All you need to know about HUF (Hindu Undivided Family)

Namrata Patel

Content Writer

What’s Inside

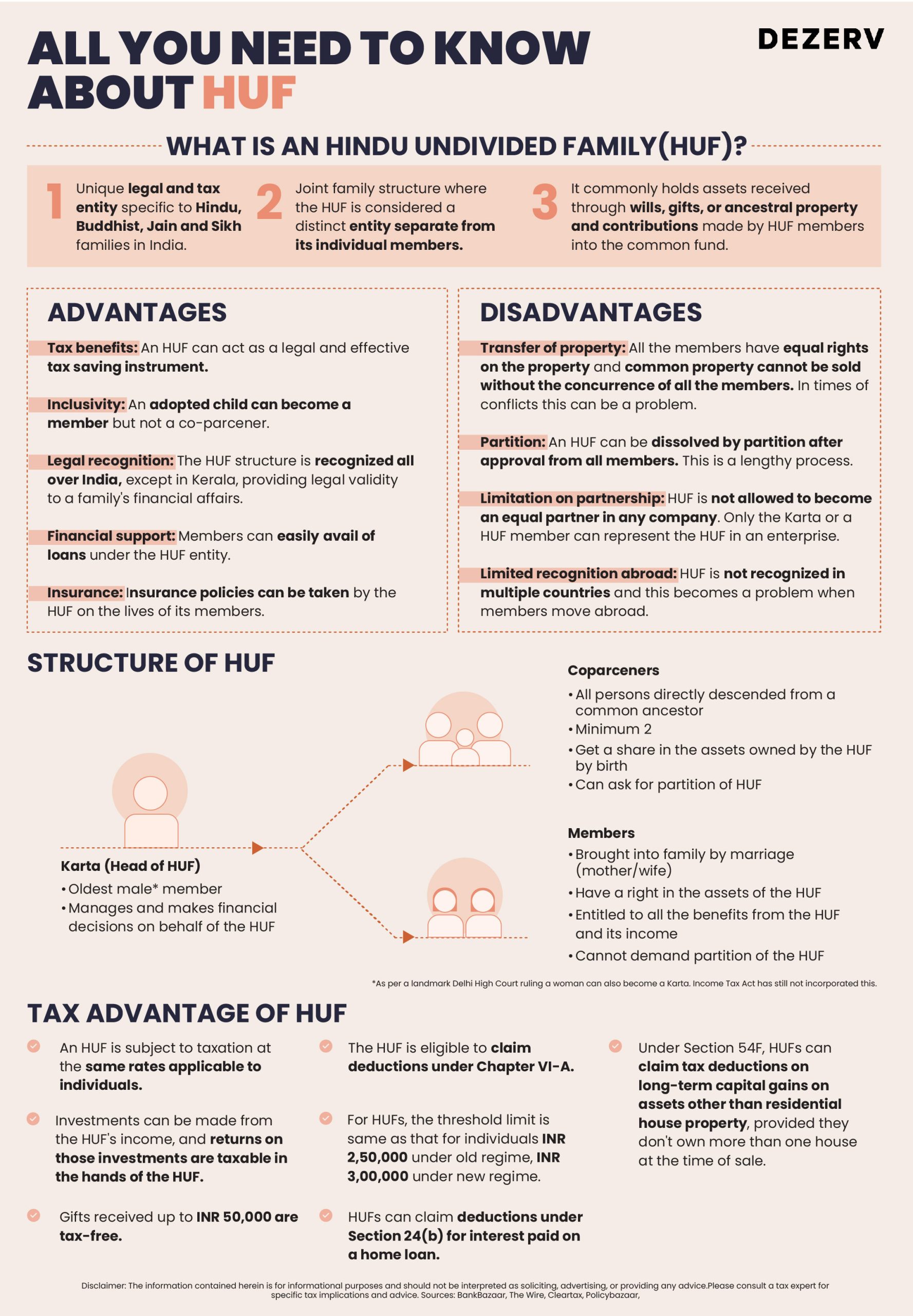

What is an Hindu Undivided Family (HUF)?

Advantages

Disadvantages

Structure of HUF

Tax Advantage of HUF

Related Tags

Stay updated

with our newsletter

A Hindu Undivided Family (HUF) is a unique legal and tax entity that is taxed at the same rates as individual taxpayers.

Since its recognition under the Income Tax Act of 1922, the HUF structure has served as a legal and effective tax-saving instrument for generations.

A few key tax benefits of HUFs:

1. An HUF has its own Permanent Account Number (PAN) and files a separate tax return.

2. It is taxed at individual slab rates, offering opportunities for income splitting.

3. Investments made from HUF income generate returns that are taxable in the hands of the HUF, not individual members.

So, what should you know about HUFs? Are you using an HUF structure for your family?

Here’s a quick cheat sheet explaining the various aspects of HUFs –

Namrata Patel is a Certified Financial Planner and content marketing manager at Dezerv, where she blends her financial expertise with engaging storytelling. Previously a columnist at Mint, Namrata has contributed significantly to Dezerv’s flagship newsletter and various other content IPs.

Dezerv Newsletter

Stay updated

with our newsletter

Our weekly newsletter on topics worth examining in the world of investing, business, & finance.