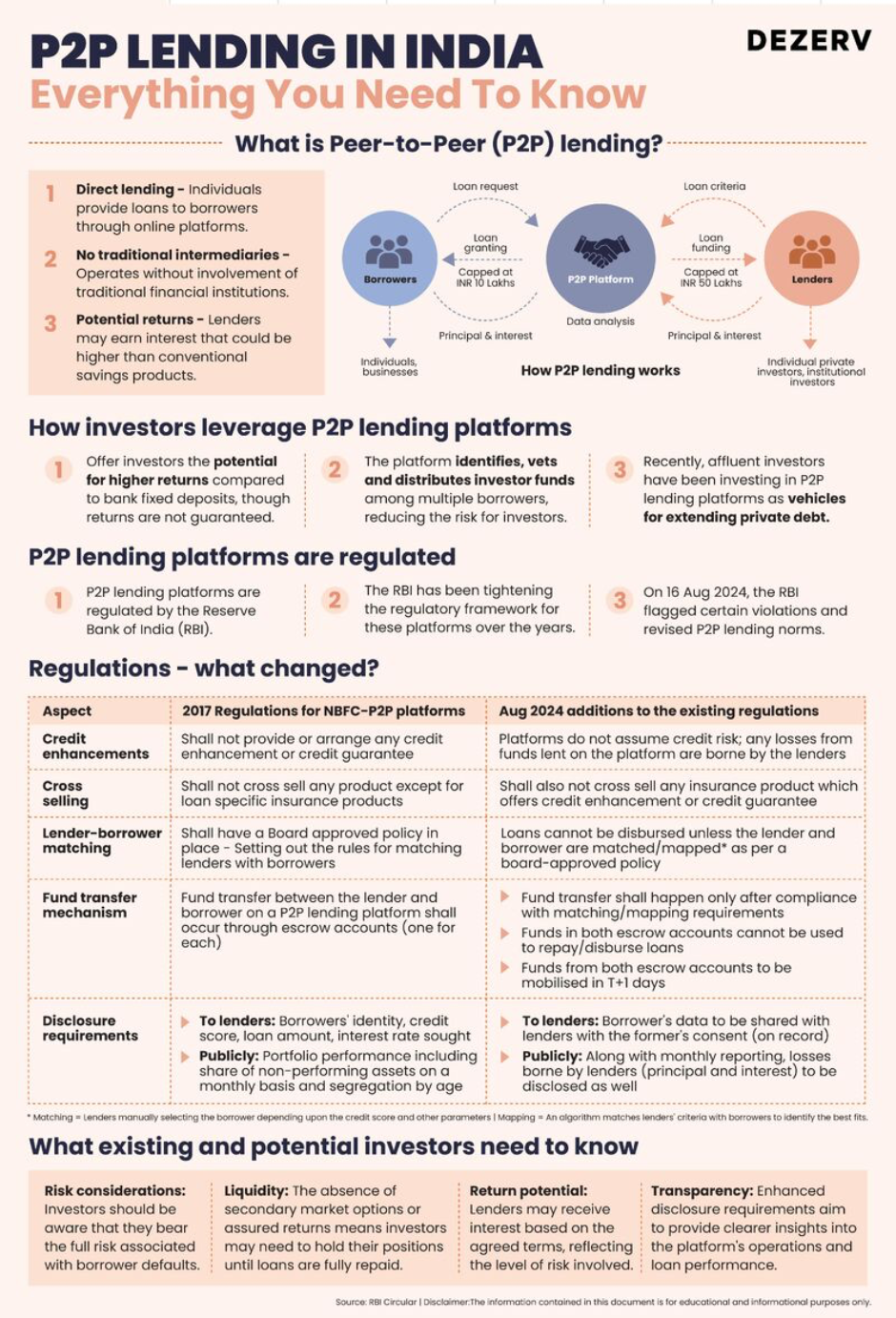

What is P2P Lending

How investors leverage P2P Lending platforms

P2P Lending platforms are regulated

Regulations

Related Tags

Stay updated

with our newsletter

Peer-to-Peer (P2P) lending has recently emerged as an investment avenue – connecting lenders directly with borrowers.

However, with recent regulatory changes by the Reserve Bank of India (RBI), understanding the functioning and risks of P2P lending is more crucial than ever.

Here’s a quick overview of P2P lending and the recent regulatory changes.

Namrata Patel is a Certified Financial Planner and content marketing manager at Dezerv, where she blends her financial expertise with engaging storytelling. Previously a columnist at Mint, Namrata has contributed significantly to Dezerv’s flagship newsletter and various other content IPs.

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.